In today’s globally connected world, corporate transparency is imperative for trust, accountability, and integrity in business. For a long time, people and entities involved in money laundering, tax evasion, and financing terrorism have relied on hidden ownership structures. It has to be noted that the Corporate Transparency Act is one important step ahead in solving these issues and developing a business climate characterized by greater transparency and ethics.

LLCBuddy editors dug a little deeper to find out in and out of the act and BOI report. In this article, we have shared some essential aspects and details of the Corporate Transparency Act. From January 1, 2024, the law becomes effective in all the states in the US. Any Limited Liability Company (LLC) formed after Jan 1, 2024, will have to file a BOI report, otherwise, they might get penalized.

Understanding the Corporate Transparency Act (CTA)

The Corporate Transparency Act was started due to concerns about anonymous shell companies used for illicit purposes. In earlier times, there was no national scale framework under USA law where corporate ownership details could be maintained or collected. Thus, leaving loopholes that rogue actors could exploit.

The Corporate Transparency Act was conceptualized to prevent any type of illegal money laundering by corporations through shady activities other than your fair business. The act was first enacted in the year 2021, on Jan 1st. It came effective from the year 2024, on Jan 1st. Any LLC or business formed after Jan 1, 2024, will mandatorily have to file the BOI report (Beneficial Ownership Information) to the FinCEN by Jan 1, 2025.

Implications of CTA for Businesses and Stakeholders

The Corporate Transparency Act has wide-ranging implications for businesses operating within the United States. This will confirm adjustments by organizations to meet those reporting requirements thereby resulting in substantial changes in administrations and operations. Moreover, this law is also anticipated to affect various stakeholders including investors, financial institutions, and law enforcement agencies that may access this information base for legitimate purposes.

Key Provisions of the Corporate Transparency Act (CTA)

- Beneficial Ownership

According to CTA, a “beneficial owner” means a person having a 25% percent or greater direct or indirect interest through any form like shares held in his name alone or jointly with another person(s) acting together, total voting rights or control over the majority of voting rights in the company utilizing any contract, agreement, understanding or otherwise.

- Reporting Requirements For Covered Companies

“Reporting companies” are required to provide information about their beneficial ownership. This means that all entities filing documents with state or tribal authorities such as corporations, and limited liability companies (LLCs), among other similar structures should report it promptly to the Financial Crimes Enforcement Network (FinCEN).

- Penalties for Non-compliance

If anyone fails to comply with these requirements or makes false statements regarding them will be serious repercussions. The monetary penalty can go up to $500 per day. If the party continues violating the same or conducts crimes then it might go up to no more than 2 years of imprisonment along with a $10,000 monetary penalty.

How to File BOI Reporting with FinCEN

BOI reporting can be filed in two simple ways. The first is to do it yourself through the FinCEN website or you can hire a professional LLC formation service to file it for you. To file it on your own, a form is available on the FinCEN website.

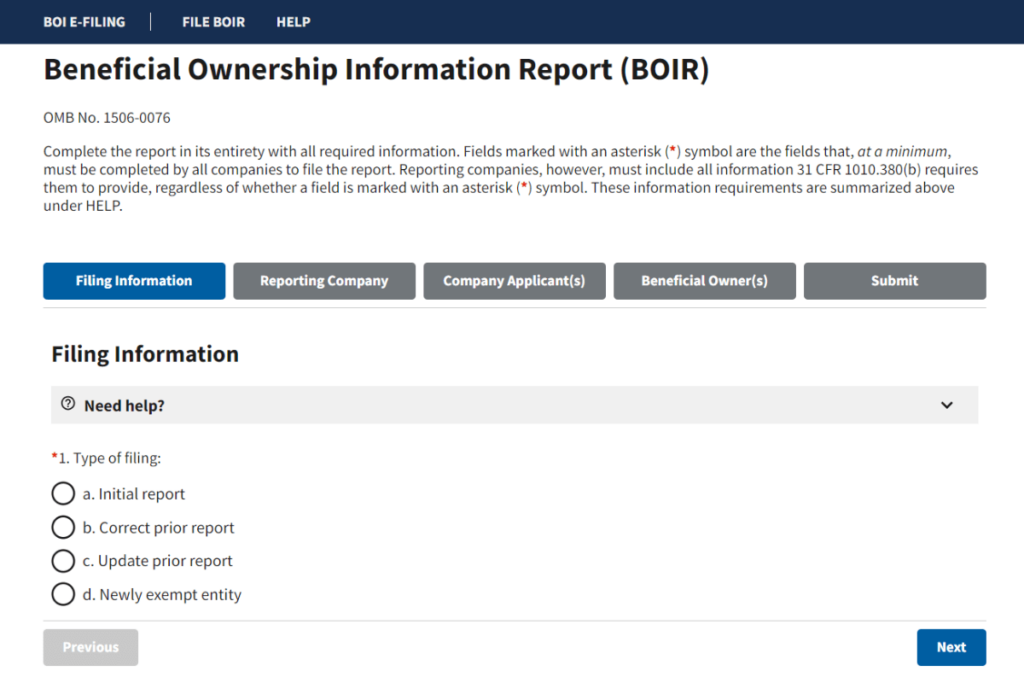

Online filing

- For online filing, firms need to go to the FinCEN BOIR e-filing page.

- Enter all the details asked in the form. Questions within (*) marks are mandatory.

- There are 4 sections before you submit the e-form online.

- Once you’re done with all 4 sections, submit the form.

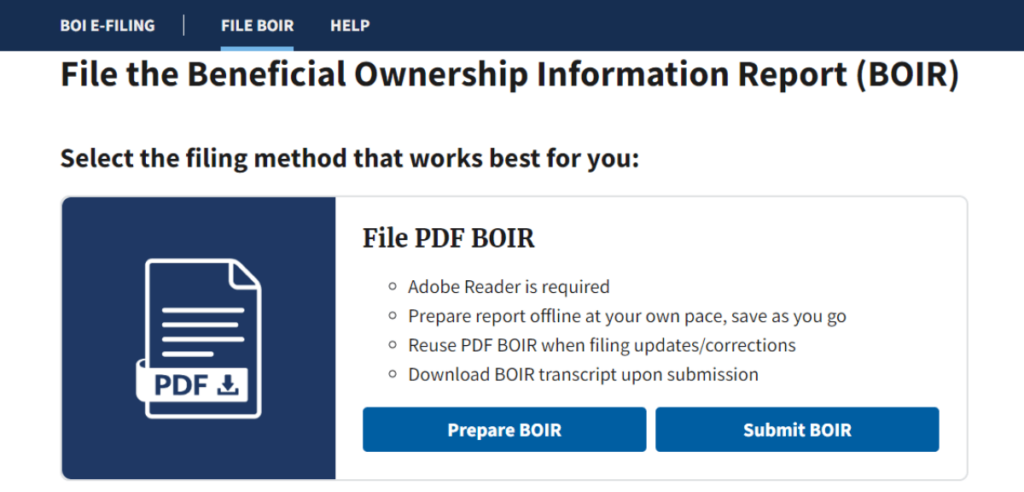

Offline Filing

- For offline filing, visit the FinCEN BOI Report filing page

- Download the PDF form from the ‘Prepare BOIR’ option

- Once downloaded, save it on your device.

- Fill the form with mandatory and correct information

- Upload the form on the same page

Submit the BOI Report

Once you are done with all the information and have filled out the form, you can submit the report. On the Submit page, you will have to provide your email, first name, and last name. Once you provide all the (*) information (attach the PDF form for offline filing), press the Submit button.

Though it seems easy to file the BOI Report when you’re doing it on your own. However, it is recommended to hire a professional. LegalZoom offers LLC formation at $0. They also guide you with BOI report filing with FinCEN without any hassle.

BOI Reporting Submission Time

- Reporting firms that are registered or created before 1 Jan 2024, should file the BOIR on or before 1 Jan 2025.

- Reporting firms that are registered or created in 2024, will have to file the BOIR within 90 calendar days of completing the registration process.

- Reporting firms that will register or create on and after 1 Jan 2025, will have to file the BOIR within 30 calendar days of completing the registration process.

Exploring Beneficial Ownership Information (BOI) Reporting

As mentioned above, a beneficial owner is a person who owns an equal of above 25% share either directly or indirectly through single or joint ownership. They usually have total control over 100% voting rights. Every year, starting from Jan 2024, reporting firms will have to file the Beneficial Ownership Information report with the FinCEN.

Purpose and Objectives of BOI Reporting

The primary reason for reporting beneficial ownership information is to fight against the use of shell companies to cover up illegal activities like terrorism financing, money laundering, and tax evasion. The Act on its part seeks to promote transparency and accountability in the corporate world by making it a requirement for companies to disclose their ultimate owners.

The BOI reporting is mandatory for firms that are either LLCs, Corporations, or any other types of business structures. As mentioned, the main purpose of this reporting is to have a clear picture of companies on what business they are involved in.

Who is Required to Report?

According to the FinCEN guidelines, there are firms called “reporting firms” that are required to report the BOI. There are two types of companies to be considered as ‘reporting firms’. They are I. Domestic Reporting Firm and II. Foreign Reporting Firm.

Limited Liability Companies, Corporations, Limited Partnerships, Limited Liability Partnerships, or any other type of business structures that are formed through filing with a state or tribal office are considered to be reporting firms. Nonetheless, these reporting requirements do not extend to sole proprietorships and general partnerships. There are 23 types of entities that are exempted from BOI reporting according to FinCEN.

- Securities reporting issuer

- Governmental authority

- Bank

- Credit union

- Depository institution holding company

- Money services business

- Broker or dealer in securities

- Securities exchange or clearing agency

- Other Exchange Act registered entity

- Investment company or investment adviser

- Venture capital fund adviser

- Insurance company

- State-licensed insurance producer

- Commodity Exchange Act registered entity

- Accounting firm

- Public utility

- Financial market utility

- Pooled investment vehicle

- Tax-exempt entity

- Entity assisting a tax-exempt entity

- Large operating company

- Subsidiary of certain exempt entities

- Inactive entity

Information to be Disclosed

Among other things, each beneficial owner’s full name(s) must be provided.

- Full legal name

- D.O.B

- Present address (business/residence)

- ID number (driver’s license/passport)

- Foreign IDs (driver’s license/passport) in case the owners don’t have any IDs issued in the USA.

Additionally, some other details about the company are required to be disclosed while filing the BOI report. The following details are,

- Company’s legal name and DBA name (if any)

- The primary/principal address of the company in the USA

- The state name where LLC was created. For a foreign LLC, mention the foreign jurisdiction.

- If it is a foreign LLC, the foreign state name where the LLC was registered

- EIN or Tax ID number of the LLC

Privacy Concerns and Safeguards

However, there are still concerns about privacy and data protection vis-a-vis this database containing beneficial ownership information even as transparency improvements are aimed at. Therefore there have been various measures put in place by the Act so that it does not become public. Access will only be granted on a need-to-know basis by authorized government agencies, financial institutions, and law enforcement agencies.

F.A.Q.

The Corporate Transparency Act is a U.S. law passed in 2021 that requires corporations, limited liability companies, and similar entities to report their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). Its goal is to prevent anonymous shell companies from being used for illicit activities like money laundering and tax evasion.

Most corporations, LLCs, and other similar entities created or registered to do business in the U.S. will need to file a beneficial ownership report with FinCEN, with some exceptions like publicly traded companies. Entities formed before the reporting requirements take effect must also comply.

A beneficial owner is defined as any individual who directly or indirectly exercises substantial control over an entity or owns/controls at least 25% of its ownership interests. The reporting requirements cover beneficial owners down to a 25% ownership threshold.

Reports must include each beneficial owner’s full legal name, date of birth, address, and a unique identifying number from an acceptable credential like a driver’s license or passport. The company’s name, address, and responsible individual details are also required.

Initial reports must be filed when the FinCEN reporting requirements take effect. After that, entities must update reports within 30 calendar days if there are changes to the beneficial ownership information. There are also annual reporting obligations.

Civil penalties of up to $500 per day can be imposed for inadvertent reporting violations, up to $10,000 per violation for negligent violations, and criminal penalties including fines and imprisonment for willful violations.

FinCEN will maintain a secure non-public database of beneficial ownership information. Access will be limited to authorized government authorities for specified permitted uses like facilitating law enforcement investigations.

The specific effective date hasn’t been set yet, but the Corporate Transparency Act requires the Treasury to issue regulations by January 2022, giving businesses time to prepare before the reporting requirements kick in.

In Conclusion

The fight against economic crimes, corruption, and the use of shell corporations in America received a new lease of life with the adoption of the Corporate Transparency Act. This requires information about beneficial ownership; this aims at exposing those behind these firms, thus dissuading them from using such entities for unlawful activities.

On this page, we have shared how you can proceed with your BOI report filing. It is mandatory for every LLC or any business structure registered in the USA. BOI reporting can be done via online or offline methods. But we would recommend getting a professional service as they not only help you file this report but also help you create your LLC at $0 (excluding state filing fee). LegalZoom is one such service with 100% accuracy.

Ultimately, therefore, this Corporate Transparency Act marks an important milestone in fighting against financial crimes as well as promoting ethics in business. Its effects can be felt on a global scale, not only within America, but opening up to a wider movement where several companies worldwide have started being more open about their operations to create trustworthiness among all players in a globally connected business industry without discrimination.