How to file a BOI Report in New Mexico: Since the Corporate Transparency Act, the Beneficial Ownership Information (BOI) principle has become an important aspect of the regulatory framework for Limited Liability Companies, Corporations, and all types of business structures. This act aims to increase transparency and fight against illegal financial activities by requiring businesses to disclose information about beneficial owners. In New Mexico, companies must comply with these BOI reporting obligations, and this guide will give a comprehensive overview of the processes involved, entities affected, and compliance actions that must be put in place.

New Mexico, also known as The Land of Enchantment, has a population of 2,135,024. That makes the state small business friendly. According to the act, small and medium-sized businesses have to file BOI reports. In this article, LLCBuddy editors shared the latest update and mandate on filing BOI reports in New Mexico.

What is Beneficial Ownership in New Mexico?

Beneficial ownership in New Mexico entails individuals who own or control an entity ultimately even though legal ownership rests with some other person. These persons may have significant influence over it or hold substantial interest therein as owners. Identifying who qualifies as a beneficial owner is a critical first step in complying with BOI reporting requirements. To be a beneficial owner, one must meet at least one of the following:

- Has direct or indirect ownership of 25% or more of the entity’s equity interests

- Directly or indirectly exercises significant control over the entity

It should be noted that beneficial ownership can involve complicated ownership structures; therefore entities should conduct thorough assessments of their organizational structure and holdings.

Beneficial Ownership Information Reporting

The BOI (Beneficial Ownership Information) Report is a memo or document that every small and medium-sized business (exemption applicable) has to file with the Financial Crimes Enforcement Network (FinCEN). In New Mexico, any LLC that is eligible to enlist under the reporting company must file the BOI Report within the given period.

It is not only mandatory for all businesses in New Mexico but also can lead to heavy monetary penalties along with imprisonment. There are many reasons why the Corporate Transparency Act was started and BOI Report filing becomes mandatory for all businesses in New Mexico.

BOI Reporting Companies (Entities) in New Mexico

Not every company, located in New Mexico, is required to file BOI reports with FinCEN. Only the eligible companies (Reporting Companies) are liable to file the BOI report. Following are the requirements for BOI reporting,

Entities Required to Report

There are certain entities that are considered “Reporting Companies” as per the Corporate Transparency Act and must report beneficial ownership information. Normally, these include:

- Corporations

- Limited Liability Companies (LLCs)

- Professional Limited Liability Companies (PLLCs)

- Other similar entities are formed by filing a document with New Mexico Secretary of State or its equivalent.

Exempted Entities

However, it is important to note that there are certain entities in New Mexico that do not have BOI reporting requirements such as;

- Sole proprietorships or any business structure that does not require registration under New Mexico SOS.

- Large entities (more than 20 employees with $5M revenue)

- Tax-exempt organizations

- Inactive entities meeting specific criteria

- Subsidiaries of exempt entities

- Complex ownership that is not publicly known

For PLLCs, selected types of companies get to file BOI reports. Small PLLCs that do not meet the eligibility of reporting companies are exempted from filing BOIR. Besides, PLLCs that are already under stringent regulatory authority like the medical or law field, might get an exemption too.

List of Entities Exempted from BOI Reporting According to FinCEN

- Securities reporting issuer

- Governmental authority

- Bank

- Credit union

- Depository institution holding company

- Money services business

- Broker or dealer in securities

- Securities exchange or clearing agency

- Other Exchange Act registered entity

- Investment companies or investment advisers

- Venture capital fund adviser

- Insurance company

- State-licensed insurance producer

- Commodity Exchange Act registered entity

- Accounting firm

- Public utility

- Financial market utility

- Pooled investment vehicle

- Tax-exempt entity

- Entity assisting a tax-exempt entity

- Large operating company

- Subsidiary of certain exempt entities

- Inactive entity

Entities should review their classification carefully in order to ascertain if they fall under the requirement for reporting or qualify for an exemption. It is recommended to consult an expert before you start filing your BOI Report. Also, not only the above-mentioned sectors but also the size and structure of the business matters when it comes to filing the report. Hence, it is important to consult an expert beforehand.

How to File a BOI Report in New Mexico?

In New Mexico, you can file your BOI report in two ways. The report can be filed online or offline. The process is pretty simple. There is an online and offline (PDF) form available. The reporting company in New Mexico has to fill up the form and submit it within the given time. Here are the steps to file the BOIR in New Mexico

Recommended: You can fill up and file the BOI forms easily and without hassle by hiring a professional service. We recommend using –

TailorBrands – (BOI Report Filing)

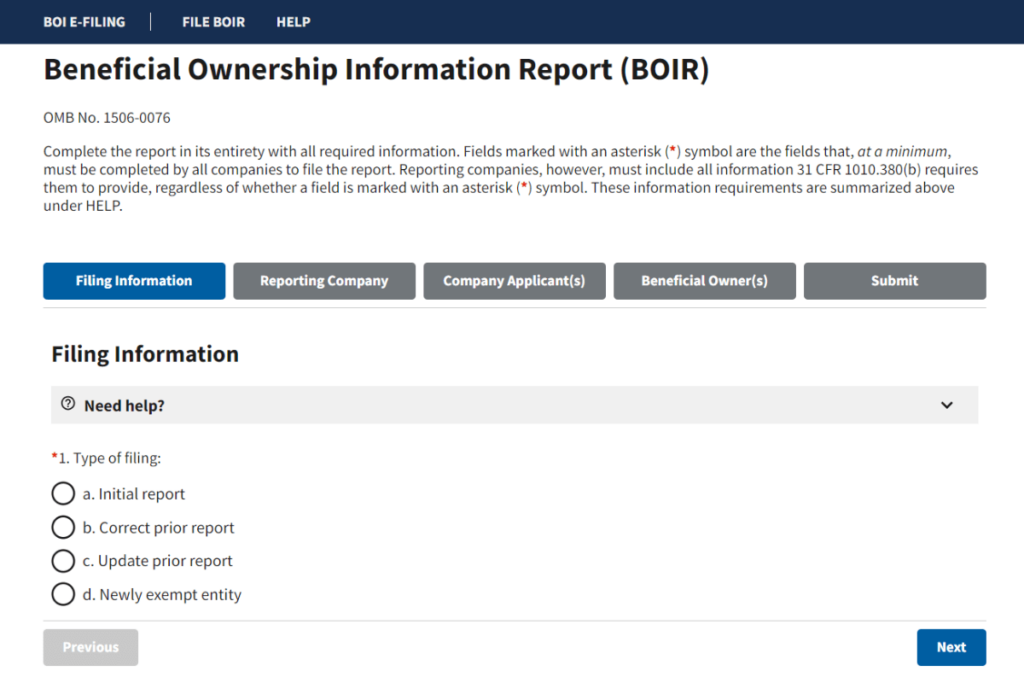

Online BOI Report Filing in New Mexico

- Step 1: For online filing, reporting companies in New Mexico are required to visit the FinCEN BOIR e-filing page.

- Step 2: The first page shows 4 options, Initial Report, Correct Prior Report, Update Prior Report, and Newly Exempt Entity.

- Step 3: For the fresh filing, select Initial Report and click NEXT.

- Step 4: On the next page, fill out the form for Reporting Company and ask for FinCEN ID.

- Step 5: The ‘Company Applicant’ page comes up next. Add the details wherever is required.

- Step 6: The next page shows the details of the Beneficial Owner(s). Also, mention if there is an exemption.

- Step 7: Submit the online form after sharing your name and email on the final page.

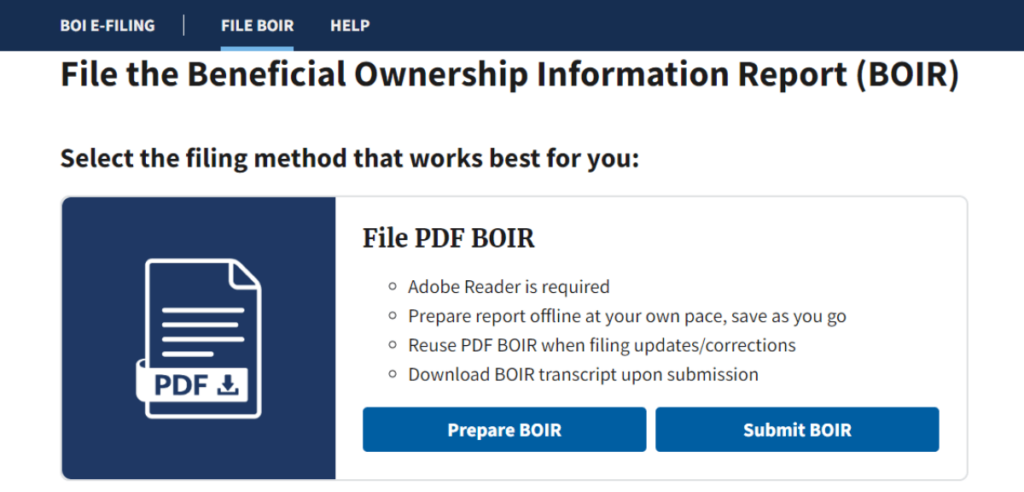

Offline BOI Report Filing in New Mexico

- Step 1: For offline filing, visit the FinCEN BOI Report filing page

- Step 2: Download the PDF form from the ‘Prepare BOIR’ option

- Step 3: The PDF form requires Adobe Reader 8 or higher, make sure you have this version installed on your device.

- Step 4: Save the form on your device.

- Step 5: Fill it up with the correct information. Make sure to select the ‘Initial Report’ if you’re filing it afresh. For correction or updating the previous form, select the other options.

- Step 6: Once filled up, upload the form on the site by clicking on ‘Submit BOIR’.

- Step 7: On the Submit page, you will have to provide your name and email. Click on the ‘upload document’ section to upload the PDF form and submit it.

Reporting Process and Timeline

BOI Reporting effectively becomes mandatory from January 1, 2024, in New Mexico and the rest of the United States. All the LLCs in New Mexico, Corporations, and other types of businesses registered under New Mexico Secretary of State will have to file the report within the given time.

- Entities in New Mexico incorporated or registered before January 1, 2024, will have to file their BOI report before January 1, 2025.

- Entities in New Mexico incorporated or registered on or after January 1, 2024, will have to file their BOI report within 90 working days from the date of completion of company registration with New Mexico SOS or similar authority.

- Entities in New Mexico incorporated or registered on or after January 1, 2025, will have to file their BOI report within 30 working days from the date of completion of company registration with New Mexico SOS or similar authority.

Penalties for Non-Compliance with CTA (BOI Report Filing)

The authority decides to make it more difficult for the companies that fail to comply with the Corporate Transparency Act or BOI report filing. Following are the monetary and other penalties for non-compliance,

- The Civil Penalty for missing the deadline in New Mexico is $500 a day for the company

- The Criminal Penalty for not filing the BOI Report in New Mexico is $10,000

- Continuing violating rules and non-compliance in New Mexico can lead to 2 years imprisonment

The FinCEN makes sure that every reporting company must file the BOI report as soon as they meet the eligibility criteria. The penalty is heavy, especially for small businesses in New Mexico.

BOI Reporting Required Information in New Mexico

The Beneficiary Ownership Information consists of some confidential information about the LLC owners in New Mexico. The compulsory information to be given in respect of each beneficial owner includes:

- Reporting Company legal name

- Alternative or DBA Name (if any)

- Tax Identification type

- Country/Jurisdiction of Formation

- Address (number, street, and apt. or suite no.)

- Individual’s Full Legal Name

- Date of birth

- Current Address

- Identifying document (Type, Number, Issuing Jurisdiction, Image)

- Beneficial Owner Details (Legal Name, FinCEN ID, Address, DOB)

Entitles should confirm that the information given is correct and up-to-date as any inconsistencies or inaccuracies may attract penalties.

Ensuring their BOI reports are accurate and updated is a responsibility that these bodies have. Disputes or concealed information, therefore, need to be attended to quickly and openly as this is essential in compliance maintenance. Should organizations fail to do this, they may invite increased scrutiny with possible penalties imposed against them.

Privacy and Data Security

While the requirements for BOI reporting in New Mexico aim at increasing transparency levels, there are practical challenges faced by entities regarding the identification and disclosure of beneficial ownership information. These may include:

- Complexity in identifying beneficial ownership for entities with intricate ownership structures or multi-layered holding companies.

- Difficulties in obtaining accurate and up-to-date information from beneficial owners, particularly where ownership interests are held indirectly or via intermediaries.

- This places an additional burden on small businesses which will find it hard to deploy enough resources and personnel to deal with compliance matters.

Entities can overcome these hurdles through engagement of professionals’ advice; and having internal mechanisms that strengthen their capacity to communicate with their beneficiaries.

Regulatory and Legal Considerations

In addition to the issues above, entities in New Mexico must also navigate numerous regulatory and legal considerations when reporting BOI. These include:

- Balancing transparency with legitimate privacy concerns, especially for individuals who may be exposed to personal safety risks or other sensitive situations.

- Addressing international implications and cross-border ownership structures since BOI reporting requirements can vary across jurisdictions.

- Compliance with other relevant legislations such as anti-money laundering (AML) laws and know-your-customer (KYC) regulations is necessary as well.

What helps entities address these concerns is consulting the legal fraternity on changes occurring within the regulatory space.

Anticipated Changes and Updates

With time, FinCEN together with other relevant agencies will provide further guidance on complying with these reporting requirements as financial crime evolves. For instance, new changes could affect how they comply with these requirements. Additionally, in the future, there is a possibility of expanding or modifying the reporting requirements to deal with emerging issues or any possible loopholes.

Impact on Businesses and Financial Sector in New Mexico

The introduction of BOI reporting requirements will have profound effects on both corporate entities and the financial sector as a whole. Likely consequences could include:

- Increased administrative burdens and compliance costs for firms, especially at the early stages of implementation.

- Enhanced due diligence procedures by financial institutions to verify the accuracy of BOI reports and identify potential red flags.

- Business practices may change leading to ownership structures that are more flexible to fit into new transparency needs.

- Entities that have complex ownership arrangements or those operating internationally may face some difficulties.

Nonetheless, in the long run, it can be expected that this law would go towards creating an environment where business is transparent and accountable thus enhancing trust and integrity within the financial system.

Significance of Reporting Beneficial Ownership Information

Reporting BOI is essential for several reasons. We have come up with three main reasons that CTA pointed out for having BOI reporting.

- Preventing Illegal Activities: Identifying true owners helps to combat money laundering, terrorist financing, and other financial crimes in New Mexico since bad actors cannot hide behind complex corporate structures.

- Enhancing Transparency: It ensures corporate transparency and accountability so that entities cannot operate under cover but are required to reveal who their beneficial owner(s) are.

- Facilitating Law Enforcement: Accurate data on BOI allows law enforcement authorities to investigate and prosecute fraudulent activities better thus protecting a fair business environment.

Starting an LLC in New Mexico or forming a corporation in New Mexico can be an eyewash of hiding other shady activities or illegal businesses. Companies often create shell companies to money launder. This reporting was started to prevent such activities in New Mexico.

State Specific Data: New Mexico

Capital and Incorporation

- The capital of New Mexico is Santa Fe.

- The population of New Mexico: 2,135,024

- The Annual GDP of New Mexico: 123,819

- Incorporation in New Mexico can be done through various methods including online and offline. For more details, visit New Mexico Secretary of State.

- Incorporation Method in New Mexico (Online): Create an account/Log in to the SOS site, get the online form, fill it, and submit online

- Incorporation Method in New Mexico (Offline): Send the form by mail to Business Services Division, 325 Don Gaspar, Suite 300 Santa Fe, NM 87501.

Filing Fees

- LLC Initial Filing Fee: $50

- LLC Amendment Fees: $50

- Annual Fee: $0 because it is not mandatory

- DBA Filing Fee: $0, as it is not mandatory to file DBA name in this state

- Incorporation Fee: Minimum $100 to maximum $1000 for filing online or by mail. It depends on the amount of shares

- Registered Agent Change Fee: $20

- Corporate Amendment Fee: $50

Important Offices

- State Tax Office: New Mexico Taxation and Revenue Department

- State Insurance Office: New Mexico Office of the Superintendent of Insurance

- Secretary of State Address: Business Services Division, 325 Don Gaspar, Suite 300 Santa Fe, NM 87501

- Department of Treasury: Department of the Treasury Internal Revenue Service Center – Ogden, UT 84201 Fax: 855-214-7520

Key Contacts

- Form 2335 Mailing Address: Department of the Treasury Internal Revenue Service Center – Ogden, UT 84201 Fax: 855-214-7520

- Filing Method for DBA: several methods, however, it is not mandatory to file a DBA name in Kansas

- Filing Fee for DBA: $0, as it is not mandatory to file DBA name in this state

- Online Filing for DBA: No online form is available, as it is not mandatory to file a DBA name in Kansas.

- Offline Filing for DBA: No PDF form is available, as it is not mandatory to file a DBA name in Kansas

By staying compliant with the BOI reporting requirements and leveraging the resources available in New Mexico, businesses can ensure they meet all regulatory obligations efficiently.

FAQs

Also Read

- Alabama BOI Report

- Alaska BOI Report

- Arizona BOI Report

- Arkansas BOI Report

- California BOI Report

- Colorado BOI Report

- Connecticut BOI Report

- Delaware BOI Report

- DC BOI Report

- Florida BOI Report

- Georgia BOI Report

- Hawaii BOI Report

- Idaho BOI Report

- Illinois BOI Report

- Indiana BOI Report

- Iowa BOI Report

- Kansas BOI Report

- Kentucky BOI Report

- Louisiana BOI Report

- Maine BOI Report

- Maryland BOI Report

- Massachusetts BOI Report

- Michigan BOI Report

- Minnesota BOI Report

- Mississippi BOI Report

- Missouri BOI Report

- Montana BOI Report

- Nebraska BOI Report

- Nevada BOI Report

- New Hampshire BOI Report

- New Jersey BOI Report

- New Mexico BOI Report

- New York BOI Report

- North Carolina BOI Report

- North Dakota BOI Report

- Ohio BOI Report

- Oklahoma BOI Report

- Oregon BOI Report

- Pennsylvania BOI Report

- Rhode Island BOI Report

- South Carolina BOI Report

- South Dakota BOI Report

- Tennessee BOI Report

- Texas BOI Report

- Utah BOI Report

- Vermont BOI Report

- Virginia BOI Report

- Washington BOI Report

- West Virginia BOI Report

- Wisconsin BOI Report

- Wyoming BOI Report

In Conclusion

In the world of business, conducting illicit monetary transactions is not a new thing. To prevent that the Corporate Transparency Act came into the picture. Businesses in New Mexico, especially, small and medium businesses must file the Business Ownership Information Report to combat growing financial crimes. In New Mexico, the companies must understand the obligations to comply with the rules.

In New Mexico, before you start filing the BOI Report, there are a few important points to note. Important points worth noting are:

- Identifying beneficial owners from their control or ownership interests over the entity.

- Reporting accurate information at all times including names, dates of birth, addresses, and identification details about beneficiaries.

- Timely filing of the initial reports and updating the reports in case of changes.

- When required, involve reputable third-party service providers to assist in the filing process.

- Ensure compliance with relevant penalties for non –compliance.

- Deal with practical challenges and legal issues related to BOI reporting.

- Keep abreast of future developments and advice from relevant bodies.

Filing the BOI Report does not require complicated steps, however, it definitely requires an expert to proceed. We recommend TailorBrands, one of the best LLC formation services that not only offers free LLC formation but also offers BOI Reporting at a very reasonable cost.