Forming an LLC requires a different business name, which must be unique and adhere to the guidelines. The great thing is DC’s Secretary of State page includes a name availability checker. Check out LLC Name Search to learn more.

Meanwhile, if you’re interested in learning more about starting an LLC in DC or forming an LLC in general, you can check out How to Start an LLC.

On this page, you’ll learn about the following:

How to Name an LLC in DC

Time needed: 5 minutes

Guidelines to Follow in Naming LLC

- Use a business name with the abbreviation “LLC” or the phrase “Limited Liability Company.”

- Your decided business name must not coincide with any existing government entity. Otherwise, you might have to face legal lawsuits when filing your LLC.

- Use the LLC name availability checker to ensure your business name is unique.

- Get a license first if you plan on using restricted words to avoid any complications.

Note that you must put adequate effort into naming your LLC because this name will be with your business for a long time. Making your LLC name unique is vital as it would prevent people from confusing your business with others, not to mention it would be easier for them to recall your business, products, or services.

How to do a DC LLC Online Name Search

As a part of the registration process, it is important to have a suitable name for your LLC in accordance with the guidelines of the State. When you are selecting a name for your LLC, you need to search on the DC State website if the chosen name is unique and available for registration or not. Look at the following points and know about them.

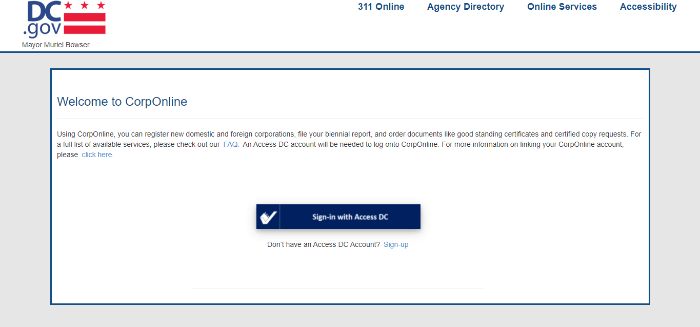

Register your Account

Visit the official page of the District of Columbia Secretary of State. Register your account on the DCRA CorpOnline Web Portal by selecting the “sign-up” option. Or click on “Sign-in with Access DC” if you have already registered your account with DC.gov.

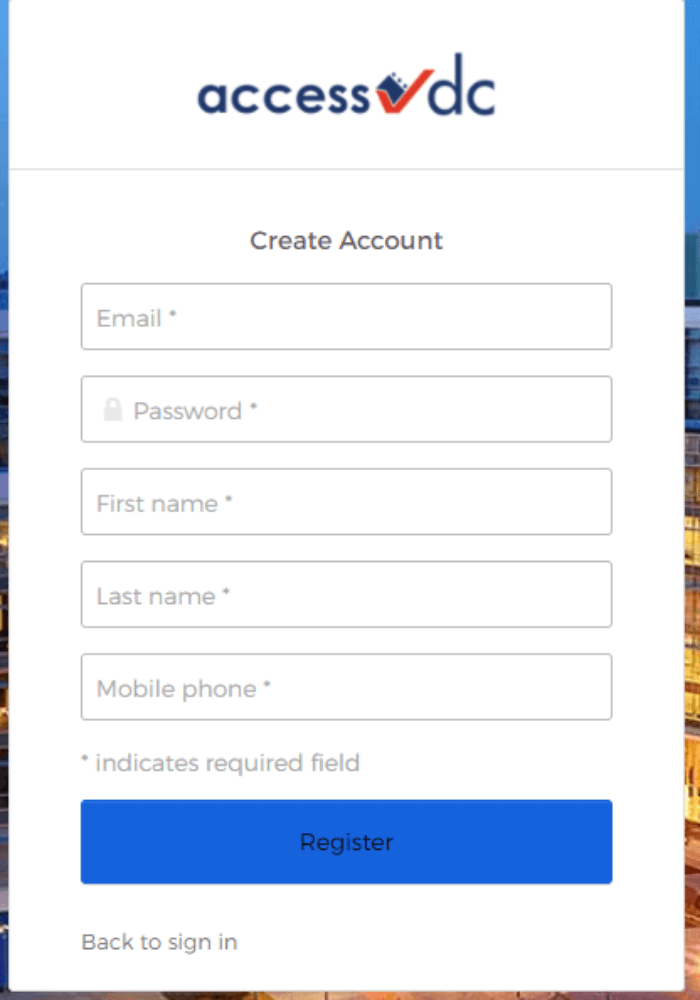

After clicking on the “Sign-up” option, the page for registration of your account will look like this. Fill in your details for user registration such as your name and address and confirm your username and password and submit the form.

Enter the name

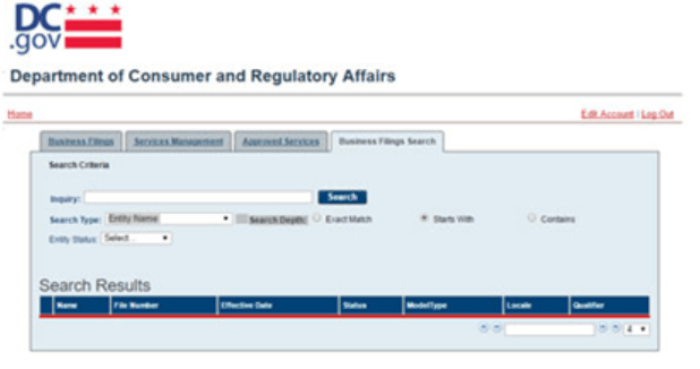

After you navigate to the search page, type your proposed name in the “Inquiry” box. You can also choose among the different available filters and conduct a broad search or narrow down your search entry by applying filters by choosing radio buttons.

Perform the Search

Search the availability of the chosen name on the website. If the proposed business name is already in use, the page will display the relevant details of the competing business. Upon performing any name search on the given page, a list of entities with the relevant name, their file number, effective date, status, locale, and qualifier shall pop up on the screen. Conduct thorough research of the name by using the provided filters such as entity name, business ID, etc. before filing it with the Authorities.

You can also visit the D.C. Trademark records or the USPTO’s Federal Electronic Records to search if your business name is already in use by some other trademark slogans or logos in the DC.

After selecting a name, you can file an application for reservation of your LLC Name for 120 days with the DCRA.

F.A.Qs

A trade name (doing business as (DBA) name) is the official name under which a proprietor or company chooses to do business.

Having a domain isn’t necessary, but it is recommended. If you have a domain name, customers will find you more accessible through online means with your online website.

For domestic LLC, you can simply brainstorm for another name if the one you pick is no longer available. For foreign LLC, you must think up a “fictitious name,” which you’ll use only in the state.

How Do I Reserve an LLC Name in District of Columbia

To reserve an LLC name in District of Columbia you need to submit a name reservation request form to the Department of Consumer and Regulatory Affairs by mail or online by paying a filing fee of $50.

Reserving an LLC name in the District of Columbia is a straightforward process that can be done online through the Department of Consumer and Regulatory Affairs (DCRA) website. Before beginning the reservation process, it is crucial for business owners to have a few potential names in mind in case their first choice is already taken. Additionally, it is important to ensure that the name complies with the district’s naming guidelines, such as not including certain restricted terms or reserved words.

Once an individual has determined an available and compliant name for their LLC, they can begin the reservation process. The first step is to visit the DCRA website and navigate to the business entity name reservation page. From there, individuals can input their chosen LLC name and submit a reservation request. The reservation is typically valid for 120 days, during which time the individual can take the necessary steps to formally establish their LLC.

Reserving an LLC name in the District of Columbia is a vital step in the business formation process, as it provides business owners with the peace of mind that their chosen name is secured. This not only allows them to begin establishing their brand identity but also protects their business from potential trademark disputes or confusion with other entities operating in the district.

In addition to reserving the LLC name, it is crucial for business owners to consider securing the corresponding domain name for their website and social media channels. This will help to establish a consistent and cohesive brand presence online, making it easier for customers to find and engage with the business.

Overall, reserving an LLC name in the District of Columbia is a relatively simple process that can be completed online in just a few steps. By taking the time to ensure that their chosen name is available and compliant with district regulations, business owners can set themselves up for success as they work towards formalizing their LLC and bringing their business idea to life. By following these guidelines and best practices, entrepreneurs in the District of Columbia can confidently reserve an LLC name and begin the exciting journey of building their new business.

In Conclusion

LLC names are important as it is the main identity of your business. While naming your LLC make sure to choose the one that suits the nature of your business. Follow the naming guidelines before you start filing your LLC name