If you are forming an LLC in NJ, then this page’s content would be vital. As you learn how to start an LLC, you will realize that the bulk of your initial work and LLC cost comprises filing a New Jersey certificate of formation, which we will elaborate on this page.

On this page, you’ll learn about the following:

What is a Certificate of Formation?

A Certificate of Formation, also known as an LLC certificate or Articles of Organization in some states, is a document filed with the secretary of state to form an LLC.

Each state has a different requirement to fill out a form. A Certificate of Formation usually includes the following:

- The name of the LLC,

- the effective date of the LLC,

- the company’s principal office,

- the business purpose,

- the duration of the business,

- a copy of the LLC’s name registration certificate, and

- the name and address of the registered agent, organizers, and

- at least one member of the company.

You can file a Certificate of Formation online, by mail, or in person.

Note that the certification of formation is a legal requirement, not to mention, the core of your LLC formation. It even makes up the bulk of your New Jersey LLC cost. Without it, you have no LLC. So, take the time to complete and file this certificate.

How to File an New Jersey Certificate of Formation

These are the simple steps to follow in filing a Certificate of Formation in New Jersey.

Step 1: Find Forms Online

Go to the New Jersey Division of Revenue to download the certificate of formation form for your LLC or to log into the online service.

Step 2: Fill Out Form

When filling out the form, you must have reserved an LLC name. Do a name search. Go to New Jersey LLC Name Search to check whether your chosen business name is available to use in this state.

You must attach a copy of your Name Reservation to your filled-out Certificate of Formation form when filing. You also need to nominate a registered agent. Here are 3 of the best LLC services on our list.

Step 3: File Formation Certificates

File your formation certificate either online or by mail by filling out a form and sending it to the NJ Division of Revenue, PO Box 308, Trenton, NJ 08646.

Steps to Register Certificate of Formation Online

Time needed: 5 minutes

If you wish to set up a business LLC in the State of New Jersey, you are required to file for the Certificate of Formation with the New Jersey Secretary of State. The State offers an online and offline method of filing the formation application. When your application is submitted via online mode, you may get the benefit of immediate processing of your application. The cost of filing for the Certificate of Formation with the New Jersey Secretary of State is $125. The formation guide below will guide you in filing the Certificate of Formation, so read in and get info,

- Go to the Official Website of the New Jersey Secretary of State

Visit the Business Formation page on the Official website of the Secretary of State of New Jersey. The page offers different online services and serves as a one-stop solution to business filings.

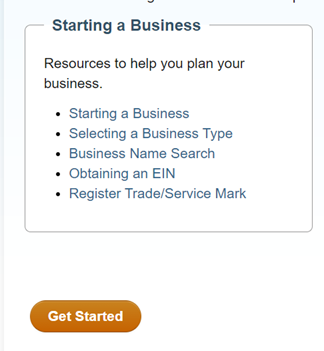

- Starting a Business

On the given page, scroll down to the heading ‘Starting a Business’ and select the following link: “Starting a business”.

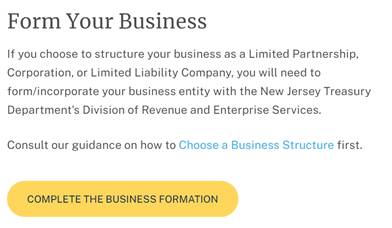

- Register Your Business

On the next page, proceed to the option of ‘Register your Business’. On the next page, click on the ‘Complete the business formation’ tab. The NJ Portal opens us. Start to fill in the information about your New Jersey Business LLC.

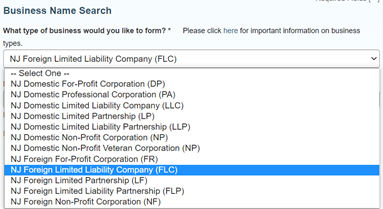

- Business Name Search

This is the first page of the online application. Select the type of business from the drop-down menu as ‘NJ Domestic Limited Liability Company (LLC)’. Next, in the space provided for business names, fill in your proposed business name. You can also refer to the naming guidelines issued by the State to select an appropriate name for your business LLC. Next, press the ‘Continue’ tab.

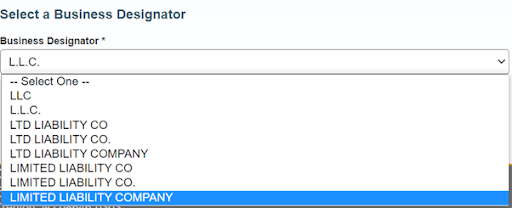

- Business Designator

On the next page, select the designation of your business LLC name, such as LLC or L.L.C, etc. Next, press the ‘Continue’ tab.

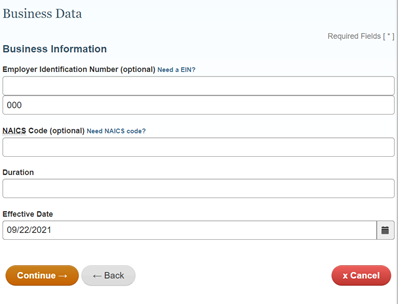

- Business Information

On the next page, fill in the information related to your business, such as Employer Identification Number, NAICS Code, Duration of your LLC, and the effective date of your Business. Next, press the ‘Continue’ tab.

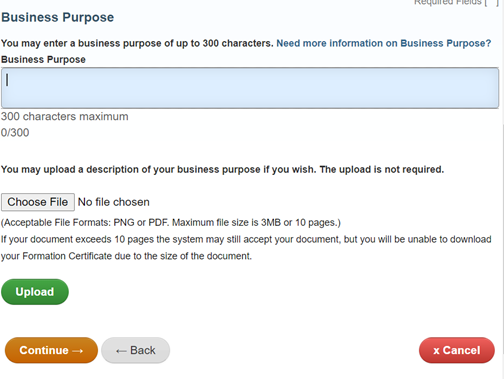

- Business Purpose

On the following page, describe the nature, character, and purpose of your business LLC. You can write your information with a maximum of 300 characters. You can also upload the description of your business LLC using the ‘Upload; option. After completing the section, select the ‘Continue’ option.

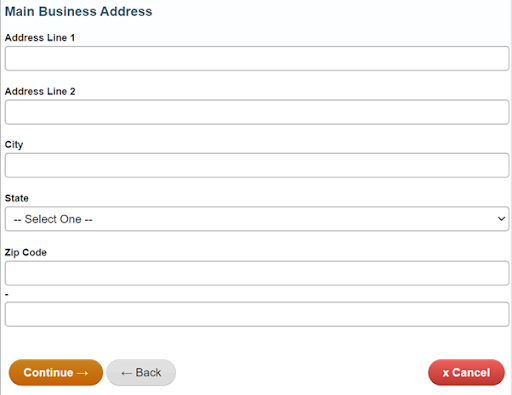

- Main Business Address

On the next page, you must provide the street address of the main address of your business LLC. Next, select the ‘Continue’ tab.

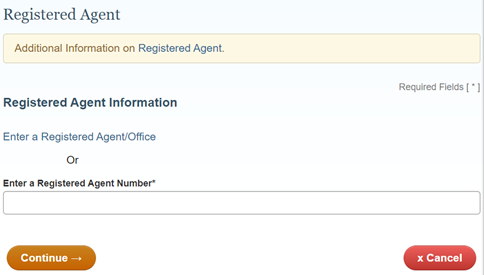

- Information about Registered Agent

In the next section, you must provide the information related to your registered agent in the State of New Jersey, such as Agent number or office address details. Next, press the ‘Continue’ tab.

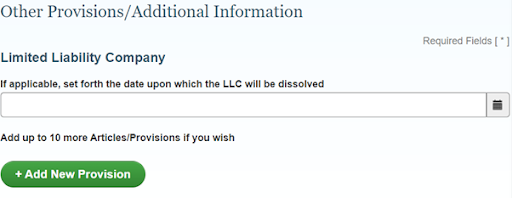

- Details about the Company Management and other provisions

In the next section, provide the details of the members or the managers of your business, such as name, address, and contact details. After this section, you must fill in the details about other related provisions that you wish to add to the application. You can add other provisions by clicking on the ‘Add New Provision’ option.

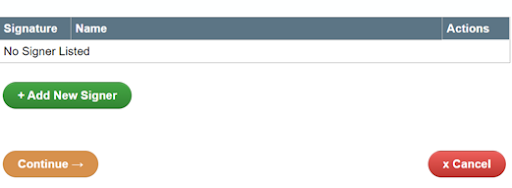

- Signature

In the next section, you must provide your signatures for the authentication of your business documents.

- Review the application

Before making the payment, visit the review page and check every information entered by you thoroughly. All the information should be accurate and correct to your knowledge.

- Make the Payment

As the final step, make the payment of $125 as the filing fee for your application for the New Jersey LLC Certificate of Formation. After successful payment, you will receive a notification from the Secretary of State office acknowledging your application.

Filing Certificate of Formation by Mail

Online filing offers a convenient option to submit and track the status of your application. Nevertheless, if you wish to file your New Jersey LLC Certificate of Formation application by mail, it can also be done easily. Follow the instructions below to file the Certificate of Formation in New Jersey,

- Download the Application Form PDF on your computer system.

- Read all the instructions and guidelines mentioned in the form carefully. The application form contained a long list of instructions and comprises more than 50 pages.

- Start to fill in the application form.

- You can also attach the name reservation certificate along with your application form.

- Review all the information entered by you in the application form to be correct and accurate.

- Make the check or money order of $125 as the filing fee for your application is payable to the Secretary of State.

- Arrange all the documents together and mail them to the following address, Client Registration Po Box 252 Trenton, NJ 08646-0252. You can also submit the application in person to the following office address: New Jersey Division of Revenue, 33 West State Street, Trenton, NJ 08608.

Cost of Filing a New Jersey LLC Certificate of Formation

Though the online mode of filing is considered as a convenient method of application filing than offline filing, the cost of registering an LLC in the State of New Jersey is the same for both methods of filing. Here is the cost of filing formation certificate in New Jersey,

- Online filing costs $125

- By mail filing costs $125

Where Can You Find Your New Jersey Certificate of Formation

Starting a business is an exciting venture. From brainstorming innovative ideas to transforming your dreams into reality, there are numerous aspects to consider. One crucial step to solidify the foundation of your business is obtaining a Certificate of Formation. In the state of New Jersey, this important document verifies the existence of your new company and, more importantly, makes it official. However, knowing where to find your New Jersey Certificate of Formation can seemingly be a daunting task, but fear not, we’re here to guide you through the process.

Firstly, let’s understand what a Certificate of Formation entails. Essentially, it is a legal document provided to new businesses by the New Jersey Division of Revenue and Enterprise Services. This document clearly states the name of your business, its structure (such as a limited liability company or corporation), and other key details. Its purpose is to help establish your business as a separate legal entity distinct from its owners. In other words, it sets down the foundation for your business’s existence in the state of New Jersey.

Now that we understand its significance, let’s dive into where you can acquire this imperative document. The first option is to apply for it online, utilizing the state’s user-friendly website. The Division of Revenue and Enterprise Services has made great strides in streamlining the process for obtaining certificates, and the online application is a prime example of this effort. By accessing their website, you’ll find step-by-step instructions for submitting your application, including the requirement of a digital signature. While this method may require some technical know-how and access to the necessary equipment, it significantly expedites the process, saving you time and energy.

For those who prefer the traditional route, acquiring the Certificate of Formation can be accomplished by mailing your application. By downloading the appropriate form from the state’s website, you can fill it out with all the required information. Be sure to double-check and review your application meticulously! mistakes or incomplete information may delay the certificate issuance process. Finally, mail the completed form to the address mentioned on the form alongside the required fees, and patiently await the arrival of your New Jersey Certificate of Formation. It may take some time, but good things come to those who wait!

Another option is to apply in person at the Division of Revenue and Enterprise Services office. This alternative is advantageous if you prefer a face-to-face interaction, as it allows for immediate resolution of any queries or concerns you may have. Additionally, applying in person eliminates the risk of documents getting lost in the mail or delayed due to unforeseen circumstances.

Lastly, if desired, you can also authorize another individual or agency to receive your Certificate of Formation on your behalf. To do so, ensure you complete and submit the appropriate authorized form, crediting that particular individual or entity. This option is useful if you’re unable to collect your certificate personally due to constraints or if you have designated someone else to handle these issues on your behalf.

Finding your New Jersey Certificate of Formation does not need to be a daunting task. Whether you choose to apply online, mail it in, apply in person, or utilize an authorized recipient, the process is attainable and rewarding. Remember, your Certificate of Formation is the vital proof that ushers your new business into existence and should be safeguarded with equal importance. Best of luck with your exciting entrepreneurial journey!

F.A.Qs

A Certificate of Formation is a legal document that will officially make your LLC into existence. This document is needed specifically for New Jersey in forming an LLC business structure.

The application form for the Certificate of Formation needs to include the LLC name, date of establishment, the company’s registered office, business purpose, how long the business will exist, and a copy of the LLC’s name registration certificate.

Filing by mail or in person is neither highly recommended nor required; waiting an extra week for your LLC to be approved isn’t that bad. The LLC approval you send in will be returned by mail. Online filing, meanwhile, is more convenient as you won’t have to stay in a queue.

Where Can You Find Your New Jersey Certificate of Formation

So, where can you find your New Jersey Certificate of Formation? The answer is quite simple. Once your business has been successfully formed and registered with the state, you can obtain a copy of your Certificate of Formation from the New Jersey Division of Revenue and Enterprise Services. This is the government agency responsible for handling business registrations in the state, and they keep official records of all businesses that are registered in New Jersey.

Obtaining a copy of your Certificate of Formation is a relatively straightforward process. You can visit the Division of Revenue and Enterprise Services website and request a copy online, or you can submit a request by mail. In either case, you will need to provide some basic information about your business, such as its name, location, and registration number. Once your request is processed and approved, you will receive a copy of your Certificate of Formation in the mail.

Having your Certificate of Formation readily available is important for several reasons. First and foremost, it serves as official proof that your business exists and is recognized by the state of New Jersey. This can be crucial when dealing with investors, lenders, or other business partners who may require proof of your business’s legitimacy.

Additionally, your Certificate of Formation may be needed for tax purposes. When filing your business taxes, you may be required to provide a copy of this document to verify your business’s legal status. Without it, you may encounter delays or complications in filing your taxes, which can result in fines or other penalties.

Furthermore, your Certificate of Formation is essential for opening a business bank account. Most banks will require this document as part of the account-opening process to ensure that your business is legally formed and in good standing with the state. Without it, you may not be able to access essential banking services needed to run your business smoothly.

In conclusion, your New Jersey Certificate of Formation is a vital document that every business owner should have on hand. It serves as official proof of your business’s registration with the state and is essential for various legal, financial, and operational purposes. By making sure you know where to find your Certificate of Formation and keeping it readily available, you can ensure that your business remains compliant and operational in the state of New Jersey.

In Conclusion

Articles of Organization or Certificate of Formation is the most important document for your New Jersey LLC. Before you submit/file the document make sure to provide proper and correct information about your company. If you have any questions, share that below in the comment section.

How do i obtain a copy of my LLC and my formation documents.