If you already have an LLC in another state and want a Missouri LLC in Missouri, then starting an LLC would be somewhat different. You must register as a foreign LLC. We have here a guide on how you can qualify and register for a foreign LLC in Missouri.

On this page, you’ll learn about the following:

Forming an Missouri Foreign LLC

A foreign LLC does not need to be a company from another country but a business formed under the laws of another state. To start a foreign LLC in Missouri, you need to register it with the Missouri Secretary of State.

Step 1: Choose Missouri Foreign LLC Name

Obtain a name reservation certificate and submit it with your foreign qualification requirements at the Missouri Secretary of State. Your LLC’s legal name outside of Missouri will be listed on the application, along with the name it will use in Missouri. Take note of the requirements for naming your LLC.

Check name availability at Missouri’s business entity names and reserve your LLC name.

Step 2: Select Missouri Foreign LLC Registered Agent

You’ll need a registered agent to form a foreign LLC in Missouri and take note that a Missouri registered agent must have a local address. Here are three of the best LLC services on our list that will provide you with registered agents to ease your worries:

Step 3: File Registration of Missouri Foreign LLC

Fill out and submit a Foreign LLC Application for Registration form via email to [email protected] or by mail to Corporations Unit, James C. Kirkpatrick State Information Center P.O. Box 778, Jefferson City, MO 65102.

Include the following:

- LLC’s full legal name.

- A fictitious name or a DBA (only if your LLC’s legal name is not available); Attach a statement of adoption of the fictitious name signed by all LLC members.

- LLC’s principal office and mailing addresses.

- LLC formation state and date.

- Registered agent’s name and address in Missouri

- Date when your LLC will start operations in Missouri.

- Credit card information on the last page of the form for the $150 application fee.

The LLC cost in Missouri, even for foreign LLCs will differ between online filing and by mail.

Step 4: Determine How Your Missouri Foreign LLC is taxed

Foreign LLCs are also subjected to the Missouri Business Privilege Tax, and they must file LLC annual reports each year.

Note that forming a foreign LLC would be good for your business as you can legally operate in a different state thus reaching a larger market and opening more opportunities for higher profit.

Steps to Register your Missouri Foreign LLC Online

Time needed: 5 minutes

To establish your foreign LLC in the State of Missouri, you must submit your Application for Registration of foreign LLC with the Secretary of State of Missouri which costs $105. Once approved by the Authorities, you will receive a Certified copy of your Registration from the State office. We have explained the aspects you need to cover when you apply for Missouri Foreign LLC.

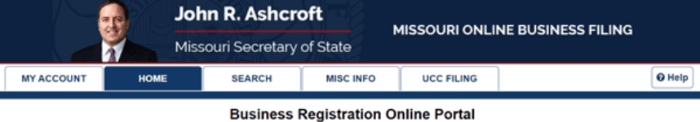

- Visit the Official Website of the Secretary of State of Missouri

Visit the Business Registration Online Portal on the Missouri Secretary of State website. The portal provides solutions to every business-related activity, such as registrations, certificates verifications, etc.

- Visit the Official Website of the Secretary of State of Missouri

Visit the Business Registration Online Portal on the Missouri Secretary of State website. The portal provides solutions to every business-related activity, such as registrations, certificates verifications, etc.

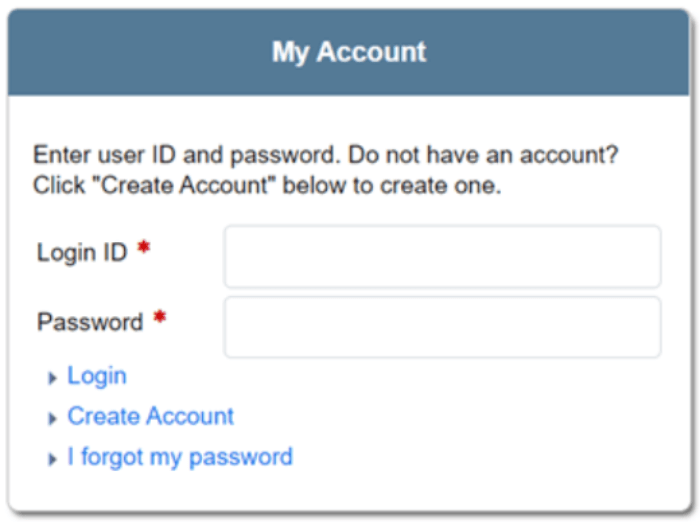

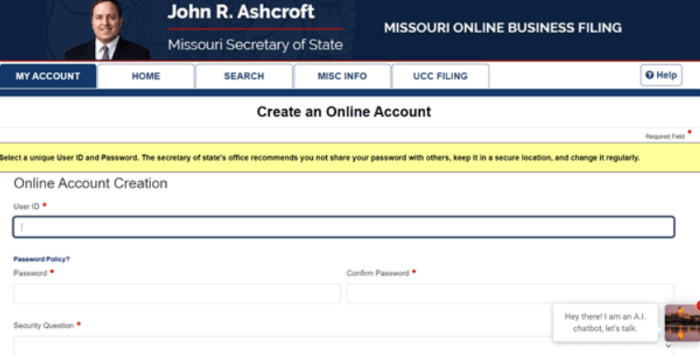

- Create your Account

For users who have not created an account on the portal, click on the option of ‘Create Account’ provided below the login section in the My Account section. On the following page, fill in the required details such as User ID, Password, Security Question, and Answer, First and Last Name, Street Address information, and contact information. Next, agree to the terms and conditions and click on the ‘Create Account’ page. Make sure to confirm your account by clicking the link email to the associated email address provided during enrollment.

- Proceed to Registration

After creating your account on the portal, log in to your account. Next, select the option of ‘Create an LLC’ and start to apply by filling in the required information and proceeding according to the instructions on the page.

- Review your application

Before submitting your application to the State, review all the information provided by you to be correct and accurate.

- Proceed to Payment

In the final section, after you have reviewed all the information, proceed to make the payment for the filing fee of your application.

Once you have completed your filing, you will receive a notification confirming your application for Foreign LLC in Missouri by the Secretary of State Office. You will receive a response to your application within 5 to 7 business days from the State Office.

Filing your Missouri Foreign LLC Application via Mail

You can also file your Missouri Foreign LLC Application by mail. Download the Application Form PDF and read the instructions carefully. Fill in the required details and make the payment of $105.00 via check or money order payable to the Secretary of State. Also, attach the Certificate of Good Standing issued by the relevant Authority in the State of Original Jurisdiction. Send your documents to the following address: Secretary of State, Corporations Divisions, PO Box 778/600 W. Main St., Rm. 322, Jefferson City, MO 65102.

After Forming Missouri Foreign LLC

Here are added things you need to accomplish after forming your Missouri Foreign LLC

- Obtain Business Licenses. Find the business licenses you’ll need using the Business License Search.

- File LLC annual reports and Business Privilege Tax.

- Pay State Taxes like sales tax; you’ll need an EIN for your LLC.

It is convenient plus easy to file for the foreign LLC if you are doing it online. The steps are very easy and that’s why it’s possible to go along with the steps and form the foreign LLC in Missouri.

F.A.Qs

If your LLC is formed under the laws of another state, it is referred to as a foreign LLC in Missouri.

Businesses incorporated outside of the state where they operate must have “foreign qualifications” issued in the other states.

A domestic LLC is a company registered in Missouri as an LLC. The entity type that has a physical presence in another state is a foreign LLC.

How Much Does It Cost to Register a Foreign LLC in Missouri

To register as a foreign LLC in Missouri, you can file through mail or online by paying a filing fee of $105 to the Missouri Secretary of State.

The cost associated with registering a foreign LLC in Missouri can vary depending on several factors, such as the type of business, the size of the company, and the specific services that may be required during the registration process. It is essential for business owners to carefully research and understand the regulations and fees associated with foreign LLC registration to avoid any unnecessary expenses or delays.

One of the initial costs that businesses must consider is the filing fee required by the Missouri Secretary of State. This fee covers the necessary paperwork and processing required to formally register a foreign LLC in the state. Additionally, businesses may need to pay additional fees for expedited services or other optional services provided by the Secretary of State’s office.

In addition to the filing fee, businesses may also need to consider other associated costs, such as legal fees for consulting with an attorney to ensure all registration requirements are met, as well as any potential annual registration fees or taxes that may be levied by the state of Missouri. These costs can add up quickly and should be factored into a business’s budget when considering expanding into the state.

Furthermore, businesses must keep in mind that in addition to the initial registration costs, there may be ongoing fees and compliance requirements that must be met to maintain the foreign LLC status in Missouri. These can include annual reporting requirements, additional taxes, and any other legal obligations that may be imposed on foreign LLCs operating within the state.

It is crucial for businesses to thoroughly research and understand all the costs associated with registering a foreign LLC in Missouri before committing to expansion or operation within the state. By understanding the fees and processes involved, businesses can avoid any surprises or unexpected costs that may arise during the registration process.

In conclusion, the cost of registering a foreign LLC in Missouri can vary depending on several factors, and it is essential for business owners to carefully research and understand all the associated fees and processes before committing to expansion within the state. By budgeting appropriately and ensuring compliance with all requirements, businesses can successfully register their foreign LLC in Missouri and operate legally within the state.

In Conclusion

Starting a foreign LLC in Missouri does not require a lot of documentation or tasks. However, it is always good to seek help from a professional when it comes to running your business. Get a professional registered agent and form your foreign LLC anywhere without a hassle.