Forming an LLC requires a different business name, which must be unique and adheres to the guidelines. The great thing is Hawaii’s Secretary of State page includes a name availability checker. Check out LLC Name Search to learn more.

Meanwhile, if you’re interested in learning more about starting a Hawaii LLC or forming an LLC in general, you can check out How to Start an LLC.

On this page, you’ll learn about the following:

How to Name an LLC in Hawaii

Time needed: 5 minutes

There are guidelines to follow in doing a Hawaii LLC name search. To learn more, check out LLC Naming Guidelines or read Foreign LLC Application for Registration if you’re planning to register a foreign LLC.

- Check Name Availability

Search the Business Entity Records in Hawaii’s Official Secretary of State page to check if your chosen business name is available. You may also try typing your trademark, business, or domain name on any search engine to generate businesses with similar names and to ensure your trademark is unique and meets the state’s requirements.

Check out How to File a DBA to learn more about registering a DBA or trademark. For social media pages, use Social Searcher to avoid using similar page names. - Check Domain Availability

If your business name is still available, you must register for a domain name using Namecheap, Google Workspace, or other domain name sites. So customers can easily find your business over the Internet. Use the Kinsta app to manage your domains efficiently.

- File Name Reservation

A Name Reservation Certificate is required along with a Certificate of Formation. You can reserve a name online, by mail, or in-person with a $10 filing fee (plus tax for online).

File your Certificate of Formation and Name Reservation online on the Secretary of State Online Services page of Hawaii. You may also download the pdf file of the Name reservation form and submit it with the processing fee to the Department of Commerce and Consumer Affairs. Business Registration Division, 335 Merchant Street, P.O. Box 40, Honolulu, Hawaii 96810.

Guidelines to Follow in Naming LLC

- Use a business name with the abbreviation “LLC” or the phrase “Limited Liability Company.”

- Your decided business name must not coincide with any existing government entity. Otherwise, you might have to face legal lawsuits when filing your LLC.

- Use the LLC name availability checker to ensure your business name is unique.

- Get a license first if you plan on using restricted words to avoid any complications.

Note that you must put adequate effort into naming your LLC because this name will be with your business for a long time. Making your LLC name unique is vital as it would prevent people from confusing your business with others, not to mention it would be easier for them to recall your business, products, or services.

Hawaii LLC Name Search (Online)

Naming an LLC is a vital part when it comes to starting an LLC in Hawaii. Before you name your LLC, it is necessary to check if the desired name is available to use. To check the availability of your business name online, one must visit the Hawaii Government website. Here’s how you can search for your LLC name online if you are starting a Hawaii LLC.

Steps to Check LLC Names Online

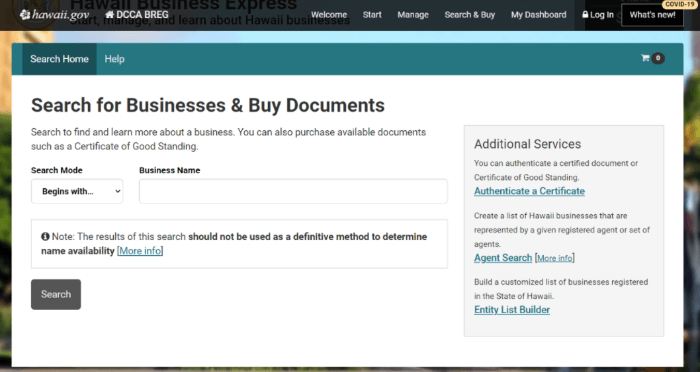

- Visit the Hawaii Business Express site. On the home page, you will get the option of searching LLC names. There are two ways to search for the desired business name. Enter the LLC name you desire to have. Any name that begins with the word/name can be searched.

2. As one hits the Search button, any LLC or business with similar names will appear in the search list. If there is no such name, then easily you can have the name for your LLC.

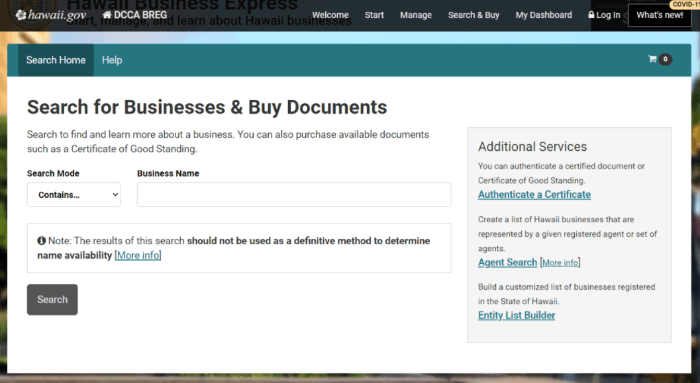

3. Another option for searching an LLC name is to mention important terms that contain in the name. Same way, you can hit the Search button to get the list of Entity names in Hawaii.

4. Once you will get the list, you can select what will be the name of your LLC. You can also build an Entity List online on the Hawaii Government website.

LLC names are the most important part while forming an LLC in Hawaii. One can read the naming guidelines in Hawaii. Depending on the guidelines, you can name your LLC. You can also file the naming request easily in Hawaii.

F.A.Qs

A trade name (doing business as (DBA) name) is the official name under which a proprietor or company chooses to do business.

Having a domain isn’t necessary, but it is recommended. If you have a domain name, customers will find you more accessible through online means with your online website.

For domestic LLC, you can simply brainstorm for another name if the one you pick is no longer available. For foreign LLC, you must think up a “fictitious name,” which you’ll use only in the state.

How Do I Reserve an LLC Name in Hawaii

To reserve an LLC name in Hawaii you need to submit a name reservation request form to the Hawaii Secretary of State by mail for $10 or online by paying a filing fee of $7.50.

First and foremost, it’s important to understand why reserving a name for your LLC is crucial. By reserving a name, you prevent any other business entity in Hawaii from using the same name, thus protecting your brand identity and reputation. A unique and recognizable name is vital for attracting customers and building trust in the marketplace.

So, how exactly do you reserve an LLC name in Hawaii? The process is relatively straightforward. You can reserve a name by submitting a Name Reservation Request form to the Hawaii Department of Commerce and Consumer Affairs (DCCA). This form can be filled out online or submitted in person, along with the required fee. The name reservation is valid for 120 days, during which time you can take the necessary steps to formally register your LLC.

When choosing a name for your LLC, it’s important to ensure that it complies with Hawaii’s naming requirements. The name must include the words “Limited Liability Company” or an abbreviation, such as “LLC.” Additionally, the name cannot be misleading or similar to the name of any existing business entity in Hawaii. Conducting a thorough search of existing business names in Hawaii can help you avoid potential conflicts and rejections.

Before submitting your Name Reservation Request form, it’s a good idea to conduct a name availability search on the DCCA’s Business Registration Division website. This search tool allows you to check the availability of your preferred business name in Hawaii and avoid any delays or potential rejections. It’s also recommended to have a few backup names in mind in case your first choice is not available.

Once your LLC name is reserved, you can begin the process of formally registering your business with the DCCA. This involves submitting Articles of Organization, along with the required fee and other necessary documentation. The Articles of Organization outline essential details about your LLC, such as its name, address, members, and purpose.

In conclusion, reserving an LLC name in Hawaii is a crucial step in establishing your business identity and protecting your brand name. By following the simple steps outlined above and complying with Hawaii’s naming requirements, you can secure your preferred business name and begin the process of formally registering your LLC. Remember to conduct a name availability search and have backup names in mind to avoid any potential conflicts or rejections. With a little preparation and attention to detail, you can navigate the process smoothly and set your business up for success.

In Conclusion

LLC names are important as it is the main identity of your business. While naming your LLC make sure to choose the one that suits the nature of your business. Follow the naming guidelines before you start filing your LLC name