If you already have an LLC in another state and want an LLC in Tennessee, then starting an LLC would be somewhat different. You must register as a foreign LLC. We have here a guide on how you can qualify and register for a foreign LLC in Tennessee.

On this page, you’ll learn about the following:

Forming a Tennessee Foreign LLC

A foreign LLC does not need to be a company from another country but a business formed under the laws of another state. To start a foreign LLC in Tennessee, you need to register it with the Tennessee Secretary of State.

Step 1: Choose Tennessee Foreign LLC Name

Obtain a name reservation certificate and submit it with your foreign qualification requirements at the Tennessee Secretary of State. Your LLC’s legal name outside of Tennessee will be listed on the application, along with the name it will use in Tennessee. Take note of the requirements for naming your LLC.

Check name availability at Tennessee’s business entity names and reserve your LLC name.

Step 2: Select Tennessee Foreign LLC Registered Agent

You’ll need a registered agent to form a foreign LLC in Tennessee and take note that a Tennessee registered agent must have a local address. Here are three of the best LLC services on our list that will provide you with registered agents to ease your worries:

Step 3: File Registration of Tennessee Foreign LLC

Fill out and submit a Foreign LLC Application for Registration form via email to [email protected] or by mail to Secretary of State’s office at 6th FL – Snodgrass Tower ATTN: Corporate Filing, 312 Rosa L. Parks AVE, Nashville, TN 37243.

Include the following:

- LLC’s full legal name.

- A fictitious name or a DBA (only if your LLC’s legal name is not available); Attach a statement of adoption of the fictitious name signed by all LLC members.

- LLC’s principal office and mailing addresses.

- LLC formation state and date.

- Registered agent’s name and address in Tennessee.

- Date when your LLC will start operations in Tennessee.

- Credit card information on the last page of the form for the $150 application fee.

The LLC cost in Tennessee, even for foreign LLCs will differ between online filing and by mail.

Step 4: Determine How Your Tennessee Foreign LLC is taxed

Foreign LLCs are also subjected to the Tennessee Business Privilege Tax, and they must file LLC annual reports each year.

Note that forming a foreign LLC would be good for your business as you can legally operate in a different state thus reaching a larger market and opening more opportunities for higher profit.

Steps to Filing Tennessee Foreign LLC Online

Time needed: 5 minutes

To start your foreign business as a Limited Liability Company in the State of Tennessee, you must first register your business with the Secretary of State of Tennessee office to obtain the Certificate of Authority. The State offers online and offline filing options. The cost of registration is $300+. When your application is approved by the State office, you will receive the Certificate of Authority of your business documents from the Secretary of State office. We have explained the aspects you need to cover when you apply for Foreign Business Registration in Tennessee.

Following are the steps to register the Foreign LLC online:

- Visit the Official website of the Tennessee Secretary of State

Go to the Businesses tab on the official Tennessee Secretary of State website. On the State main web page, click on the ‘Businesses’ option on the top toolbar.

- Choose the “File new Business Online” option

Click on the File New Business Online tab in the circle.

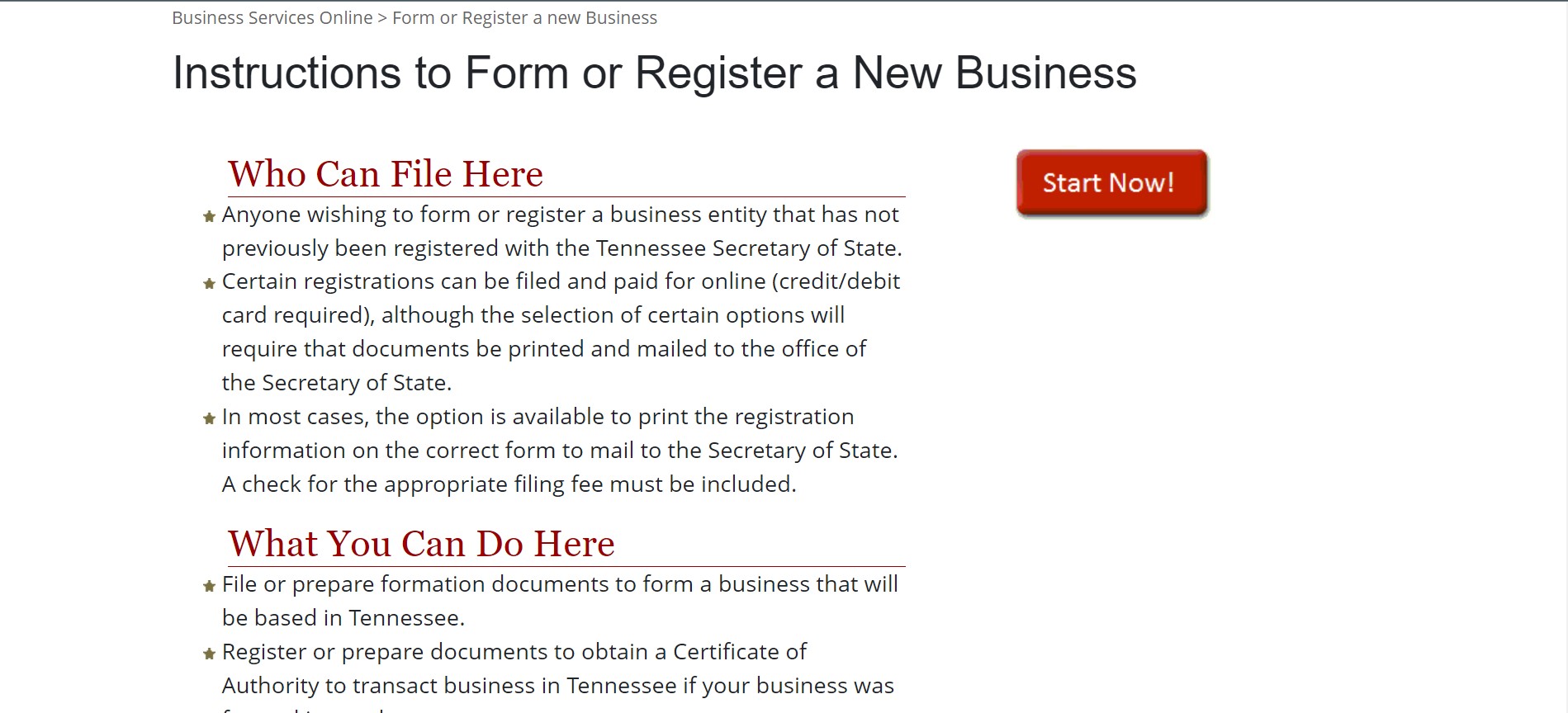

- Click on Start Now Option

On the next page, you will see a red “Start Now” button. Click on that.

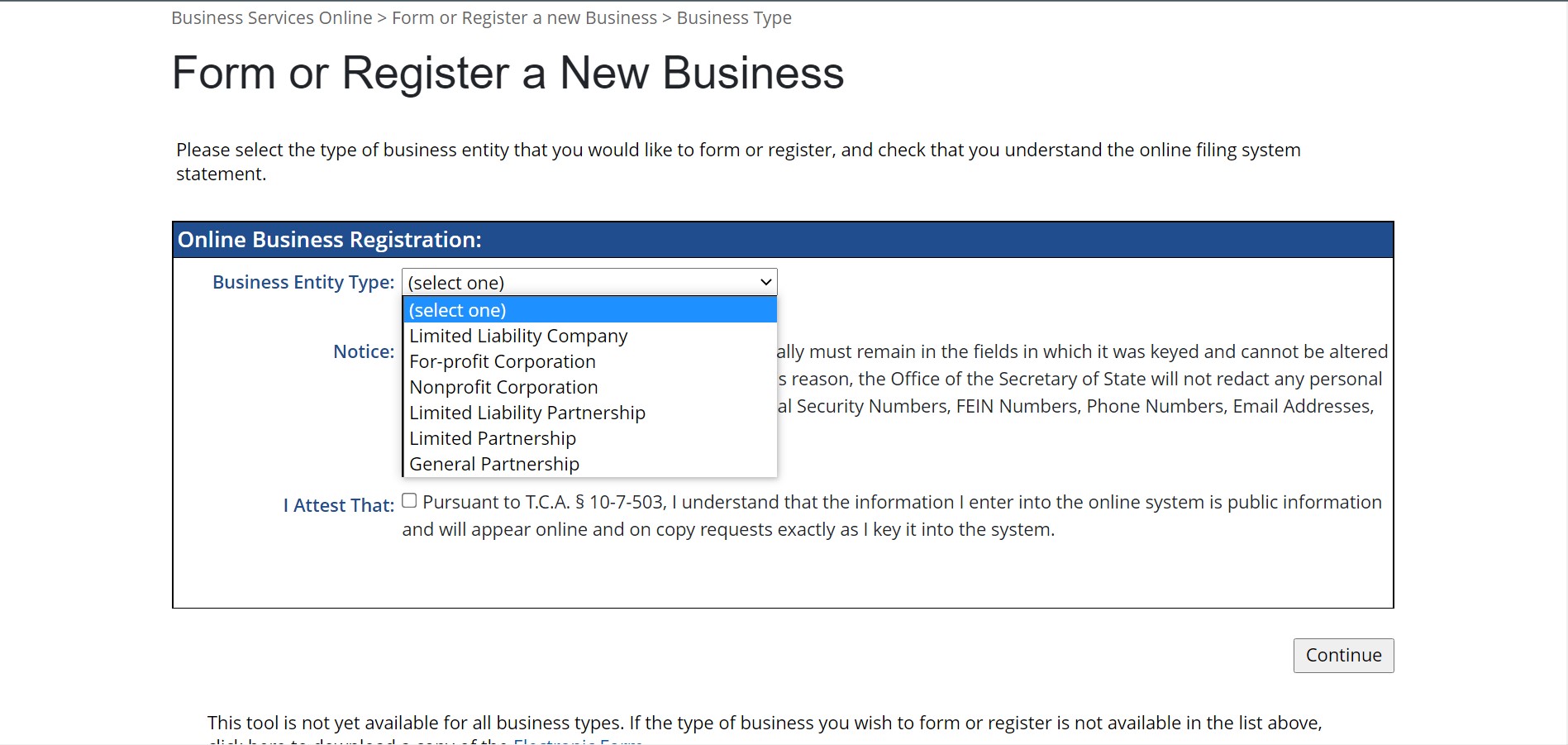

- Choose Business Entity Type

Select “Limited Liability Company” from the business entity type- drop-down menu & check the box before “I Attest That”

- Start Filing the Application Form

The application form is displayed on the screen. Enter the business entity name and confirm the same. Select the formation locale as ‘Foreign Business’. If your business is a Series LLC, you can accordingly select the same. Next, press the ‘Continue’ tab.

- Proceed with other details & signatures

Fill in the required details on all the subsequent pages. Make sure that you have filled in the information correctly. Put all the relevant signatures of the signatories.

- Make the Payment

Once you have correctly filled the application form, proceed to the payment gateway page and make the payment as per your business structure, i.e. $300+ $50 for every member. You receive an acknowledgment of your application, once you have submitted it successfully.

Filing Tennessee Foreign LLC by Mail

If you wish to file your Tennessee Foreign Business LLC Certificate of Authority application by mail, you can do so easily.

- Download the application form PDF (Form SS-4233) on your device.

- Read the instructions attached to the form carefully and accordingly fill in the details.

- You can attach the Certificate of Existence issued by the State of Original Jurisdiction.

- After you have reviewed all the details thoroughly in the application form, issue a money order or check payable to the Tennessee Secretary of State.

- Compile all the documents together and mail it to the following address, Business Services Division, Tre Hargett, Secretary of State, State of Tennessee 312 Rosa L. Parks AVE, 6th Fl. Nashville, TN 37243-1102.

- You can also submit your walk-in application to the Secretary of State Business Services Division located at 6th FL – Snodgrass Tower, 312 Rosa L. Parks Ave, Nashville, TN 37243.

After Forming Tennessee Foreign LLC

Here are added things you need to accomplish after forming your Tennessee Foreign LLC

- Obtain Business Licenses. Find the business licenses you’ll need using the Business License Search.

- File LLC annual reports and Business Privilege Tax.

- Pay State Taxes like sales tax; you’ll need an EIN for your LLC.

It is convenient plus easy to file for the foreign LLC if you are doing it online. The steps are very easy and that’s why it’s possible to go along with the steps and form the foreign LLC in Tennessee.

F.A.Qs

If your LLC is formed under the laws of another state, it is referred to as a foreign LLC in Tennessee.

Businesses incorporated outside of the state where they operate must have “foreign qualifications” issued in the other states.

A domestic LLC is a company registered in Tennessee as an LLC. The entity type that has a physical presence in another state is a foreign LLC.

How Much Does It Cost to Register a Foreign LLC in Tennessee

To register as a foreign LLC in Tennessee, you can file through mail by paying a filing fee od $50 per member to the Tennessee Secretary of State.

The process of registering a foreign LLC involves several steps, each of which comes with its own associated costs. The first step is obtaining a Certificate of Existence from the LLC’s home state, which serves as proof that the company is in good standing there. This can be a relatively straightforward process, but it does come with a fee that can vary depending on the state.

After obtaining the Certificate of Existence, the next step is submitting an Application for Registration with the Tennessee Secretary of State. This includes providing basic information about the LLC, such as its name, address, and the names and addresses of its members. There is also a filing fee associated with this application, which can also vary depending on the state of the LLC’s origin.

Once the Application for Registration is approved, the LLC is required to appoint a registered agent in Tennessee. This agent serves as a point of contact for legal matters and must have a physical address in the state where they can be reached. There are costs associated with hiring a registered agent, as they usually charge an annual fee for their services.

In addition to these initial costs, there are also ongoing expenses that come with maintaining a foreign LLC in Tennessee. This includes an annual filing fee, which must be paid to the Secretary of State to keep the LLC in good standing. It is essential to budget for these recurring costs to ensure that the LLC can continue to operate legally in the state.

Overall, registering a foreign LLC in Tennessee can be a significant financial commitment. Entrepreneurs and small business owners must carefully weigh the costs involved against the potential benefits of expanding their operations into the state. It is crucial to do thorough research and consult with legal and financial professionals to understand the full extent of the expenses associated with this process.

While the costs of registering a foreign LLC in Tennessee may seem daunting, they are ultimately an essential investment in the future success of the business. By understanding and budgeting for these expenses, entrepreneurs can position their companies for growth and profitability in a new market. As with any business decision, careful planning and financial management are key to achieving success in the long run.

In Conclusion

Starting a foreign LLC in Tennessee does not require a lot of documentation or tasks. However, it is always good to seek help from a professional when it comes to running your business. Get a professional registered agent and form your foreign LLC anywhere without a hassle.