Delaware is widely promoted as the preferred state for business formation due to its corporate court system and flexible entity laws. While these features benefit certain companies, they do not automatically benefit most small or locally operating LLCs. For many business owners, forming an LLC in Delaware introduces duplicate compliance, additional fees, and administrative complexity without providing operational advantages. This article explains specific situations where forming an LLC in Delaware may not be the best choice, using state-level filing rules and federal requirements.

Reasons Delaware May Not Be the Right State for Your LLC

Delaware’s legal framework is designed primarily for companies with complex ownership structures, multi-state operations, or plans to raise external investment. For owner-managed LLCs, freelancers, service providers, and small retail businesses operating in a single state, Delaware formation often creates compliance obligations in two jurisdictions without providing corresponding legal or tax benefits.

1. You Must Register Again in Your Home State

If an LLC is formed in Delaware but conducts business activities in another state, most states require the company to register as a foreign LLC. This means the business must comply with two separate state systems: the formation state (Delaware) and the operating state (home state).

Specific Impacts Include:

- Separate formation and foreign qualification filings

- Two registered agents

- Multiple annual report deadlines

- Additional state filing fees

For most small businesses, operating under a single state jurisdiction is more cost-effective and easier to manage.

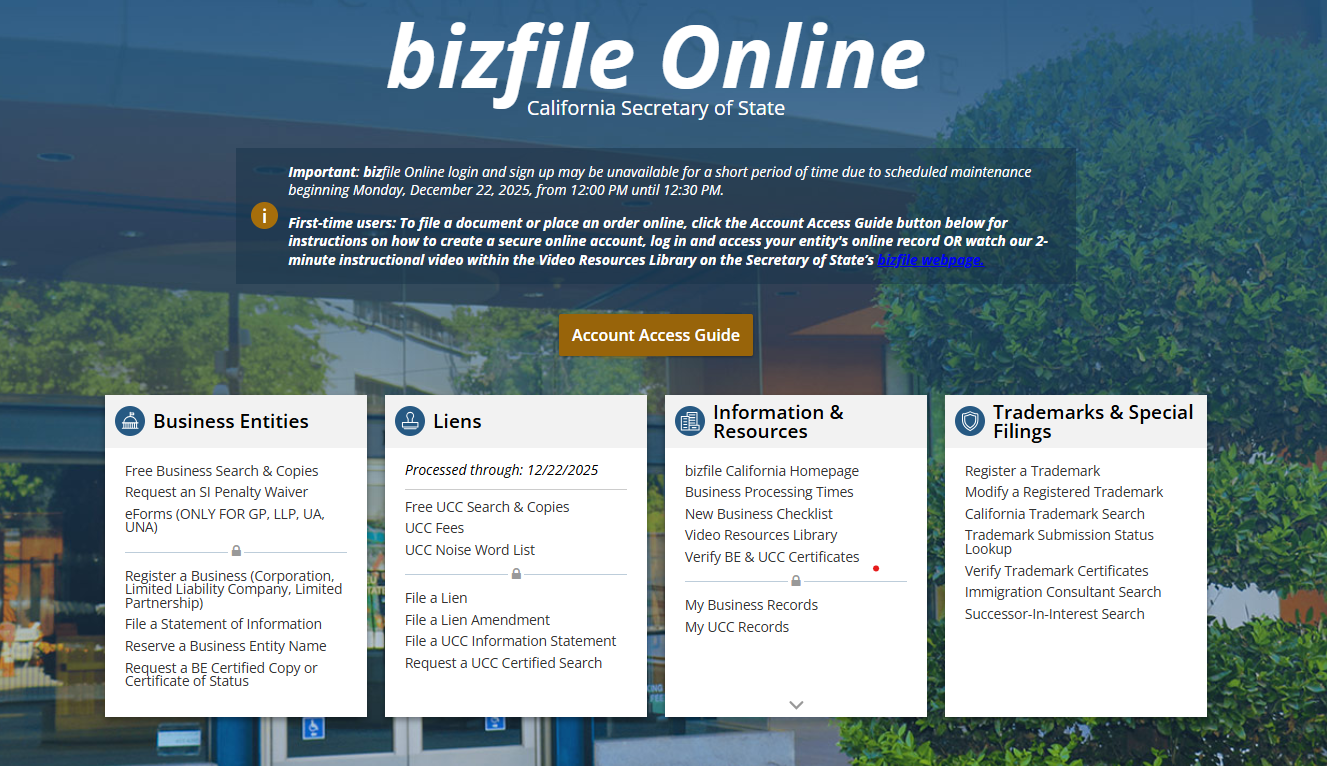

The California Secretary of State page provides official registration procedures for out-of-state LLCs seeking authority to operate within the state.

2. Delaware Franchise Tax and Registered Agent Costs

All Delaware LLCs are subject to an annual franchise tax and must maintain a Delaware-based registered agent, regardless of where the business actually operates. These obligations apply even when the LLC has no physical presence or customers in Delaware.

3. Annual Costs Without Operational Benefit

For LLCs that do not conduct business in Delaware, these annual costs do not provide legal protection, tax savings, or operational efficiency. Instead, they increase recurring expenses without improving compliance outcomes in the home state.

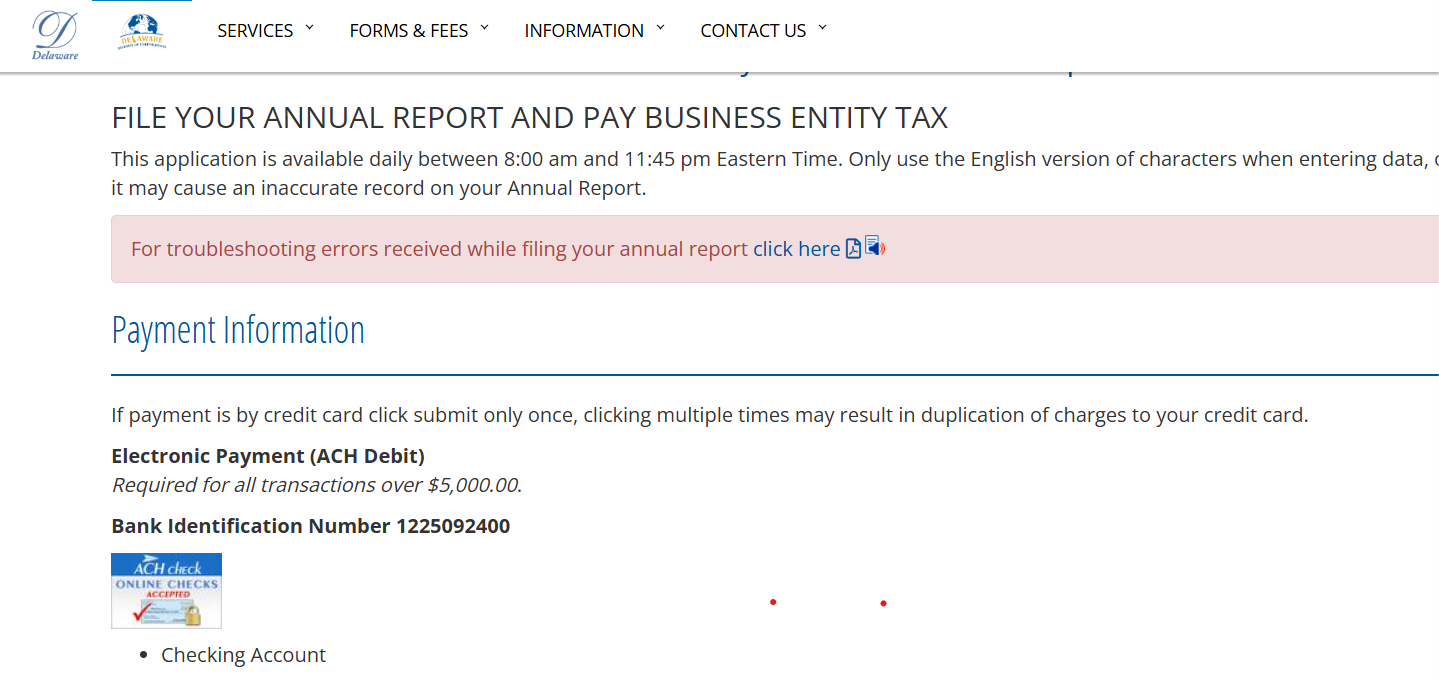

Delaware’s official guidance outlines the annual franchise tax owed by all LLCs formed or registered in the state.

4. Privacy Expectations Are Frequently Misunderstood

Some business owners choose Delaware, believing it offers full anonymity. While Delaware does not publicly list member names on formation documents, ownership disclosure is still required for federal tax filings, banking verification, and BOI reporting obligations.

Federal and Banking Disclosures Still Apply: Privacy services cannot replace mandatory disclosures required by the IRS, financial institutions, and federal reporting rules. Misunderstanding this distinction often leads to unnecessary expenses without achieving meaningful privacy protection.

5. IRS and Banking Verification May Take Longer

Forming an LLC in Delaware while operating elsewhere may increase verification steps during EIN issuance and bank account setup. Financial institutions frequently request additional documentation to confirm business location and authority to operate.

Additional Documentation Requests

Banks and the IRS may require:

- Foreign registration certificates

- Certificates of good standing from Delaware

- Proof of authority to operate in the home state

These requirements can delay EIN processing and business banking approval.

6. Limited Benefit for Local or Service-based Businesses

Businesses serving local markets, such as consultants, contractors, online resellers, and small retailers, generally do not gain measurable advantages from Delaware formation. These businesses remain subject to licensing, tax, and regulatory rules in the state where operations occur.

7. Compliance Still Follows the Operating State

Even when formed in Delaware, an LLC must comply with:

- State income or sales tax rules

- Local licensing requirements

- Employment and labor laws

Delaware formation does not replace these obligations.

Better Alternatives for Most LLC Owners

For most small businesses, forming an LLC in the state where operations take place provides clearer compliance, fewer filings, and lower administrative burden.

- Form the LLC in the State of Operation

Forming locally ensures single state compliance, one registered agent, one annual reporting schedule, and lower ongoing costs.

- Use Government Sources for Accurate Guidance

Official sources such as IRS.gov and state Secretary of State websites provide authoritative filing instructions, tax obligations, and reporting deadlines. Relying on these sources reduces error and unnecessary filings.

- Delaware is not necessary for most small or local businesses

- Out-of-state formation usually triggers foreign registration

- Franchise taxes and registered agents fees increase annual costs

- Privacy benefits are often misunderstood

- Forming in operating state is typically more efficient

Final Words

Delaware offers legitimate advantages for certain business structures, particularly those seeking outside investment or operating across multiple jurisdictions. However, for many LLC owners, forming in Delaware introduces duplicate compliance and ongoing costs without delivering practical benefits. Reviewing official government requirements and aligning formation decisions with actual business operations helps ensure long-term administrative efficiency and compliance.