A single-member LLC (SMLLC) is one of the simplest business structures, but its tax rules are often misunderstood. Many business owners wonder whether they can opt for partnership taxation to simplify their tax structure or share losses in a manner similar to partnerships. However, federal tax law determines which classifications an LLC may choose. Understanding these rules helps prevent IRS mistakes, misfilings, and rejected forms.

- A partnership requires two or more owners, so an SMLLC cannot elect partnership taxation.

- The IRS automatically treats a single-member LLC as disregarded entity.

- An SMLLC may elect S corporation or C corporation taxation.

- Adding another member allows partnership taxation.

Can a Single-Member LLC Elect Partnership Taxation?

The answer is no, a single-member LLC cannot elect partnership taxation. This is one of the most common misconceptions among new LLC owners. Understanding why the IRS limits this option helps prevent incorrect filings.

Partnerships Require Two or More Owners

Under federal tax law, a partnership exists only when two or more people operate a business together. Since SMLLC has only one owner, it cannot meet this requirement and cannot file Form 1065.

IRS Definition of a Partnership

The IRS defines a partnership as a relationship between two or more persons. A single-member LLC does not meet this definition and therefore cannot elect to be taxed as a partnership.

Default IRS Classification for an SMLLC

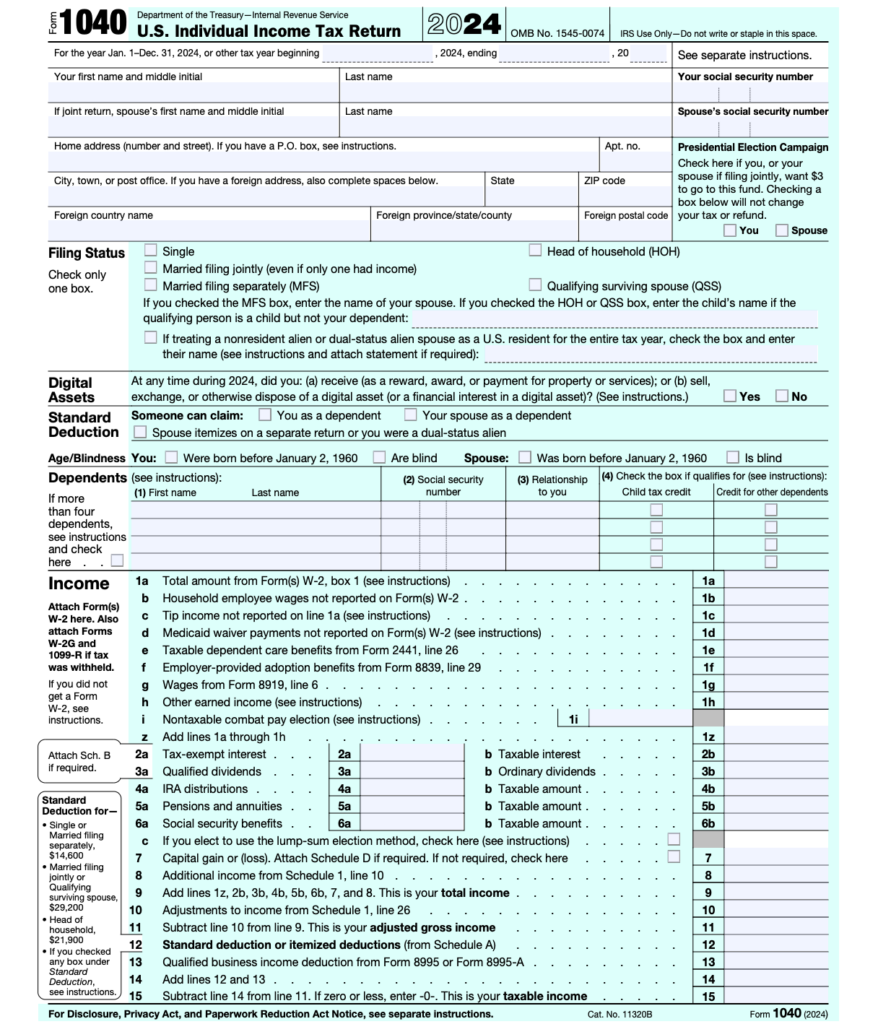

By default, an SMLLC is treated as a disregarded entity, meaning the LLC does not file its own federal tax return. Instead, all business income is reported directly on the owner’s Form 1040 (usually Schedule C).

Here is an example of IRS Form 1040, available on the official IRS website.

Misunderstanding the Election Options

Many owners assume partnership taxation is an option simply because multi-member LLCs can choose it. However, the IRS does not allow a one-owner business to adopt partnership tax treatment regardless of preference.

What Tax Options a Single-Member LLC Can Elect

LLCs are more popular due to their tax structure compared to other business structures. It has a pass-through taxation as well as other types of tax options. Even though partnership taxation is not available, a single-member LLC has two alternative tax elections.

Electing S Corporation Taxation

A single-member LLC may file Form 2553 to elect S corporation taxation. This option may help reduce self-employment taxes when the business earns steady profit.

Electing C Corporation Taxation

A single-member LLC may also elect C corporation taxation by filing IRS Form 8832. This structure may benefit businesses that prefer a corporate tax rate or plan to retain earnings.

Adding a Second Member to Qualify for Partnership Taxation

If partnership taxation is the goal, adding a second member is the only path to qualify. Once the LLC becomes a multi-member LLC under state law, the IRS automatically treats it as a partnership unless an election is filed. Note that, before adding a member, update your Operating Agreements to define ownership percentages, voting rights, and financial responsibilities.

Conclusion

A single-member LLC cannot elect partnership taxation because federal tax rules require at least two owners for partnership status. However, owners still have flexible options through S corporation or C corporation elections. Understanding these options helps owners select the right tax path while avoiding IRS misclassification issues.