Many LLC owners eventually end up with more than one business idea, brand, or service, and wonder if everything can be handled under a single LLC. This usually comes up when adding a side project, launching a second brand, or offering a different service that still feels related.

While it is generally allowed to run multiple business activities under one LLC, problems often happen when owners assume that different names or brands automatically imply legal separation. Unfortunately, that is not how LLCs actually work. This article explains the common problems and how multiple businesses can operate under one LLC.

- One LLC can legally operate multiple business activities

- Brand names do not create separate legal entities

- DBAs separate names, not liability

- Separate LLCs may be safer when activities are high-risk or unrelated

How Multiple Businesses Can Operate Under One LLC

A single LLC can engage in more than one business activity, as long as those activities are permitted under state law and properly disclosed where required. The key point is that the LLC remains one legal entity, meaning taxes, reporting, and compliance obligations apply to the company as a whole, not per brand.

Checking Whether the LLC’s Purpose Allows Expansion

Most states allow a broad business purpose, such as engaging in any lawful business activity, which usually makes it easy to add new services or brands. If the original filing used a very narrow purpose, expanding into unrelated work may require filing an amendment to keep state records accurate.

Using DBAs to Separate Business Names

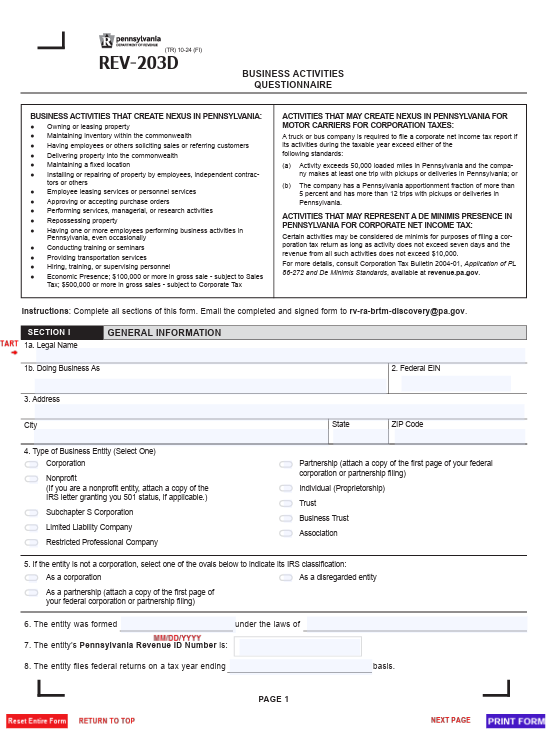

When an LLC operates under multiple brand names, a Doing Business As (DBA) filing is usually required if the brand name differs from the LLC’s legal name. A DBA allows the LLC to use different names publicly, but it does not create a separate legal entity or isolate liability.

Handling Taxes and Banking the Right Way

Even with multiple business activities, the LLC generally files one tax return and uses one EIN unless it has elected a different tax classification. Income from all activities must be reported together. Many owners track revenue internally by business line for clarity.

EIN and Tax Reporting

Separate EINs are not issued for individual DBAs. The IRS treats all activities as part of the same LLC, which means accurate bookkeeping is essential to avoid reporting errors.

Forming a Series LLC

Many entrepreneurs form a series LLC to run multiple businesses under a single LLC. A series LLC is a unique kind of LLC that allows owners to separate multiple brands (series), restrict liabilities, and protect the personal assets of each brand under one master LLC.

Series LLCs are not commonly used; therefore, the process is complicated. However, it is very flexible for those who run multiple businesses, for example, a mass media company. In a series LLC, each series (brand) has a separate name, bank account, records, and books. Each series is protected from the liabilities of other series. Hence, forming a series LLC is profitable and flexible. However, since the concept is not common and still not familiar to many people, forming a series LLC comes last on the list of options.

There are only a few states that allow forming a Series LLC. Alabama, Arkansas, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Ohio, Oklahoma, South Dakota, Tennessee, Texas, Utah, Virginia, and Wyoming are the states that allow the formation of a Series LLC. California does not allow Series LLC formation; however, foreign Series LLCs that operate businesses in California are entitled to pay the annual Franchise Tax.

The Core Issue Most Owners Miss

The confusion usually starts with how people think about “businesses” versus how the law treats them. An LLC is one legal entity, and everything done under it is viewed as part of the same company, even if customers see different brands or services. Without additional structuring, the state, the banks, and the Internal Revenue Service (IRS) do not treat each activity as separate.

Confusing Brand Names With Legal Entities

Using multiple business names does not create multiple companies. Even if each brand has its own website, logo, or customers, contracts and liabilities still attach to the same LLC unless a new entity is formed. This misunderstanding is one of the most common reasons owners believe they are more protected than they actually are.

Shared Liability Across Activities

When multiple businesses operate under one LLC, legal and financial risk is shared. If one activity is sued or runs into debt, the assets and income of the entire LLC may be exposed, even if the issue has nothing to do with the other business lines.

Banking and Recordkeeping Issues

Banks and payment processors usually expect clarity about what the LLC does. When multiple activities are mixed together without clear internal tracking, it can cause confusion, frozen accounts, or accounting errors, especially if revenue sources are not clearly documented.

Final Words

Running multiple businesses under one LLC is allowed, but it requires careful planning and a clear understanding of how the law treats legal entities. Without proper structure, owners may unintentionally expose all business activities to shared risk. For simple or closely related operations, one LLC with DBAs is sufficient. However, as complexity or risk increases, forming separate LLCs may provide better protection and clarity.