The objective of the annual report is three-fold. The annual report keeps the Government informed about all the updates, communicates about all the modifications or changes, & keeps the LLC members informed about the necessary taxes and costs. This article has all the information about Virginia LLC annual report filing in Virginia.

An annual report can be called an address book, as it features all the relevant addresses of the company & the members. This yearly report is a record of all the company’s activities in an entire year. It is also referred to as the Annual Franchise Tax Report because it helps in filing the franchise tax.

On this page, you’ll learn about the following:

Contents of the Annual Report

Typically the annual report filed by a Virginia LLC (or any other business entity for that matter) will include all the information related to its business & members. The standard contents of the annual report or the annual franchise tax report are

- Office Address of the LLC

- Names & Addresses of the Members & managers.

- Identification Documents

- Social Security numbers of the key members of LLC

- The objective of the business of LLC

- List of all the signatories of the LLC

- Information of the registered agent, if any

Virginia LLC Annual Report

An Annual report is essential for all business types. It authenticates that the information provided to the Secretary Of the State is accurate & updated. The information provided in the annual report helps the State officials to ensure that all the companies pay taxes. The Virginia Annual Report is filed with the Virginia State Corporation Commission.

Does the State of Virginia Require an Annual Report Filing?

A business entity in Virginia to file an annual report with the Virginia State Corporation Commission to remain in the Good Standing Status. This rule applies to all the legal entities such as C Corporations, Limited Partnerships, Limited Liability Companies, bound to file the Annual Report.

Annual Report Deadline

As mentioned above, filing the Annual report is a mandatory requirement even for an LLC. An LLC operating in Virginia has to file the Annual report every year by the end of the anniversary month.

Penalties for Non-filing or late filing

An Annual Report is one of the important documents filed by an LLC. Any report filed after the due date may result in a $25 late fee & the LLC losing good standing status. If there is a further failure in filing the report, it may result in the dissolution of the LLC.

Why Do LLCs Have to File the Annual Report?

Some of the states are not required to file this yearly report, commonly known as the Annual Report. However, there are some reasons why states should file an LLC Annual Report. Here are some reasons,

To Maintain the Accuracy of the Information

An annual report filed by the LLC has all the updated information about its official addresses & the names or addresses of all its officials. This updated information allows the State authorities to track down any LLC when communicating.

To Provide the Correct Correspondence

Many times, any creditor or other entity willing to transact with the LLC requires the correct correspondence address. If this information (which can only be modified with the help of an annual report) is not updated every year, such entities will not be able to communicate with them.

To Notify the Government About All the Significant Changes

If you have changed your main business address or had new business appointments of managers or members, the annual public information report notifies the State Government Entities about it. So, the next time someone questions a newer reform that you have introduced in your LLC, you will be saved because you had submitted the information with the Government.

To Provide an Activity Log of an LLC

The Annual Report is like an activity log of the LLC. It brings on record; all the transactions, new associations, appointments, etc. & keeps those records intact for all future references.

To Help You With the One-time Filing of Taxes

The annual report is an excellent means to keep you on your toes in case of your dues payment. Every LLC must pay the taxes through the annual report filing. By filing the report on time, the LLC can manage the exemptions & can avoid penalties imposed by the Government.

To Enable the State to Track the Payments

The government authorities use all the information filed through the annual report, for tracking the payment of State Taxes.

How to File a Virginia LLC Annual Report

The Virginia LLC Annual Report can be filed online or by mail. An LLC operating in Virginia has to file the Annual report every year by the end of the anniversary month.

Steps to File Virginia LLC Annual Report Online

Time needed: 5 minutes

Below is the procedure to file the Virginia LLC Annual Report online.

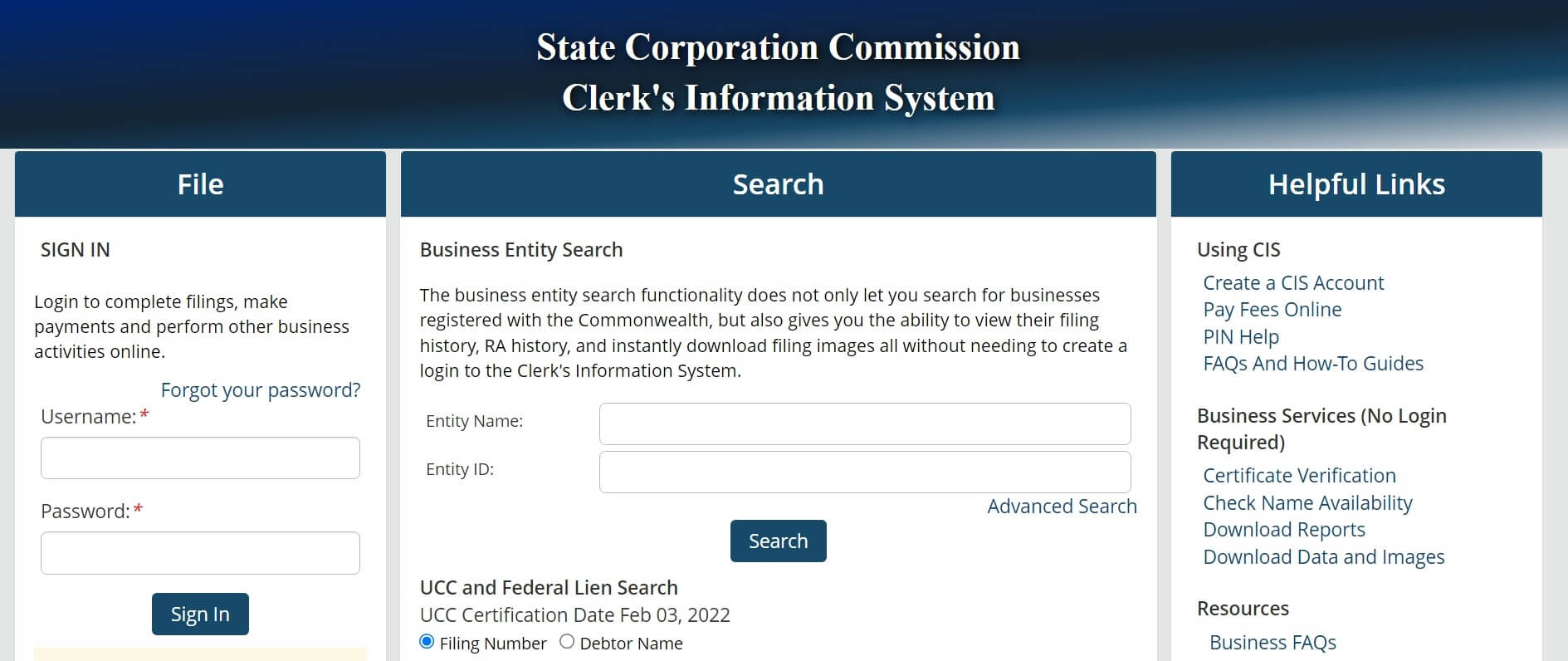

- Visit Virginia State Corporation Commission’s Online File Login Page.

The first step in filing the Virginia Annual Report is to visit Virginia State Corporation Commission’s Online File Login Page.

- Sign in with your username & password.

Sign in with your username & password, or create an account by clicking on the register button.

- Begin the process of filing the annual report online.

Once you have signed in, fill in all the details & start filing the annual report online.

Filing Virginia LLC Annual Report By Mail

To file the LLC Annual report in Virginia you can follow the steps as mentioned below,

- The state of Virginia sends the annual report form to the Registered agent’s office before the due date of filing. You can also request the Annual Report Form to be sent to your company address through this online link.

Virginia LLC Annual Report (Domestic & Foreign)

| State Office: | Virginia State Corporation Commission, 1300 East Main Street PO Box 1197, Richmond, VA 23218 Links to Website |

| Due Date: | An LLC operating in Virginia has to file the Annual report every year, by the end of the anniversary month. |

| Filing Fee: | The Annual Report filing fee is $50. |

| Penalty: | Any report filed after the due date may result in a $25 late fee & the LLC losing good standing status. If there is a further failure in filing the report, it may result in the dissolution of the LLC. |

| Filing Method: | An LLC can file the Annual Report Online or by mail. |

| Forms: | The Form can be requested on this link. |

| Important Information: | Once a Domestic or Foreign Virginia Limited Liability Company submits the Annual Report along with the prescribed fees to the Virginia State Corporation Commission, the filing is said to be complete. |

Seek the Help of a Registered Agent

Every State will have a different rule for filing the Annual Report. Usually, it is submitted every year, but it is submitted once in two years in some states. Some states require the filing of the report only once in ten years.

Not only the timing, the mode of filing, the proper addresses, exemptions, legality, annual report compliance, etc., have to be taken care of while paying the taxes or filing any reports with the State authorities. In many such scenarios, it is advised that an LLC appoints a Registered Agent to manage all this. Check out the best LLC service that offers all the services at an affordable price. An experienced agent is required for:

- Streamlining the mandatory processes & filing.

- Sending or receiving any documents.

- Reminding you about important dates of filing or payment of taxes.

- Simplifying the filing procedures.

- Avoid any penalties.

- Flexibility in working.

- Maintaining Privacy (as it keeps your personal records off the public record)

You can read more about a Virginia Registered Agent here.

FAQs

Yes, an annual report is essential for every business entity in most states. Some states also ask to file biennial or decennial reports to be filed.

A Yearly Business Report or the annual report typically incorporates the address of the business, names & addresses of the members, a list of all the signatories, SSN of the members, & details of the registered agent.

A Registered Agent is well-aware of all the filing requirements, annual report filing fee, & overall Annual Report compliance. The knowledge & proficiency of the registered agent allows the smooth filing of reports & other fees.

The most important thing for filing an Annual Report is record keeping. Make sure that you document every other transaction well.

Yes, the fees may vary depending on the type of entity or the type of legal entity you are representing.

How Fast Can I Fill Virginia LLC Annual Report

Deadline for filing annual reports in Virginia is the last date of company’s anniversary month with the Virginia Secretary of State. Late fee of $25 is charged.

First and foremost, it’s important to understand what information is required to complete your annual report. In Virginia, the annual report typically includes basic information about your LLC such as its name, address, registered agent, and the names and addresses of its members or managers. You will also need to provide a brief statement of the LLC’s business activities and affirm that the information provided is true and accurate. It’s a good idea to gather all of this information before starting the filing process to avoid any delays or hiccups along the way.

Once you have all the necessary information in hand, the next step is actually filling out the annual report. Fortunately, the Virginia State Corporation Commission provides a straightforward online portal for filing your annual report electronically. This user-friendly system allows you to create an account, enter the required information, review and edit your data as needed, and submit your report with just a few clicks. By filing online, you can streamline the process and ensure that your annual report is received and processed promptly.

If you prefer to file your annual report by mail, you can download the necessary forms from the Virginia State Corporation Commission’s website and send them in along with the appropriate filing fee. While this traditional method may take a little longer than filing online, it can still be a viable option for those who prefer paper documentation or who may not have access to reliable internet service.

Regardless of how you choose to file your Virginia LLC’s annual report, it’s important to make sure that you do so in a timely manner. The state of Virginia typically requires annual reports to be filed each year by a specific deadline, which is usually based on the anniversary date of your LLC’s formation. Failure to file your annual report on time can result in late fees, penalties, or even the dissolution of your LLC’s legal status, so it’s crucial to mark your calendar and stay on top of this important requirement each year.

In conclusion, while filing your Virginia LLC’s annual report may not be the most exciting task, it is an essential responsibility that should not be overlooked. By understanding what information is required, utilizing the state’s online filing portal, and submitting your report on time, you can ensure that your LLC remains in good standing and continues to operate legally in the state of Virginia.

In Conclusion

An LLC has to file many types of reports, such as Application for Reinstatement, Periodic Report of a limited partnership (usually filed by the exempt nonprofit organization), etc., which are required depending on the type of entity. The Annual Report is mandatory irrespective of the entity type. It requires compliance across entities.