The objective of the annual report is three-fold. The annual report keeps the Government informed about all the updates, communicates about all the modifications or changes, & keeps the LLC members informed about the necessary taxes and costs. This article has all the information about Oklahoma LLC annual report filing in Oklahoma.

An annual report can be called an address book, as it features all the relevant addresses of the company & the members. This yearly report is a record of all the company’s activities in an entire year. It is also referred to as the Annual Franchise Tax Report because it helps in filing the franchise tax.

On this page, you’ll learn about the following:

Contents of the Annual Report

Typically the annual report filed by an Oklahoma LLC (or any other business entity for that matter) will include all the information related to its business & members. The standard contents of the annual report or the annual franchise tax report are

- Office Address of the LLC

- Names & Addresses of the Members & managers.

- Identification Documents

- Social Security numbers of the key members of LLC

- The objective of the business of LLC

- List of all the signatories of the LLC

- Information of the registered agent, if any

Oklahoma LLC Annual Report

An Annual report is essential for all business types. It authenticates that the information provided to the Secretary Of the State is accurate & updated. The information provided in the annual report helps the State officials to ensure that all the companies pay taxes. The Oklahoma Annual Report is filed with the Oklahoma Secretary of State.

Does the State of Oklahoma Require an Annual Report Filing?

Every Business Entity in Oklahoma must file an Annual Certificate or Annual Report. This includes all the legal entities such as C Corporations, Limited Partnerships, Limited Liability Companies, bound to file the Annual Report.

Annual Report Deadline

As mentioned above, filing the Annual report is a mandatory requirement even for an LLC. An LLC operating in Oklahoma has to file the Annual report every year with the Oklahoma Secretary of State by the end of the Business’s Anniversary month.

Penalties for Non-filing or late filing

An Annual Report is one of the important documents filed by an LLC. Any Annual Report or Annual Certificate (as referred to in Oklahoma) filed after the deadline will lose its good standing status. Further failure to file the annual report will cause the dissolution of the LLC.

Why Do LLCs Have to File the Annual Report?

Some of the states are not required to file this yearly report, commonly known as the Annual Report. However, there are some reasons why states should file an LLC Annual Report. Here are some reasons,

To Maintain the Accuracy of the Information

An annual report filed by the LLC has all the updated information about its official addresses & the names or addresses of all its officials. This updated information allows the State authorities to track down any LLC when communicating.

To Provide the Correct Correspondence

Many times, any creditor or other entity willing to transact with the LLC requires the correct correspondence address. If this information (which can only be modified with the help of an annual report) is not updated every year, such entities will not be able to communicate with them.

To Notify the Government About All the Significant Changes

If you have changed your main business address or had new business appointments of managers or members, the annual public information report notifies the State Government Entities about it. So, the next time someone questions a newer reform that you have introduced in your LLC, you will be saved because you had submitted the information with the Government.

To Provide an Activity Log of an LLC

The Annual Report is like an activity log of the LLC. It brings on record; all the transactions, new associations, appointments, etc. & keeps those records intact for all future references.

To Help You With the One-time Filing of Taxes

The annual report is an excellent means to keep you on your toes in case of your dues payment. Every LLC must pay the taxes through the annual report filing. By filing the report on time, the LLC can manage the exemptions & can avoid penalties imposed by the Government.

To Enable the State to Track the Payments

The government authorities use all the information filed through the annual report, for tracking the payment of State Taxes.

How to File a Oklahoma LLC Annual Report

The Oklahoma LLC Annual Report can be filed online, or it can be filed by mail. An LLC operating in Oklahoma has to file the Annual report every year with the Oklahoma Secretary of State by the end of the Business’s Anniversary month.

Steps to File Oklahoma LLC Annual Report Online

Time needed: 5 minutes

Below is the procedure to file the Oklahoma LLC Annual Report online.

- Visit Oklahoma Secretary of State Website.

Your first step in filing the Oklahoma Annual Report is to visit the Oklahoma Secretary of State website.

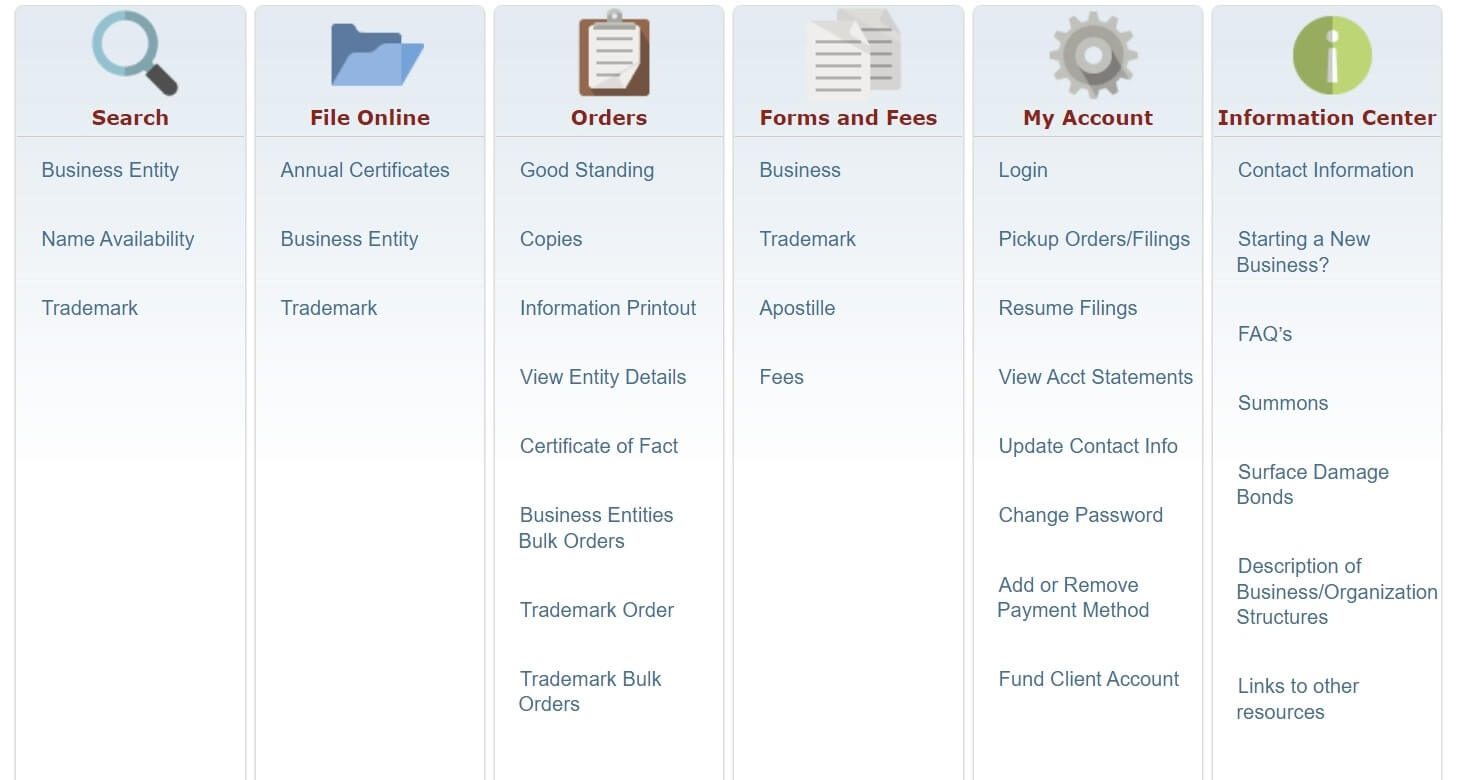

- Click on the “Business Services” Tab.

Click on the Business Services tab from the list at the top of the page.

- Click on the Business Tab.

On the next page, click on the Business Tab under the Forms & Fees segment.

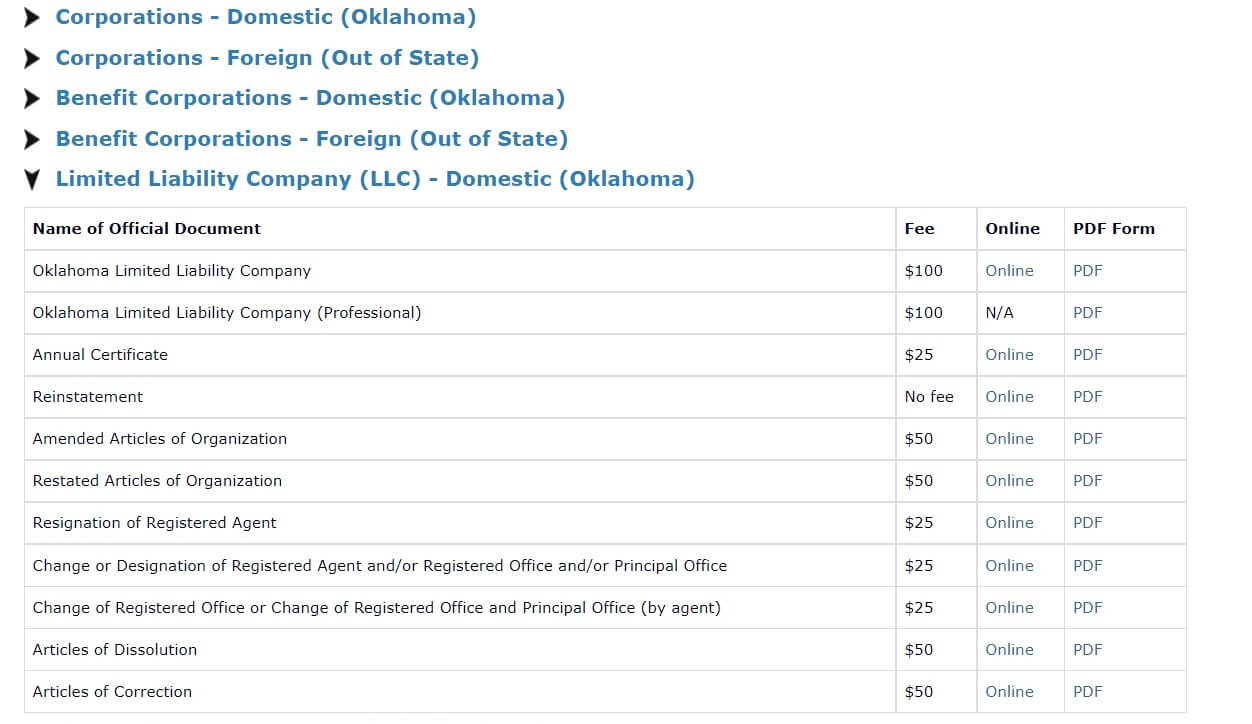

- Choose Business Type.

Upon clicking on the Business tab, you will see a list of different types of business entities. Click on LLC as a business type.

- Click on the Online Option.

Click on the Online option in front of the Annual Certificate option.

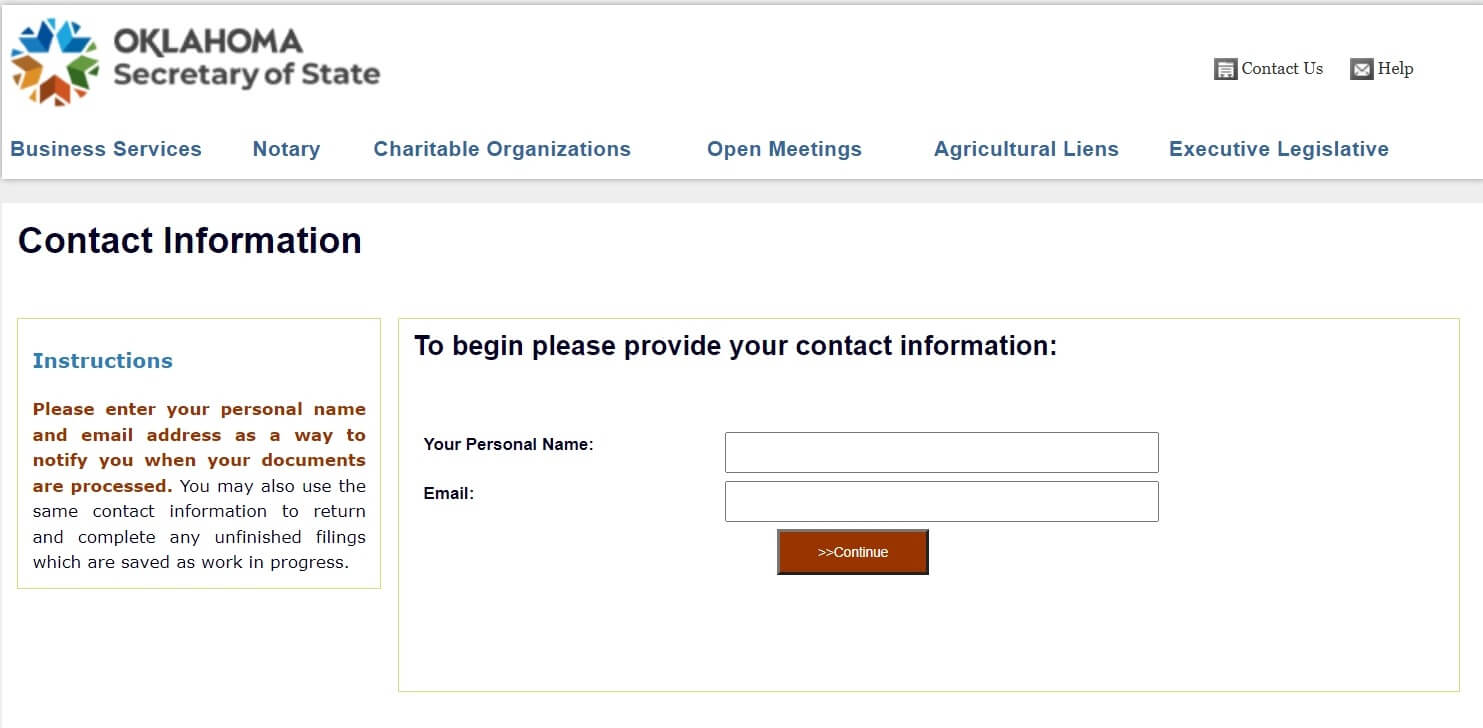

- Enter Name & Email Address.

On the next prompt enter your Name & email address. Click on the Continue tab to start filing the annual report.

Filing Oklahoma LLC Annual Report By Mail

To file the LLC Annual report in Oklahoma, you can follow the steps as mentioned below,

- Visit the Oklahoma Secretary of State website

- Click on Business Services Tab from the list at the top of the page.

- On the next page, click on the Business Tab under the Forms & Fees segment

- Click on your business type

- Click on the PDF option in front of the Annual Certificate option

- Download the form.

- Fill the form with correct information.

- Send the printed copies of the forms and relevant documents to the address: Secretary of State, 421 NW 13th, Suite 210, Oklahoma City, OK 73103

Oklahoma LLC Annual Report (Domestic & Foreign)

| State Office: | Secretary of State, 421 NW 13th, Suite 210, Oklahoma City, OK 73103 Links to Website, Form |

| Due Date: | An LLC operating in Oklahoma has to file the Annual report every year with the Oklahoma Secretary of State, by the end of the Business’s Anniversary month. |

| Filing Fee: | The Annual Report filing fee is $25. |

| Penalty: | Any Annual Report or Annual Certificate (as referred to in Oklahoma) filed after the deadline will lose its good standing status. Further failure to file the annual report will cause the dissolution of the LLC. |

| Filing Method: | An LLC can file the Annual Report Online or by mail. |

| Forms: | Form |

| Important Information: | Once a Domestic or Foreign Oklahoma Limited Liability Company submits the Annual Report along with the prescribed fees to the Oklahoma Secretary of State, the filing is said to be complete. |

Seek the Help of a Registered Agent

Every State will have a different rule for filing the Annual Report. Usually, it is submitted every year, but it is submitted once in two years in some states. Some states require the filing of the report only once in ten years.

Not only the timing, the mode of filing, the proper addresses, exemptions, legality, annual report compliance, etc., have to be taken care of while paying the taxes or filing any reports with the State authorities. In many such scenarios, it is advised that an LLC appoints a Registered Agent to manage all this. Check out the best LLC service that offers all the services at an affordable price. An experienced agent is required for:

- Streamlining the mandatory processes & filing.

- Sending or receiving any documents.

- Reminding you about important dates of filing or payment of taxes.

- Simplifying the filing procedures.

- Avoid any penalties.

- Flexibility in working.

- Maintaining Privacy (as it keeps your personal records off the public record)

You can read more about an Oklahoma Registered Agent here.

FAQs

Yes, an annual report is essential for every business entity in most states. Some states also ask to file biennial or decennial reports to be filed.

A Yearly Business Report or the annual report typically incorporates the address of the business, names & addresses of the members, a list of all the signatories, SSN of the members, & details of the registered agent.

A Registered Agent is well-aware of all the filing requirements, annual report filing fee, & overall Annual Report compliance. The knowledge & proficiency of the registered agent allows the smooth filing of reports & other fees.

The most important thing for filing an Annual Report is record keeping. Make sure that you document every other transaction well.

Yes, the fees may vary depending on the type of entity or the type of legal entity you are representing.

How Fast Can I Fill Oklahoma LLC Annual Report

Deadline for filing annual reports in Oklahoma is last the date of company’s anniversary with the Oklahoma Secretary of State. Failing to do so may result in dissolution of the LLC.

The answer may vary depending on the complexity of your LLC and how organized your records are. However, in general, filling out the Oklahoma LLC annual report should not be a time-consuming process. With the right information on hand, you can get it done in a timely manner and ensure that your business remains in good standing with the state.

One of the most important things you can do to speed up the process of filling out your annual report is to stay organized throughout the year. This means keeping track of important documents such as your operating agreement, meeting minutes, and financial records. By having these documents readily available when it’s time to fill out your annual report, you can streamline the process and avoid any last-minute scrambling.

In addition to staying organized, it’s also important to know exactly what information is required in the Oklahoma LLC annual report. Typically, this includes basic information about your business such as its name, address, and registered agent. You may also need to disclose any changes to your LLC’s ownership or management structure.

Once you have all the necessary information on hand, filling out the annual report can be a relatively straightforward process. Most of the required information can be completed online through the Oklahoma Secretary of State’s website. This means you can complete the entire process from the comfort of your home or office without the need for any paper forms or in-person visits.

Of course, if you do run into any trouble or have questions while filling out your annual report, you can always reach out to the Oklahoma Secretary of State’s office for assistance. They are there to help ensure that your annual report is completed accurately and on time.

In conclusion, filling out the Oklahoma LLC annual report should not be a daunting task. By staying organized, knowing what information is required, and utilizing online resources, you can get it done quickly and efficiently. So don’t procrastinate when it comes to your annual report – get it done as soon as possible to ensure that your business remains compliant with state regulations.

In Conclusion

An LLC has to file many types of reports, such as Application for Reinstatement, Periodic Report of a limited partnership (usually filed by the exempt nonprofit organization), etc., which are required depending on the type of entity. The Annual Report is mandatory irrespective of the entity type. It requires compliance across entities.