Forming an LLC requires a different business name, which must be unique and adheres to the guidelines. The great thing is Rhode Island’s Secretary of State page includes a name availability checker. Check out LLC Name Search to learn more.

Meanwhile, if you’re interested in learning more about starting a Rhode Island LLC or forming an LLC in general, you can check out How to Start an LLC.

On this page, you’ll learn about the following:

How to Name an LLC in Rhode Island

Time needed: 5 minutes

There are guidelines to follow in doing a Rhode Island LLC name search. To learn more, check out LLC Naming Guidelines or read Foreign LLC Application for Registration if you’re planning to register a foreign LLC.

- Check Name Availability

Search the Business Entity Records in Rhode Island’s Official Secretary of State page to check if your chosen business name is available. You may also try typing your trademark, business, or domain name on any search engine to generate businesses with similar names and to ensure your trademark is unique and meets the state’s requirements.

Check out How to File a DBA to learn more about registering a DBA or trademark. For social media pages, use Social Searcher to avoid using similar page names. - Check Domain Availability

If your business name is still available, you must register for a domain name using Namecheap, Google Workspace, or other domain name sites. So customers can easily find your business over the Internet. Use the Kinsta app to manage your domains efficiently.

- File Name Reservation

A Name Reservation Certificate is required along with a Certificate of Formation. You can reserve a name online, by mail, or in person with a $50 filing fee (plus tax for online).

File your Certificate of Formation and Name Reservation online on the Secretary of State Online Services page of Rhode Island. You may also download the pdf file of the Name reservation form and submit it with the processing fee to the Office of the Secretary of State Corporations Division 148 W. River Street Providence, Rhode Island 02904-2615.

Guidelines to Follow in Naming LLC

- Use a business name with the abbreviation “LLC” or the phrase “Limited Liability Company.”

- Your decided business name must not coincide with any existing government entity. Otherwise, you might have to face legal lawsuits when filing your LLC.

- Use the LLC name availability checker to ensure your business name is unique.

- Get a license first if you plan on using restricted words to avoid any complications.

Note that you must put adequate effort into naming your LLC because this name will be with your business for a long time. Making your LLC name unique is vital as it would prevent people from confusing your business with others, not to mention it would be easier for them to recall your business, products, or services.

How to Do Rhode Island LLC Online Name Search

Naming a business is one of the fundamental steps. But it can be hard at times because the name you want should be available also. For this purpose, you can run a Rhode Island LLC name search. There are the following ways to search for the availability of any business entity name:

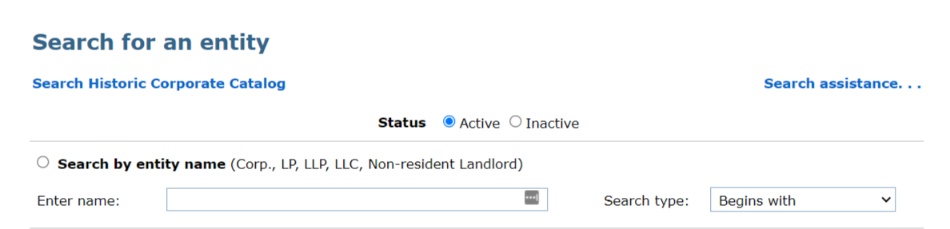

Search by Entity Name

Once you land on the Rhode Island SOS page, you can search by using the entity name. Enter the name in the search field provided. You can refine your search by the ‘search type’ option.

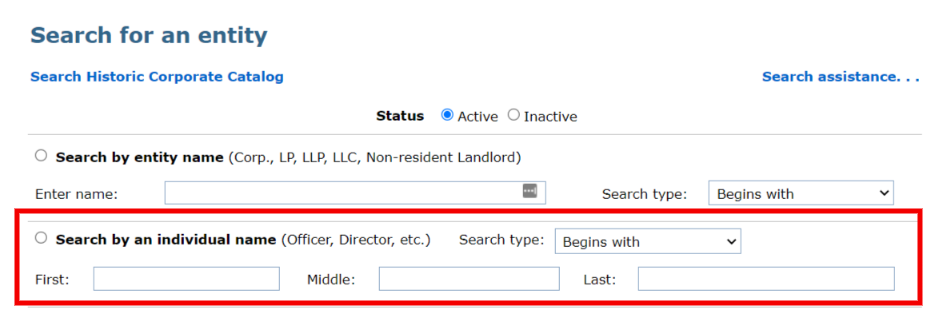

Search by Individual Name

Another option available for business entity search is by individual name. Type the first, middle, and last names in the provided fields. Select the type in the ‘Search type’ dropdown list. Press enter and you will get the list of businesses available.

Search by Identification Number

You can also try to search for a business entity through an Identification number. You just need to enter the 9-digit identification number in the field provided, then press enter.

Search by Filing Number

One more way to search for the business name availability is by the filing number. You have to enter this 12-digit number in the search tab, and press enter. You will get the details of the business registered against the provided number.

Search by Agent

This is another method to search for names available. You have to type the agent name in the search tab and press enter. For refining your search, you can select the options in the ‘search type’ dropdown list.

F.A.Qs

A trade name (doing business as (DBA) name) is the official name under which a proprietor or company chooses to do business.

Having a domain isn’t necessary, but it is recommended. If you have a domain name, customers will find you more accessible through online means with your online website.

For domestic LLC, you can simply brainstorm for another name if the one you pick is no longer available. For foreign LLC, you must think up a “fictitious name,” which you’ll use only in the state.

How Do I Reserve an LLC Name in Rhode Island

To reserve an LLC name in Rhode Island you need to submit a name reservation request form to the Rhode Island Secretary of State by mail or online by paying a filing fee of $50.

So, how do you go about reserving an LLC name in Rhode Island? The process is actually quite simple and can be done online through the Secretary of State’s website. To reserve a name, you will need to search the state’s database to make sure your desired name is not already taken. If the name is available, you can then fill out a Name Reservation Application and pay a small fee to secure the name for a period of 120 days.

Reserving a name for your LLC in Rhode Island can provide you with several benefits. First and foremost, it gives you peace of mind knowing that your chosen name won’t be snatched up by another business before you have a chance to officially register your LLC. This guarantees brand consistency and helps build credibility with your customers right from the start.

Additionally, reserving your LLC name can give you time to finalize your business plans and prepare all the necessary paperwork for registering your business. It can be a stressful experience trying to come up with a great business name, so having the name reserved can relieve some of that pressure and allow you to focus on other aspects of starting your business.

Furthermore, by reserving your LLC name, you can protect your intellectual property. Your business name is a valuable asset that sets you apart from competitors, and ensuring that no one else can use the same name will safeguard your brand identity and reputation.

Another potential benefit of reserving your LLC name is that it can prevent confusion among consumers. Having multiple businesses operating under the same or similar names can create confusion in the marketplace, which could negatively impact your business’s success. By reserving your name, you can avoid these issues and establish a strong, recognizable brand presence in the market.

In conclusion, reserving an LLC name in Rhode Island is an important step in starting a new business. It offers several benefits, including protecting your brand identity, providing peace of mind, and preventing confusion in the marketplace. By taking the time to reserve your LLC name, you are setting yourself up for success and ensuring that your business has a strong foundation from the very beginning.

In Conclusion

LLC names are important as it is the main identity of your business. While naming your LLC make sure to choose the one that suits the nature of your business. Follow the naming guidelines before you start filing your LLC name