If you are forming an LLC in Oregon, then this page’s content would be vital. As you learn how to start an LLC, you will realize that the bulk of your initial work and LLC cost comprises filing Oregon articles of organization, which we will elaborate on this page.

On this page, you’ll learn about the following:

What is an Article of Organization?

Articles of Organization, also known as an LLC certificate or Certificate of Formation in some states, is a document filed with the secretary of state to form an LLC.

Each state has a different requirement to fill out a form. An Article of Organization usually includes the following:

- The name of the LLC,

- the effective date of the LLC,

- the company’s principal office,

- the business purpose,

- the duration of the business,

- a copy of the LLC’s name registration certificate, and

- the name and address of the registered agent, organizers, and

- at least one member of the company.

You can file an Article of Organization online, by mail, or in person.

Note that the certification of formation is a legal requirement, not to mention, the core of your LLC formation. It even makes up the bulk of your Oregon LLC cost. Without it, you have no LLC. So, take the time to complete and file this certificate.

How to File Oregon Articles of Organization

These are the simple steps to follow in filing an Article of Organization in Oregon.

Step 1: Find Forms Online

Go to the Oregon Secretary of State to download the Articles of Organization form for your LLC or to log into the online service.

Step 2: Fill Out Form

When filling out the form, you must have reserved an LLC name. Do a name search. Go to Oregon LLC Name Search to check whether your chosen business name is available to use in this state.

You must attach a copy of your Name Reservation to your filled-out Articles of Organization form when filing. You also need to nominate a registered agent. Here are 3 of the best LLC services on our list.

Step 3: File Formation Certificates

File your formation certificate either online or by mail by filling out a form and sending it to the Secretary of State – Corporation Division – 255 Capitol St. NE, Suite 151 – Salem, OR 97310-1327

Steps to Register Article of Organization Online

Time needed: 5 minutes

To set up your LLC in Oregon, one must file for the Articles of Organization with the Oregon Secretary of State office. You can apply either online or by mail. When applying through online mode, your application gets the advantage of immediate processing as well. The cost of registration of a business LLC in Oregon is $100. The formation guide below will assist you in filing an application for articles of organization.

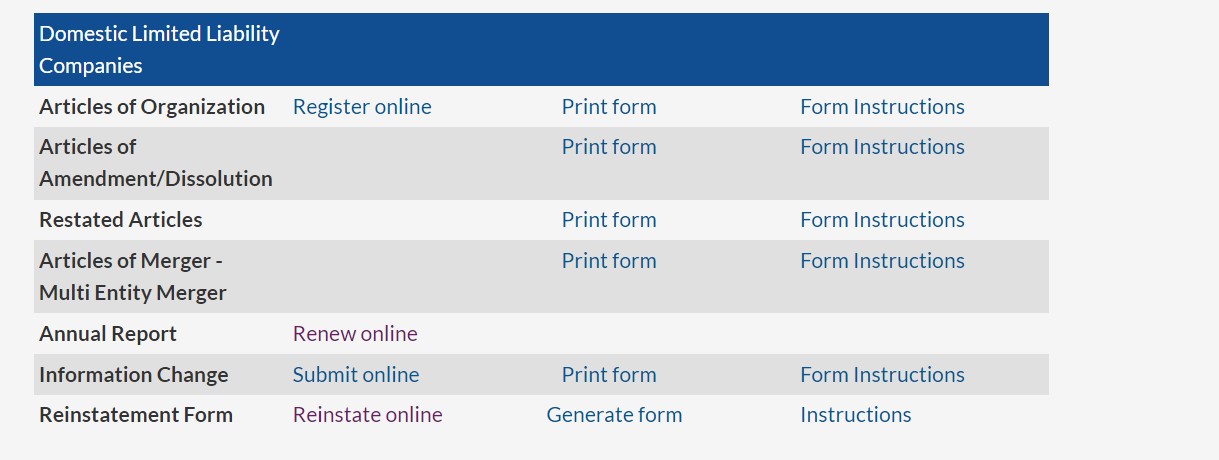

- Visit the website of the Oregon Secretary of State

Go to the official website of the Oregon Secretary of State. The Business section on the website offers an online medium for business registration and filings.

- Register online

On this page, scroll down to the table containing different links related to ‘Domestic Limited Liability Companies’. Select the ‘Register online’ option available adjacent to the first option of ‘Articles of Organization’.

- Create your account

On the portal, if you already have an account, continue to log in by entering your username and password. In case you do not have an account, register yourself on the portal by creating your username and password.

- Start to file your application

After confirmation of your account, log in to your account using the username and password. On the user homepage, select the option of “New Business” from the toolbar. Next, under the “Register a Business Name” heading, click on the ‘Start’ option. Proceed to fill in the application. You must fill in the necessary details such as your official business name, principal office address, details of your registered agent, duration of your LLC, details of manager/members, your contact details, and signature.

- Review the application

Revisit all the details entered by you in the application form. All the information entered by you should be true, correct, and accurate to your knowledge.

- Make the payment

Once you have finalized your overall application, you proceed to the payment gateway page to make a payment of $100 as the filing fee of your application for Articles of Organization. When you have successfully submitted your application form, you will receive a notification from the Secretary of State office acknowledging the receipt of your application.

Oregon Articles of Organization Filing By Mail

If you want to file your Oregon LLC Articles of Organization by an offline method, you can do that easily by mail. Follow the instructions below to file the Articles of Organization in Oregon

- Access the Application Form PDF on your computer system.

- Download the form and read all the instructions mentioned in the form carefully and proceed to fill in the application form in accordance with the guidelines.

- Attach the name reservation certificate with your application form.

- Recheck all the information entered by you to be correct and true to your knowledge.

- Issue a check or money order for $100 as the filing fee of your application payable to the ‘Corporation Division’.

Arrange all the documents together and mail it to the following address, Secretary of State – Corporation Division – 255 Capitol St. NE, Suite 151 – Salem, OR 97310-1327.

Cost of Filing Articles of Organization in Oregon

Online mode of application is considered as a more convenient mode as it is easy for the applicant to file their business documents and track the status of their application, there is not much difference in the filing fee through both the modes. Here is the cost of filing formation articles in Oregon

- Online filing costs $100

- By mail filing costs $100

F.A.Qs

An Article of Organization is a legal document that will officially make your LLC into existence. This document is needed specifically for Oregon in forming an LLC business structure.

The application form for the Articles of Organization needs to include the LLC name, date of establishment, the company’s registered office, business purpose, how long the business will exist, and a copy of the LLC’s name registration certificate.

Filing by mail or in person is neither highly recommended nor required; waiting an extra week for your LLC to be approved isn’t that bad. The LLC approval you send in will be returned by mail. Online filing, meanwhile, is more convenient as you won’t have to stay in a queue.

Where Can You Find Your Oregon LLC Articles of Organization

Articles of Organization for Oregon LLC can be accessed through the Oregon Secretary of State website. You can also download the PDF from the same website.

But where can you find your Oregon LLC Articles of Organization? The process may seem daunting at first, but with a little guidance, you’ll be well on your way to completing this important step in starting your business.

The first thing you’ll need to do is visit the website of the Oregon Secretary of State. Here, you’ll find a wealth of information about starting a business in Oregon, including detailed instructions on how to file your Articles of Organization. The website is a valuable resource for business owners, offering step-by-step guides, downloadable forms, and helpful tips to ensure your paperwork is completed accurately and on time.

Once you’ve familiarized yourself with the requirements for filing your Articles of Organization, it’s time to gather the necessary information. You’ll need to provide basic details about your LLC, such as its name, address, and the identities of its members or managers. It’s important to double-check this information for accuracy, as any errors could delay the approval of your paperwork.

Next, you’ll need to complete the Articles of Organization form provided by the Oregon Secretary of State. This document will ask for all the required information about your LLC, as well as your signature as the organizer. Be sure to read the instructions carefully and fill out the form completely to avoid any delays in the processing of your application.

Once you’ve completed the necessary paperwork, you can submit your Articles of Organization to the Oregon Secretary of State. You have the option to file online, by mail, or in person at the Secretary of State’s office in Salem. Each method has its own advantages, so choose the one that works best for you.

After you’ve submitted your Articles of Organization, all that’s left to do is wait for approval from the Secretary of State. This process can take several days or even weeks, depending on the volume of applications being processed. Once your paperwork has been approved, you will receive a stamped copy of your Articles of Organization, along with a Certificate of Formation confirming the creation of your LLC.

In conclusion, filing your Oregon LLC Articles of Organization is a crucial step in establishing your business as a legal entity in the state. By taking the time to understand the requirements, gather the necessary information, and submit your paperwork accurately, you’ll be well-equipped to navigate this process successfully. The Oregon Secretary of State’s office is a valuable resource for business owners, offering guidance and support every step of the way. So roll up your sleeves, get to work, and before you know it, you’ll have your LLC up and running in the great state of Oregon.

In Conclusion

Articles of Organization or Certificate of Formation is the most important document for your Oregon LLC. Before you submit/file the document make sure to provide proper and correct information about your company. If you have any questions, share that below in the comment section.