If you are forming an LLC in PA, then this page’s content would be vital. As you learn how to start an LLC, you will realize that the bulk of your initial work and LLC cost comprises filing a Pennsylvania certificate of organization, which we will elaborate on this page.

On this page, you’ll learn about the following:

What is a Certificate of Organization?

A Certificate of Organization, also known as an LLC certificate or Articles of Organization in some states, is a document filed with the department of state to form an LLC.

Each state has a different requirement to fill out a form. A Certificate of Organization usually includes the following:

- The name of the LLC,

- the effective date of the LLC,

- the company’s principal office,

- the business purpose,

- the duration of the business,

- a copy of the LLC’s name registration certificate, and

- the name and address of the registered agent, organizers, and

- at least one member of the company.

You can file a Certificate of Organization online, by mail, or in person.

Note that the certification of formation is a legal requirement, not to mention, the core of your LLC formation. It even makes up the bulk of your Pennsylvania LLC cost. Without it, you have no LLC. So, take the time to complete and file this certificate.

How to File an Pennsylvania Certificate of Organization

These are the simple steps to follow in filing a Certificate of Organization in Pennsylvania.

Step 1: Find Forms Online

Go to the Pennsylvania Department of State to download the certificate of organization form for your LLC or to log into the online service.

Step 2: Fill Out Form

When filling out the form, you must have reserved an LLC name. Do a name search. Go to Pennsylvania LLC Name Search to check whether your chosen business name is available to use in this state.

You must attach a copy of your Name Reservation to your filled-out Certificate of Organization form when filing. You also need to nominate a registered agent. Here are 3 of the best LLC services on our list.

Step 3: File Formation Certificates

File your formation certificate either online or by mail by filling out a form and sending it to the Pennsylvania Department of State Bureau of Corporations and Charitable Organizations P.O. Box 8722 Harrisburg, PA 17105-8722.

Steps to Register Certificate of Organization Online

Time needed: 5 minutes

To set up your business LLC in the State of Pennsylvania, you must file for the Certificate of Organization with the Secretary of State of Pennsylvania office. When you apply through online mode, your application also gets the advantage of immediate processing. The cost of registration is $125. The formation guide below will assist you in filing the Certificate of Organization.

- Access the Secretary of State of Pennsylvania website

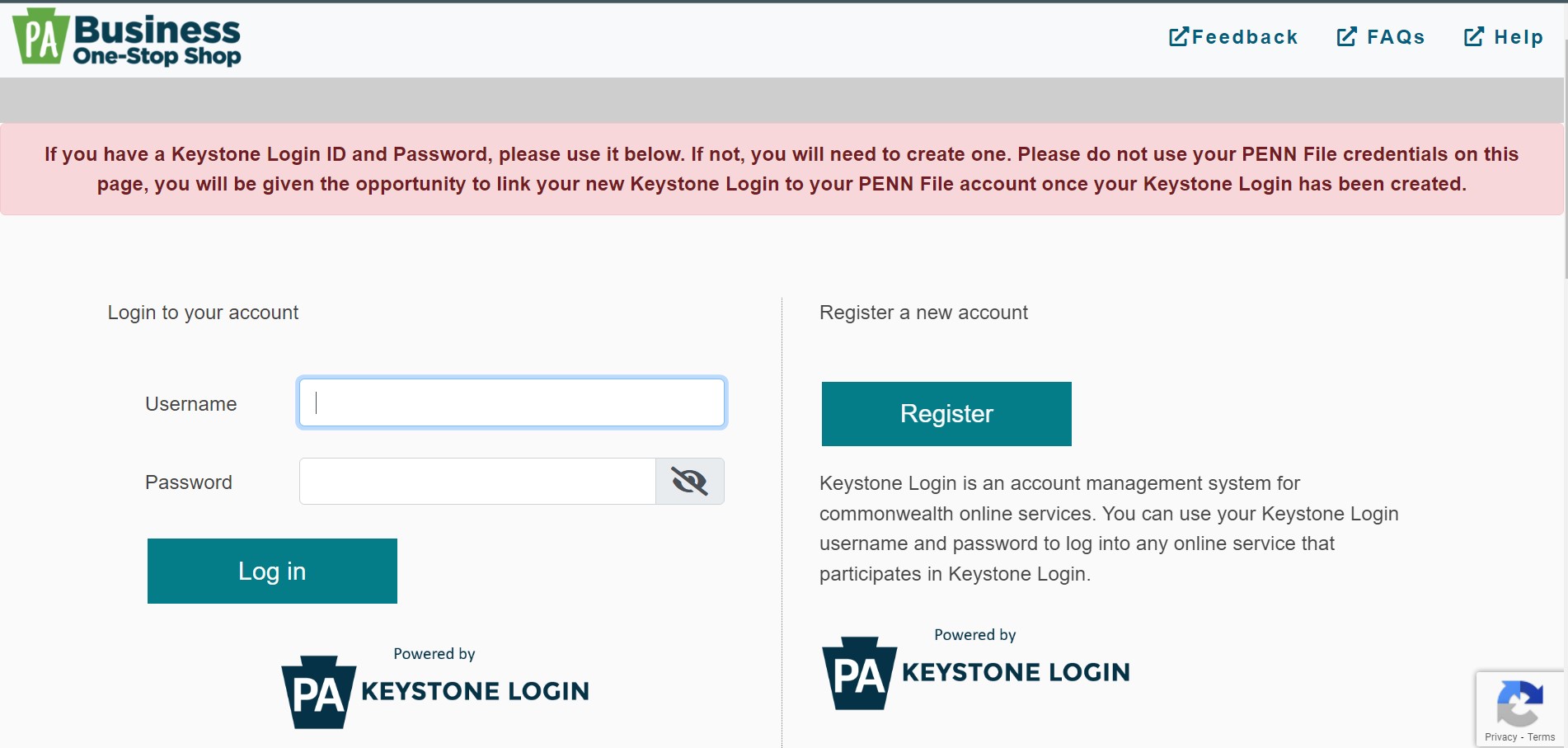

Visit the Official website of the Pennsylvania Secretary of State. The website hosts a Business One-Stop Shop portal that provides an easier and convenient mode of online business filings. On this page, the login box appears. If you already have an account on the portal, you can proceed by entering your username and password. If you do not have an account, read the next step to know about it.

- Create your account

On the One-Stop shop homepage, beside the login box, the account registration option is also present. Click on the ‘Register’ tab on the screen.

- Account registration information

On the next page, enter all the required information to create your account on the portal. Create your username and password. Next, provide the user information including the first and last name, date of birth, email, and contact details. Further, answer at least three security questions. Click on the ‘Submit’ tab

- Start to file your application

Login to your account on the portal. On the user homepage, select the option of “PENN File” from the dashboard. Scroll down to the option of “Start or manage business filings”. Next, select the option of “Domestic Limited Liability Company” from the list. Next, select the “Certificate of Organization” option. Now, proceed to file your application by entering all the required information about your Pennsylvania business LLC.

- Review your application

Before you proceed to the next step, make sure to review all the details provided by you are correct and accurate.

- Make the payment

After completing your application, you can proceed to the next step to make the payment of $125 as the filing fee of your application. After you have successfully submitted your application, you will receive a notification from the Secretary of State office, acknowledging the receipt of your application.

Pennsylvania Certificate of Organization Filing By Mail

If you wish to file your registration application through an offline method, you can do that easily by mail. Follow the instructions below to file the Certificate of Organization in Pennsylvania

Follow the instructions below to file the Certificate of Organization in Pennsylvania,

- Access the Application form PDF on your device. Download the document.

- Carefully read all the instructions and guidelines mentioned in the form.

- Proceed to fill in the application form accordingly.

- You must attach the name reservation certificate of your business LLC along with the application.

- After filling in all the details, review the application. All the information provided by you should be correct and accurate.

- The office mandated the following documents to be attached with the application: the Docketing Statement, and any necessary governmental approvals.

- Issue a check or money order for $125 as the filing fee of your registration application, payable to the ‘Department of State’.

- Arrange all the documents together and mail to the following address, Pennsylvania Department of State Bureau of Corporations and Charitable Organizations P.O. Box 8722 Harrisburg, PA 17105-8722

F.A.Qs

A Certificate of Organization is a legal document that will officially make your LLC into existence. This document is needed specifically for Pennsylvania in forming an LLC business structure.

The application form for the Certificate of Organization needs to include the LLC name, date of establishment, the company’s registered office, business purpose, how long the business will exist, and a copy of the LLC’s name registration certificate.

Filing by mail or in person is neither highly recommended nor required; waiting an extra week for your LLC to be approved isn’t that bad. The LLC approval you send in will be returned by mail. Online filing, meanwhile, is more convenient as you won’t have to stay in a queue.

Where Can You Find Your Pennsylvania LLC Certificate of Organization

Certificate of Organization for Pennsylvania LLC can be accessed through the PA one stop-hub website by creating your account. You can also download the PDF from the Pennsylvania Department of State’s website.

If you’re wondering where you can find your Pennsylvania LLC Certificate of Organization, it’s important to understand the process and steps required to obtain this vital document. The first thing to know is that the Certificate of Organization is typically filed with the Pennsylvania Department of State, specifically the Bureau of Corporations and Charitable Organizations. This government agency oversees business entities in the state and maintains important records for businesses operating within Pennsylvania.

To find your LLC Certificate of Organization, you can visit the Pennsylvania Department of State website and access the online business entity search tool. This valuable resource allows you to search for your company by name or entity number and retrieve important documents related to your business, including the Certificate of Organization. By simply entering your LLC name or entity number into the search tool, you can quickly locate and download a copy of your Certificate of Organization for your records.

In addition to the online search tool, you can also contact the Pennsylvania Department of State directly to request a copy of your LLC Certificate of Organization. This can be done by phone, email, or mail, and may require a small processing fee. By reaching out to the Bureau of Corporations and Charitable Organizations, you can ensure that you have all the necessary documentation to prove the legal existence of your LLC.

It’s important to note that keeping a copy of your LLC Certificate of Organization on hand is critical for various reasons. This document is often required when opening a business bank account, applying for business loans, entering into contracts, or conducting other legal transactions on behalf of your company. By having a clear and up-to-date Certificate of Organization, you can provide proof of your LLC’s legitimacy and protect your business interests.

In conclusion, knowing where to find your Pennsylvania LLC Certificate of Organization is essential for all business owners operating in the state. By understanding the process and resources available to obtain this important document, you can ensure that your LLC is in good standing and compliant with state regulations. Whether through the online search tool or direct contact with the Pennsylvania Department of State, obtaining and maintaining your Certificate of Organization is an important step in securing the success and longevity of your business.

In Conclusion

Articles of Organization or Certificate of Formation is the most important document for your Pennsylvania LLC. Before you submit/file the document make sure to provide proper and correct information about your company. If you have any questions, share that below in the comment section.

Me gustaría saber más cómo legalizar mi pequeńa empresa hacer todo lo correcto