If you are forming a Utah LLC, then this page’s content would be vital. As you learn how to start an LLC, you will realize that the bulk of your initial work and LLC cost comprises filing a Utah certificate of organization, which we will elaborate on this page.

On this page, you’ll learn about the following:

What is a Certificate of Organization?

A Certificate of Organization, also known as an LLC certificate or Articles of Organization in some states, is a document filed with the secretary of state to form an LLC.

Each state has a different requirement to fill out a form. A Certificate of Organization usually includes the following:

- The name of the LLC,

- the effective date of the LLC,

- the company’s principal office,

- the business purpose,

- the duration of the business,

- a copy of the LLC’s name registration certificate, and

- the name and address of the registered agent, organizers, and

- at least one member of the company.

You can file a Certificate of Organization online, by mail, or in person.

Note that the certification of formation is a legal requirement, not to mention, the core of your LLC formation. It even makes up the bulk of your Utah LLC cost. Without it, you have no LLC. So, take the time to complete and file this certificate.

How to File an Utah Certificate of Organization

These are the simple steps to follow in filing a Certificate of Organization in Utah.

Step 1: Find Forms Online

Go to the Utah Secretary of State to download the certificate of organization form for your LLC or to log into the online service.

Step 2: Fill Out Form

When filling out the form, you must have reserved an LLC name. Do a name search. Go to Utah LLC Name Search to check whether your chosen business name is available to use in this state.

You must attach a copy of your Name Reservation to your filled-out Certificate of Organization form when filing. You also need to nominate a registered agent. Here are 3 of the best LLC services on our list.

Step 3: File Formation Certificates

File your formation certificate either online or by mail by filling out a form and sending it to the Utah Division of Corporations & Commercial Code P.O. Box 146705 Salt Lake City, UT 84114.

Steps to Register Article of Organization Online

Time needed: 5 minutes

To start your business LLC in the State of Utah, the preliminary requirement is to apply for articles of organization of your Utah Limited Liability Company with the Secretary of State. When your application is filed through online mode, you will also receive the benefit of immediate processing. The filing fee is $70. The formation guide in the following steps will help you file the Articles of Organization in Utah.

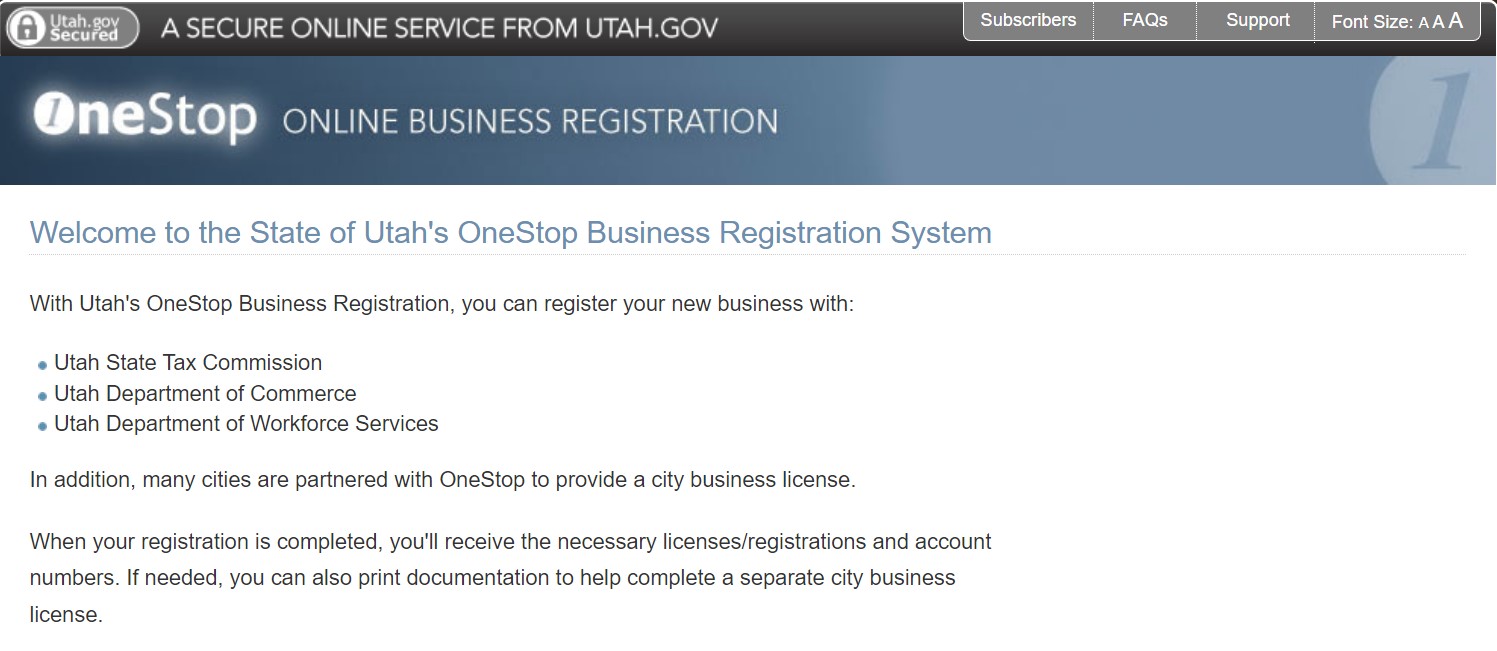

- Visit the official website of the Secretary of State of Utah

Access the official website of the Secretary of State of Utah. The website hosts a One-Stop Portal for Online business registration and filings. On the webpage, scroll down and click on the ‘Continue’ tab.

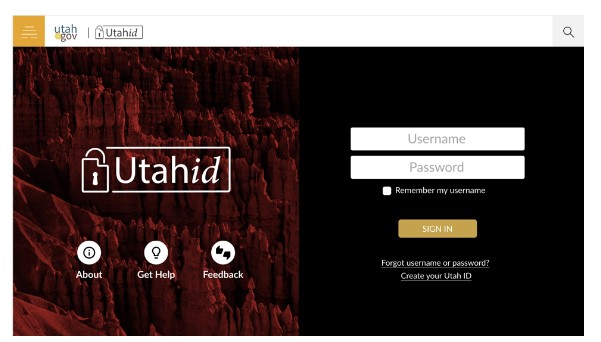

- Create your account on the portal

On the following page, the login box is displayed. If you already have an account, enter your login credentials and sign in to access your personal account on the portal. In case, you do not have an account, click on the ‘Create your Utah ID’ link. On the next page, provide your personal information and create your user ID and password. Click on the ‘Submit’ tab.

- Start to file your online application

Login to your Utah business portal account using your user ID and password. On the user landing page, select the option to “Register a New Business”. Next, click on “Begin Registration”. Select the business type as a new business in Utah and proceed to answer the questions as per your business filing. Now, click on the ‘Next Step’ option. More questions relating to your business will be presented. Answer these pre-registration questions. Next, choose your business entity type from the drop-down menu and now you can proceed to start your application.

- Read the instructions

Before you start to fill your application, read all the instructions and guidelines attached to the online application. Start to fill in all the required details in the application form. Do not skip any mandatory section.

- Review your application

Revisit all the sections to ensure that all the information provided by you is true and correct to your knowledge.

- Make the payment

After finalizing the application, you can proceed to the payment gateway page and pay $70 as the filing fee for your online application. You will receive a notification from the Secretary of State office, acknowledging the receipt of your application.

Utah Articles of Organization Filing By Mail

If you want to file your business registration application through offline options, you can do that easily by mail. Follow the instructions below to file your Utah LLC Articles of Organization by mail:

- Access the application form on the official state website. You can download the application form PDF on your computer system.

- Read the instructions and guidelines mentioned in the application form.

- Start to fill the required details in the application form.

- Recheck whether all the details provided by you are accurate and correct.

- You can also attach the name reservation certificate along with the application form.

- Issue a money order or check for $70 as the filing fee, payable to the ‘Department of Commerce’.

- Arrange all the documents together and mail it to the following address, Utah Division of Corporations & Commercial Code, P.O. Box 146705, Salt Lake City, UT 84114.

Cost of Filing Articles of Organization in Utah

The online filing option is considered the more convenient method of application filing due to easy updates and tracking options. Nevertheless, the cost of filing a registration application in the State of Utah is the same for both methods of filing. Here is the cost of filing formation articles in Utah,

- Online filing costs $70.00

- By mail filing costs $70.00

F.A.Qs

A Certificate of Organization is a legal document that will officially make your LLC into existence. This document is needed specifically for Utah in forming an LLC business structure.

The application form for the Certificate of Organization needs to include the LLC name, date of establishment, the company’s registered office, business purpose, how long the business will exist, and a copy of the LLC’s name registration certificate.

Filing by mail or in person is neither highly recommended nor required; waiting an extra week for your LLC to be approved isn’t that bad. The LLC approval you send in will be returned by mail. Online filing, meanwhile, is more convenient as you won’t have to stay in a queue.

Where Can You Find Your Utah LLC Certificate of Organization

Certificate of Organization for Utah LLC can be accessed through the Utah’s one stop business website by creating your account. You can also download the PDF from State of Utah website.

So, where can you find your Utah LLC Certificate of Organization? Fortunately, the process is relatively straightforward and can be accessed through multiple avenues. The first place to check is the online portal of the Utah Division of Corporations. Here, you can search for your LLC by name and find a digital copy of your Certificate of Organization. This online portal provides quick and easy access to important business documents, saving you time and hassle.

If you prefer a more traditional approach, you can also obtain a physical copy of your Utah LLC Certificate of Organization by contacting the Utah Division of Corporations directly. By requesting a copy through mail or in person, you will have a hard copy of this vital document that can be stored securely and accessed whenever needed for legal matters or business transactions.

Another important tip to keep in mind is the significance of keeping your Utah LLC Certificate of Organization up to date. As your business grows and changes, it is crucial to ensure that the information on your Certificate of Organization remains accurate and reflects the current state of your LLC. Any updates or amendments should be filed promptly with the Utah Division of Corporations to avoid any potential legal issues in the future.

Moreover, your Utah LLC Certificate of Organization is not just a legal requirement but also a symbol of your business’s legitimacy and professionalism. Having this document readily available showcases a level of organization and credibility that can instill confidence in potential clients, investors, and partners. It also serves as a reminder of the hard work and dedication that went into establishing your business and achieving your entrepreneurial goals.

In conclusion, obtaining and maintaining your Utah LLC Certificate of Organization is a crucial aspect of running a successful business in the state. By knowing where to find this document and keeping it updated, you are ensuring the stability and security of your LLC for years to come. Whether through online resources or direct communication with the Utah Division of Corporations, taking the time to obtain and preserve your Certificate of Organization is an investment in the long-term success of your business. Stay proactive, stay informed, and stay on top of your legal obligations as a business owner in Utah.

In Conclusion

Articles of Organization or Certificate of Formation is the most important document for your Utah LLC. Before you submit/file the document make sure to provide proper and correct information about your company. If you have any questions, share that below in the comment section.