If you are forming an Arizona LLC, then this page’s content would be vital. As you learn how to start an LLC, you will realize that the bulk of your initial work and cost comprises filing an Arizona article of organization, which we will elaborate on this page.

On this page, you’ll learn about the following:

What is an Article of Organization?

An Article of Organization, also known as an LLC certificate in some states, is a document filed with the secretary of state to form an LLC.

Each state has a different requirement to fill out a form. An article of organization usually includes the following:

- The name of the LLC,

- the effective date of the LLC,

- the company’s principal office,

- the business purpose,

- the duration of the business,

- a copy of the LLC’s name registration certificate, and

- the name and address of the registered agent, organizers, and

- at least one member of the company.

You can file an Article of Organization online, by mail, or in person.

Note that the certification of formation is a legal requirement, not to mention, the core of your LLC formation. It even makes up the bulk of your LLC cost. Without it, you have no LLC. So, take the time to complete and file this certificate.

How to File an Arizona Article of Organization

These are the simple steps to follow in filing an article of Organization in Arizona.

Step 1: Find Forms Online

Go to the Arizona Secretary of State to download the article of organization form for your LLC or to log into the online service.

Step 2: Fill Out Form

When filling out the form, you must have reserved an LLC name. Do a name search. Go to Arizona LLC Name Search to check whether your chosen business name is available to use in this state.

You must attach a copy of your Name Reservation to your filled-out articles of organization form when filing. You also need to nominate a registered agent. Here are 3 of the best LLC services on our list.

Step 3: File Formation Certificates

File your formation certificate either online or by mail by filling out a form and sending it to the Arizona Corporate Commission, Examination Section 1300 W, Washington Street, Phoenix, Arizona 85007.

File Alaska Article of Organization Online

Time needed: 5 minutes

To start an LLC in Arizona, you need to file for the certificate of Incorporation of your LLC with the Secretary of State of Arizona. You can do this online and you can file for it through mail too. Online filing helps in expedited processing of the Certificate as well. The formation guide in the following steps will help you file for the articles of the organization so read on and get the info.

- Visit the website

Go to the official website of the Arizona Corporation Commission. The website will guide you on how to file for Articles of Incorporation online.

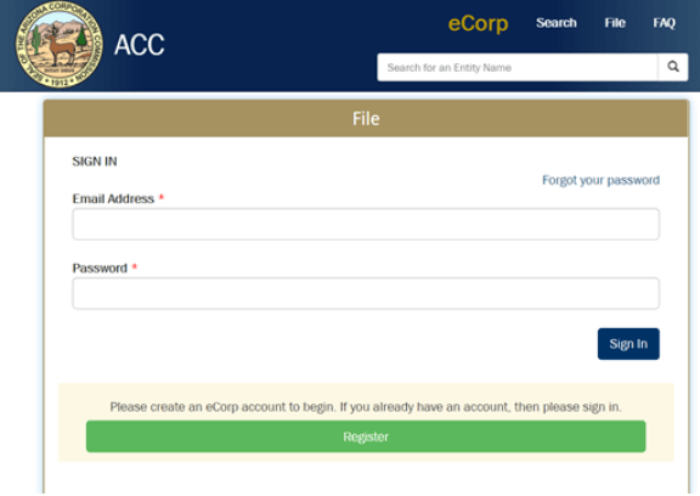

- Sign in to your account

The opening page will ask for your login credentials for the eCorp Account. If you already have an account on the platform, then fill in your login details and continue to “Sign-in”.

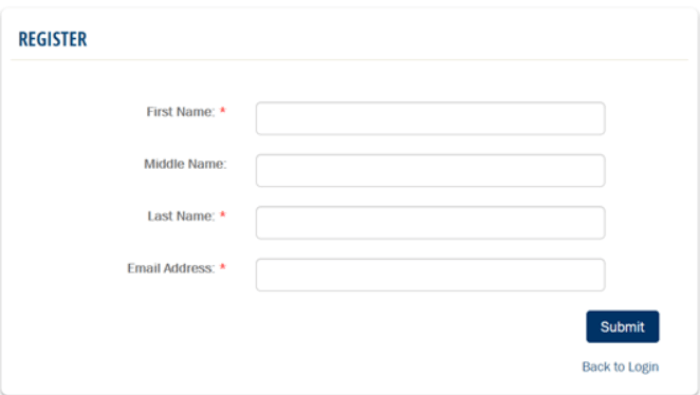

- Create your Account

If you do not have an eCorp account, click on the “Register” option on the page. This will navigate you to the Register page, where you must fill in your basic details such as First and Last name, and email address.

- Proceed with the Registration

After registering your account on the eCorp platform, log in with your username and password. After logging in, select the “Online Services” option. Then, choose the option of “Start a New Business” and proceed with the filing of your documents for application for Articles of Incorporation with the State of Arizona.

Filing Arizona Articles of Organization by Mail

The State of Arizona also provides an easy mechanism to file the application for articles of Incorporation by mail. By following the instructions below, one can file the certificate of Incorporation in Arizona

- Download the Application form PDF.

- Fill in the mandatory details, such as Entity type, name, the character of business, shares, Street Address of the Business, Details of Directors, Details of Statutory Agent, etc. You can either fill in the details on your system then download the document or print the document and then write in ink.

- After filling in all the details, review the information thoroughly.

- Once you complete all the required formalities, make a payment of $50 in the name of the Secretary of State.

- Mail your application and cover sheet to the following address: Arizona Corporation Commission – Examination Section 1300 W. Washington St., Phoenix, Arizona 85007.

- You can also submit your documents in-person to the following address: Arizona Corporation Commission, Corporations Division,1300 W. Washington St., Phoenix, AZ 85007.

Cost of Filing an Arizona Formation Certificate

The filing of the formation certificate makes up the majority of the cost of forming an Arizona LLC, and this filing can be done online as well as via mail. It is more convenient to file an article of organization online than by mail. However, the cost of filing remains the same irrespective of the mode of application.

- Online filing costs $50 (expedited fee costs $85)

- By-mail Filing costs $50

F.A.Qs

An Article of Organization is a legal document that will officially make your LLC into existence. This document is needed specifically for Arizona in forming an LLC business structure.

The application form for the Article of Organization needs to include the LLC name, date of establishment, the company’s registered office, business purpose, how long the business will exist, and a copy of the LLC’s name registration certificate.

Filing by mail or in person is neither highly recommended nor required; waiting an extra week for your LLC to be approved isn’t that bad. The LLC approval you send in will be returned by mail. Online filing, meanwhile, is more convenient as you won’t have to stay in a queue.

Where Can You Find Your Arizona LLC Articles of Organization

You can find the Arizona Articles of Organization from the Arizona Corporation Commission website. You can file online as well as download the PDF.

So where can you find your Arizona LLC Articles of Organization? The answer is simple: with the Arizona Corporation Commission (ACC). This state agency is responsible for overseeing all business entities in Arizona, including LLCs. When you file your Articles of Organization with the ACC, you are essentially registering your LLC with the state and providing important information about your business, such as its name, address, and the names of its members.

To obtain a copy of your Arizona LLC Articles of Organization, you can visit the ACC’s website and search for your business entity. The ACC’s website allows you to search for LLCs by name, entity number, or individual members. Once you locate your LLC, you can view and download a copy of your Articles of Organization. This document serves as proof that your LLC is officially registered and in compliance with Arizona state laws.

It’s important to keep a copy of your Arizona LLC Articles of Organization on file, as you may need it for various reasons, such as opening a business bank account, obtaining business licenses and permits, or applying for loans or grants. Furthermore, having a copy of this document readily available can help you resolve any disputes or legal issues that may arise in the future.

If you are unable to access your Arizona LLC Articles of Organization online, you can request a copy from the ACC by mail or in person. The ACC’s office is located in Phoenix, Arizona, and their friendly and knowledgeable staff are available to assist you with any questions or concerns you may have regarding your LLC.

In conclusion, the Arizona Corporation Commission is the go-to source for obtaining your Arizona LLC Articles of Organization. By filing this important document with the ACC, you are establishing the legal foundation of your LLC and ensuring that your business is in good standing with the state. So, if you’re starting a business in Arizona and forming an LLC, make sure to file your Articles of Organization with the ACC and keep a copy of this document handy for future reference.

In Conclusion

Articles of Organization or Certificate of Formation is the most important document for your Arizona LLC. Before you submit/file the document make sure to provide proper and correct information about your company. If you have any questions, share that below in the comment section.