If you are forming an LLC in Indiana, then this page’s content would be vital. As you learn how to start an LLC, you will realize that the bulk of your initial work and LLC cost comprises filing an Indiana article of organization, which we will elaborate on this page.

On this page, you’ll learn about the following:

What is an Article of Organization?

An Article of Organization, also known as an LLC certificate or Certificate of Formation in some states, is a document filed with the secretary of state to form an LLC.

Each state has a different requirement to fill out a form. An Article of Organization usually includes the following:

- The name of the LLC,

- the effective date of the LLC,

- the company’s principal office,

- the business purpose,

- the duration of the business,

- a copy of the LLC’s name registration certificate, and

- the name and address of the registered agent, organizers, and

- at least one member of the company.

You can file an Article of Organization online, by mail, or in person.

Note that the certification of formation is a legal requirement, not to mention, the core of your LLC formation. It even makes up the bulk of your Indiana LLC cost. Without it, you have no LLC. So, take the time to complete and file this certificate.

How to File an Indiana Articles of Organization

These are the simple steps to follow in filing an Article of Organization in Indiana.

Step 1: Find Forms Online

Go to the Indiana Secretary of State to download the article of organization form for your LLC or to log into the online service.

Step 2: Fill Out Form

When filling out the form, you must have reserved an LLC name. Do a name search. Go to Indiana LLC Name Search to check whether your chosen business name is available to use in this state.

You must attach a copy of your Name Reservation to your filled-out Article of Organization form when filing. You also need to nominate a registered agent. Here are 3 of the best LLC services on our list.

Step 3: File Formation Certificates

File your formation certificate either online or by mail by filling out a form and sending it to the Secretary of State, Business Services Division, 302 West Washington Street, Room E018, Indianapolis, IN 46204.

Filing Indiana Articles of Organization Online

Time needed: 5 minutes

If you want to form an LLC in the State of Indiana, you must file for the Articles of Organization. You can do this online and you can file through mail too. When you go for the online filing, it also helps in the immediate processing of your application. The formation guide in the following steps will help you file for the articles of an organization so read and get the info.

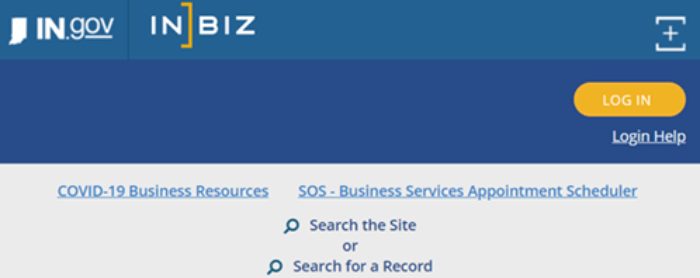

- Go to the official website of the State of Indiana

You need to visit the Business section of the State of Indiana website. The website will help you form the LLC in the State and do it in the easiest way, i.e., online.

- Start a New Business

Scroll down the page and click on the option “Start a New Business”

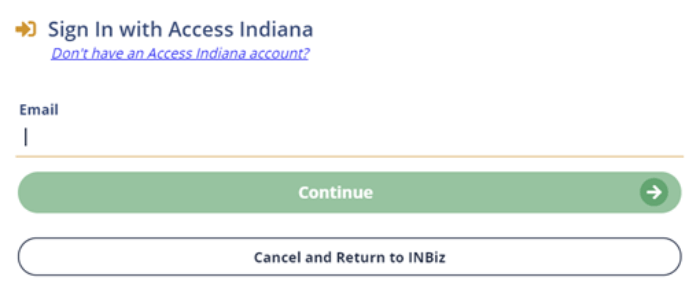

- Sign In with Access Indiana

If you already registered your account on the website, click on “log in” option and proceed to fill in your login credentials and access your account. If you do not have an account, click on the “Create Account” option on the page.

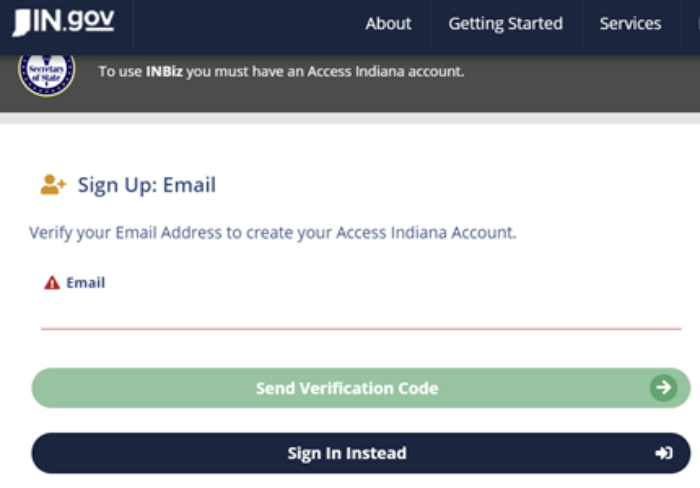

- Create your Account

To create your online account on the portal, fill in your email address, and after verification, proceed to fill in the other required details to create your account.

- Proceed with the Application

After creating your account on the portal, login into your account using your email and password. Then, select “Start a New Business” from the toolbar section at the top of the page. The account also offers you guided assistance. You can choose for assistance in filing the Application

- Fill in the information

On the Application page for Articles of Organization of your LLC, fill in the required information. Make sure the information provided is accurate and correct.

- Review the application

Before applying to the authorities, review the information filled in the application.

- Make the payment

Pay the application filing fee of $95 for the processing of your application.

Filing Indiana Articles of Organization by Mail

If you want to file the Articles of Organization by Mail, you can easily do that. By following the instructions below, one can file the Articles of Organization in Indiana.

- Download the Application Form PDF on your computer.

- Read it carefully and fill the form up thoroughly with correct and accurate information.

- Get a couple of copies of the form.

- Attach the check of $100 payable to the Secretary of State Business.

Send all the documents to the mailing address, Secretary of State, Business Service Division, 302 West Washington Street, Room E018, Indianapolis, IN 46204

Cost of Filing an Indiana Articles of Organization

It is more convenient to file an Article of Organization online than by mail. The cost of filing an LLC in Indiana is slightly higher for offline filing than online filing. Here is the cost of filing formation certificate in Indiana,

- Online filing costs $95

- By mail filing costs $100

F.A.Qs

An Article of Organization is a legal document that will officially make your LLC into existence. This document is needed specifically for Indiana in forming an LLC business structure.

The application form for the Articles of Organization needs to include the LLC name, date of establishment, the company’s registered office, business purpose, how long the business will exist, and a copy of the LLC’s name registration certificate.

Filing by mail or in person is neither highly recommended nor required; waiting an extra week for your LLC to be approved isn’t that bad. The LLC approval you send in will be returned by mail. Online filing, meanwhile, is more convenient as you won’t have to stay in a queue.

Where Can You Find Your Indiana LLC Articles of Organization

Articles of Organization for Indiana LLC can be accessed through the Indiana Secretary of State website. You can also download the PDF from the same website.

The Articles of Organization serve as the foundational document for an LLC. This document outlines key information about the company, including its name, address, registered agent, and purpose. Filing the Articles of Organization is necessary to legally establish the LLC in Indiana and can be done online through the Indiana Secretary of State’s website.

So, where exactly can you find your Indiana LLC Articles of Organization? The Articles of Organization are typically filed with the Secretary of State’s office. In Indiana, this office is responsible for overseeing business registrations and maintaining public records. The exact process for obtaining a copy of the Articles of Organization may vary depending on the state’s regulations.

For those who filed their Articles of Organization online, they can usually access a copy of the document through the Secretary of State’s website. This online portal often provides a convenient way to download and print the Articles of Organization for your records. It’s important to keep this document in a safe place as it serves as proof of the company’s existence.

If you filed your Articles of Organization through mail or in-person, you may need to request a copy directly from the Secretary of State’s office. There may be a nominal fee associated with obtaining a copy of this document, but having it on hand can help with various administrative tasks, such as opening a business bank account or securing financing.

It’s important to note that the Articles of Organization are just one of the many documents that may be required when forming an LLC. Depending on the nature of your business and its activities, additional filings or permits may be necessary. Consulting with a legal professional or business advisor can help ensure that you are meeting all the legal requirements for your Indiana LLC.

In conclusion, the Articles of Organization form the bedrock of your Indiana LLC. Ensuring that you have a copy of this document readily available can help you navigate the complexities of business ownership and stay in compliance with state regulations. By understanding where to find your Indiana LLC Articles of Organization, you can set your business up for success and focus on building your entrepreneurial dreams.

In Conclusion

Articles of Organization or Certificate of Formation is the most important document for your Indiana LLC. Before you submit/file the document make sure to provide proper and correct information about your company. If you have any questions, share that below in the comment section.

donde puedo encontrar los nombrres disponibles en el momento de elegir como se llamaria mi corporacion .

en cuanto a la participaciones o acciones donde se indican en el formulario como estaria divididas