If you are forming an LLC in West Virginia, then this page’s content would be vital. As you learn how to start an LLC, you will realize that the bulk of your initial work and LLC cost comprises filing West Virginia articles of organization, which we will elaborate on this page.

On this page, you’ll learn about the following:

What is an Article of Organization?

An Article of Organization, also known as an LLC certificate or Certificate of Formation in some states, is a document filed with the secretary of state to form an LLC.

Each state has a different requirement to fill out a form. An Article of Organization usually includes the following:

- The name of the LLC,

- the effective date of the LLC,

- the company’s principal office,

- the business purpose,

- the duration of the business,

- a copy of the LLC’s name registration certificate, and

- the name and address of the registered agent, organizers, and

- at least one member of the company.

You can file an Article of Organization online, by mail, or in person.

Note that the certification of formation is a legal requirement, not to mention, the core of your LLC formation. It even makes up the bulk of your West Virginia LLC cost. Without it, you have no LLC. So, take the time to complete and file this certificate.

How to File West Virginia Articles of Organization

These are the simple steps to follow in filing an Article of Organization in West Virginia.

Step 1: Find Forms Online

Go to the West Virginia Secretary of State to download the articles of organization form for your LLC or to log into the online service.

Step 2: Fill Out Form

When filling out the form, you must have reserved an LLC name. Do a name search. Go to West Virginia LLC Name Search to check whether your chosen business name is available to use in this state.

You must attach a copy of your Name Reservation to your filled-out Articles of Organization form when filing. You also need to nominate a registered agent. Here are 3 of the best LLC services on our list.

Step 3: File Formation Certificates

File your formation certificate either online or by mail by filling out a form and sending it to any of the following addresses:

- Charleston Office One-Stop Business Center 1615 Washington St. E. Charleston, WV 25311.

- Clarksburg Office North Central WV Business Center 200 W. Main St. Clarksburg, WV 26301.

- Martinsburg Office Eastern Panhandle Business Center 229 E. Martin St. Martinsburg, WV 25401.

Steps to Register Article of Organization Online

Time needed: 5 minutes

To establish your business LLC in the State of West Virginia, one must apply for Articles of Organization with the Secretary of State office. The cost of the application is $100. When you apply through online mode, you also get the benefit of immediate processing of your application. The formation guide in the following steps will assist you in filing the Articles of Organization application with the West Virginia Secretary of State office.

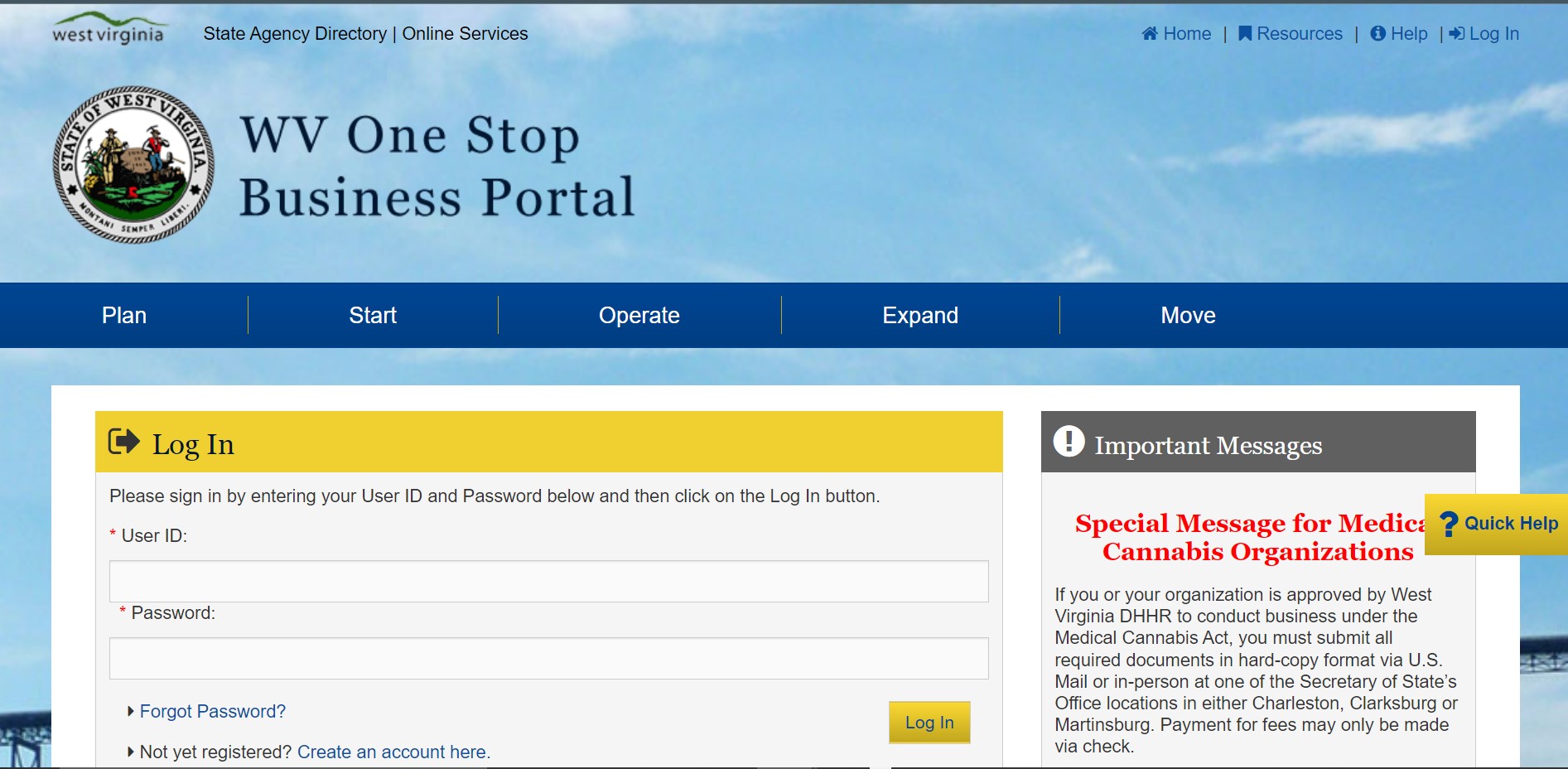

- Go to the Official Secretary of State website

Visit the official website of the Secretary of State of West Virginia. The Website hosts a WV One Stop Business Portal, which provides an easy and convenient platform for different business filings and related online services. On the page, the Login box appears. If you already have an account on the portal, you can proceed to log in by entering your user ID and password in the provided space. In case you do not have an account, read the next step ahead to know about it.

- Start to file your application

After confirmation of your WV Business portal account, log in to your account. On the user homepage, select the relevant option for business registration or filing of Articles of Organization for your West Virginia Domestic LLC. Read the instructions carefully and proceed to fill in the application form with all the mandatory information.

- Review your application

Once you have completed the application form, recheck all the details provided by you to be correct and accurate to your knowledge.

- Make the payment

As the final step, after you have confirmed all the information in your application, proceed to pay $100 as the filing fee of your application. You will receive a notification from the Secretary of State office acknowledging the receipt of your application.

West Virginia Articles of Organization Filing By Mail

If you wish to file your Application for Articles of Organization by offline method, you can do that easily by mail. Follow the instructions below to learn more about how to file an application via mail with the Secretary of State of West Virginia.

- Access the Application Form PDF from the official website of the Secretary of State. Download the application form PDF on your computer.

- Read all the instructions provided in the form carefully.

- Start to fill in the required details in the application form. You must also fill the Customer Order Request form attached with the original form. You can also attach the Name Reservation certificate as well.

- After completing the form, review all the details provided by you in the form. All the details should be correct and accurate to your knowledge.

- Issue a check or money order for $100 as the filing fee payable to the West Virginia Secretary of State. You can also authorize online payment by filing in the e-Payment form attached with the original application form.

- Arrange all the documents together and mail it to one of the following three addresses: Charleston Office One-Stop Business Center 1615 Washington Street East Charleston, WV 25311; Clarksburg Office North Central WV Business Center 200 West Main Street Clarksburg, WV 26301; Martinsburg Office Eastern Panhandle Business Center 229 E. Martin Street Martinsburg, WV 25401

Cost of Filing Articles of Organization in West Virginia

In general, the online method is the preferred mode of application due to easy filing and tracking options. Nevertheless, the State accepts applications through online as well as offline mode, without any difference in the filing fee. Here is the cost of filing formation articles in West Virginia,

- Online filing costs $100.00

- By mail filing costs $100.00

Where Can You Find Your West Virginia LLC Articles of Organization

Establishing a Limited Liability Company (LLC) is a popular choice for entrepreneurs due to its flexible structure and liability protection. This type of business entity provides a clear distinction between personal and business assets, shielding owners from potential risks. West Virginia, known for its picturesque landscapes and business-friendly environment, offers entrepreneurs a straightforward process of forming and managing an LLC. To initiate this process, individuals must understand one essential document – the Articles of Organization.

But where can you find your West Virginia LLC Articles of Organization? Fortunately, the search for this vital document is not an arduous task. The Articles of Organization serve as a governing document for an LLC, acting as a totem pole for tracking information on the business entity. Those willing to embark on this entrepreneurial journey simply need to know a few key places where these articles can be accessed.

First and foremost, the West Virginia Secretary of State’s Office is the primary and most reliable resource for locating these documents. The Secretary of State serves as the official record-keeper for LLCs and maintains an easily accessible online database. Entrepreneurs can make quick use of their digital portal, which provides a user-friendly interface to search and retrieve LLC filings. One can sift through this efficiently indexed repository by utilizing various search parameters like the company name, Registered Agent, or the document’s filing number. In a few moments, a variety of valuable information, including the Articles of Organization, can be at the fingertips of eager entrepreneurs.

Ensuring transparency and public access, the West Virginia Secretary of State’s Office further enables individuals to request certified copies of the Articles of Organization. These copies serve as legal validation, often required when dealing with financial institutions, legal entities, or simply showcasing proof of formation. Additionally, acquiring these certified copies is a reliable way to authenticate important business details while undergoing partnerships, vendor relationships, or mergers. Official documentation lends credibility to a company’s operations and portrays a sense of professionalism that resonates with investors, clients, and governmental institutions alike.

Apart from governmental resources, entrepreneurs may also turn to professional service providers specializing in business filings and compliance matters. Business filing service companies can undertake the task of acquiring and storing the Articles of Organization on behalf of their clients. The benefit of employing such companies is the convenience they offer while saving precious time that entrepreneurs can invest in their business’s core operations. Whether in paper or digital format, these service providers ensure that businesses maintain a proper record-keeping system, streamlining crucial information retrieval whenever necessary.

To recap, the West Virginia Secretary of State’s Office, with its comprehensive online database and certified copies provision, stands as the primary source for accessing a company’s Articles of Organization. Parallelly, business filing service companies provide an added layer of convenience to entrepreneurs who prefer outsourcing their document management tasks without sacrificing reliability.

Understanding where to locate one’s West Virginia LLC Articles of Organization is crucial for entrepreneurs navigating the state’s business landscape. Being aware of the existence of authoritative government resources such as the Secretary of State’s Office, as well as trusted business service providers, ensures entrepreneurs can readily access this important document, allowing them to operate smoothly, confidently, and effectively run their thriving West Virginia LLCs.

F.A.Qs

An Article of Organization is a legal document that will officially make your LLC into existence. This document is needed specifically for West Virginia in forming an LLC business structure.

The application form for the Articles of Organization needs to include the LLC name, date of establishment, the company’s registered office, business purpose, how long the business will exist, and a copy of the LLC’s name registration certificate.

Filing by mail or in person is neither highly recommended nor required; waiting an extra week for your LLC to be approved isn’t that bad. The LLC approval you send in will be returned by mail. Online filing, meanwhile, is more convenient as you won’t have to stay in a queue.

Where Can You Find Your West Virginia LLC Articles of Organization

Luckily, obtaining the Articles of Organization for your West Virginia LLC is a relatively straightforward process. You can access these documents online through the Secretary of State’s website. The website provides a user-friendly interface that allows you to search for and download various forms related to business filings, including the Articles of Organization.

To locate the Articles of Organization, simply navigate to the state’s business entity search page and enter your LLC’s name in the search bar. Once you find your LLC in the search results, you will be able to view and download your Articles of Organization. This document is essential to have on hand as it serves as proof of your LLC’s existence and provides important information that may be required when conducting business operations.

Another option for accessing your LLC’s Articles of Organization in West Virginia is to request a copy from the Secretary of State’s office directly. You can do so by contacting the Business and Licensing Division by phone, email, or in person. The office staff will be able to assist you with locating and obtaining a copy of your Articles of Organization.

It’s important to keep in mind that the Articles of Organization are public records, meaning they are accessible to anyone who wishes to view them. This transparency is a fundamental aspect of the LLC formation process and is designed to provide transparency and accountability to the public. As such, it’s essential to ensure that the information contained in your Articles of Organization is accurate and up to date.

In summary, finding your West Virginia LLC Articles of Organization is a vital step in the LLC formation process. These documents establish your LLC’s official existence and provide important details about your business. Whether you choose to access them online through the Secretary of State’s website or request a copy directly from the office, ensuring that you have a copy of your Articles of Organization on hand is essential for maintaining compliance and conducting business operations.

In Conclusion

Articles of Organization or Certificate of Formation is the most important document for your West Virginia LLC. Before you submit/file the document make sure to provide proper and correct information about your company. If you have any questions, share that below in the comment section.