If you are forming an Oklahoma LLC, then this page’s content would be vital. As you learn how to start an LLC, you will realize that the bulk of your initial work and LLC cost comprises filing Oklahoma Articles of Organization, which we will elaborate on this page.

On this page, you’ll learn about the following:

What is Articles of Organization?

Articles of Organization, also known as an LLC certificate or Certificate of Formation in some states, is a document filed with the secretary of state to form an LLC.

Each state has a different requirement to fill out a form. An Article of Organization usually includes the following:

- The name of the LLC,

- the effective date of the LLC,

- the company’s principal office,

- the business purpose,

- the duration of the business,

- a copy of the LLC’s name registration certificate, and

- the name and address of the registered agent, organizers, and

- at least one member of the company.

You can file an Article of Organization online, by mail, or in person.

Note that the certification of formation is a legal requirement, not to mention, the core of your LLC formation. It even makes up the bulk of your Oklahoma LLC cost. Without it, you have no LLC. So, take the time to complete and file this certificate.

How to File Oklahoma Articles of Organization

These are the simple steps to follow in filing an Article of Organization in Oklahoma.

Step 1: Find Forms Online

Go to the Oklahoma Secretary of State to download the Articles of Organization form for your LLC or to log into the online service.

Step 2: Fill Out Form

When filling out the form, you must have reserved an LLC name. Do a name search. Go to Oklahoma LLC Name Search to check whether your chosen business name is available to use in this state.

You must attach a copy of your Name Reservation to your filled-out Articles of Organization form when filing. You also need to nominate a registered agent. Here are 3 of the best LLC services on our list.

Step 3: File Formation Certificates

File your formation certificate either online or by mail by filling out a form and sending it to the Oklahoma Secretary of State 421 NW 13th St, Suite #210 Oklahoma City, OK 73103

Steps to Register Article of Organization Online

Time needed: 5 minutes

If you want to establish your business LLC in the State of Oklahoma, you must register for the Oklahoma Articles of Organization. You can apply either through an online filing option or through the mail. The cost of registration is $100.00. When applying through an online option, you get the leverage of immediate application processing. The formation guide below will guide you for the Oklahoma LLC Articles of Incorporation.

- Go to the Official website of the Oklahoma Secretary of State

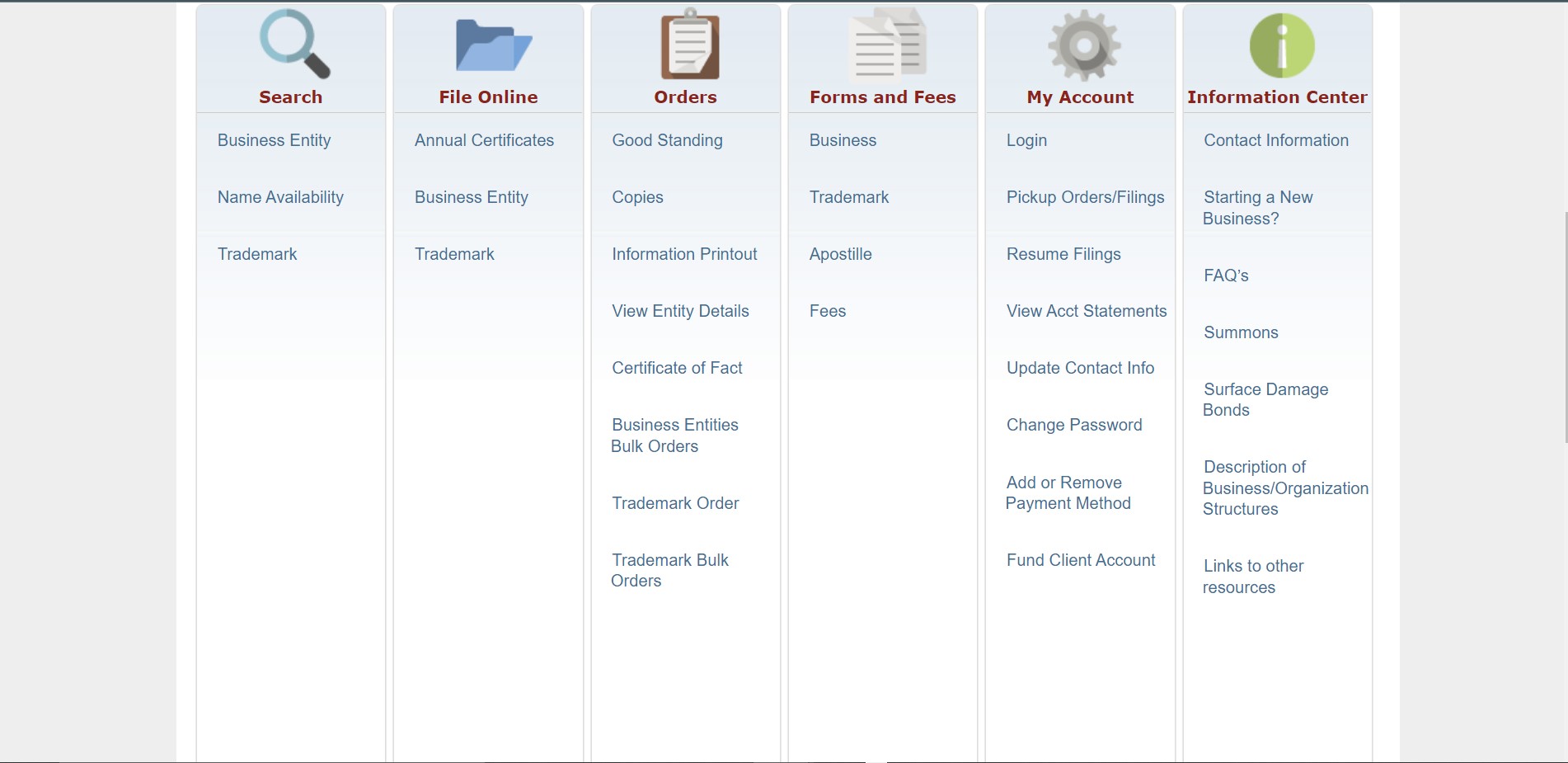

Visit the Business page on the Oklahoma Secretary of State website. The page offers different online business services and forms filing options.

- Scroll down to the ‘File Online’ Section

Under the ‘File Online’ section, select the option of ‘Business Entity’.

- Online Registration of Business Entity Filings

On the following page, scroll down to the Online Registration Filings sections. Under the heading of ‘Domestic Organizations’, select the option of ‘Domestic Limited Liability Company’.

- Create or Log in to your Account

The log-in box appears on the next page. To begin with the registration process, you need to create an account on the State website. Provide your Personal name and Email ID and click on the ‘Continue’ tab

- Select a Work Item

On the next page, click on the ‘Start New’ tab under the Work item. A summary of the details and filing requirements will appear on the next page. Click on the ‘Next’ tab.

- Enter the name

On the next page, you must fill in the name of your Limited Liability Company. The page offers you a name availability search option. After you have entered the name, click on the search option. Any other business with a similar name will appear on the screen along with their filing number. Select a suitable name for your business LLC accordingly. After finalizing a name, click on the ‘Next’ tab.

- Effective Date

In the next section, you are required to fill in the details of the effective date of your Oklahoma Business LLC. If the effective date is the same as the filing date, select the first option. In case the effective date is delayed, specify the particular date in the box provided below on the page. Click on the ‘Next’ tab.

- Provide the address details

On the next page, provide the street address details of the principal place of business, wherever located. Click on the ‘Next’ tab.

- Fill in the other required details

The remaining sections contain information about the Duration of your business LLC, whether it has perpetual existence or a specified dissolution date. Next, provide the information about your Registered agent in Oklahoma. In the succeeding section, attach all the required documents and your signature.

- Review the information

before making the payment of the application form, review all the information entered by you to be correct and accurate

- Make the payment

as the final step, make the payment of $100 as the filing fee for your Oklahoma Limited Liability Company Articles of Incorporation. After successfully completing your application, you will receive a notification from the State office acknowledging your application.

Oklahoma Articles of Organization Filing By Mail

Though online filing is a preferable method of application filing, you can also file your Oklahoma LLC Articles of Organization by mail. Read the information below to learn how to go about it.

- Download the Application Form PDF on your computer system.

- Read the instructions provided in the form carefully.

- Proceed to fill in the required details in the application form.

- Attach the name reservation certificate along with the application.

- Review all the information entered by you to be correct and accurate.

- Make the payment of $100 as the filing fee for your Articles of Incorporation Application form, payable to the ‘Oklahoma Secretary of State’.

- Send all the documents to the following mailing address, Oklahoma Secretary of State, 421 N.W. 13th, Suite 210, Oklahoma City, Oklahoma 73103.

Cost of Filing Articles of Organization in Oklahoma

It is easier and more convenient to file for the Articles of Organization through online filing than by offline filing. The overall cost to form an Oklahoma LLC is the same for both, online and offline methods of filing. Here is the cost of filing formation articles in Oklahoma

- Online filing costs $100.00

- By mail filing costs $100.00

F.A.Qs

An Article of Organization is a legal document that will officially make your LLC into existence. This document is needed specifically for Oklahoma in forming an LLC business structure.

The application form for the Articles of Organization needs to include the LLC name, date of establishment, the company’s registered office, business purpose, how long the business will exist, and a copy of the LLC’s name registration certificate.

Filing by mail or in person is neither highly recommended nor required; waiting an extra week for your LLC to be approved isn’t that bad. The LLC approval you send in will be returned by mail. Online filing, meanwhile, is more convenient as you won’t have to stay in a queue.

Where Can You Find Your Oklahoma LLC Articles of Organization

Articles of Organization for Oklahoma LLC can be accessed through the Oklahoma Secretary of State website. You can also download the PDF from the same website.

For those looking to start an LLC in Oklahoma, you may be wondering where you can find and file your Articles of Organization. Thankfully, the process is relatively straightforward and can be done either online or through traditional mail.

If you prefer to file your Articles of Organization online, the Oklahoma Secretary of State website offers a convenient and efficient way to do so. By visiting their website, you can access the necessary forms and information required to start the registration process. This option is ideal for those who are tech-savvy and prefer the ease and speed of electronic filing.

On the other hand, if you prefer to file your Articles of Organization through traditional mail, you can request a paper form by contacting the Oklahoma Secretary of State’s office. Simply fill out the form with all the required information, including the name of your LLC, the registered agent’s address, and the purpose of the business. Once the form is completed, you can mail it back to the Secretary of State’s office along with the filing fee.

It’s important to note that there are specific requirements and regulations that must be followed when filing your Articles of Organization in Oklahoma. For example, the name of your LLC must be unique and not already in use by another business entity. Additionally, you must appoint a registered agent who will be responsible for accepting legal documents on behalf of the LLC.

Filing your Articles of Organization is a crucial step in officially establishing your LLC in Oklahoma. This document not only creates your business entity but also outlines important details such as the LLC’s structure, management, and purpose.

By taking the time to properly file your Articles of Organization, you can ensure that your business is compliant with state laws and regulations. Failure to do so could result in penalties or legal issues down the road, so it’s essential to follow the proper procedures when setting up your LLC.

Whether you choose to file online or through traditional mail, the process of registering your LLC in Oklahoma is simple and straightforward. By being diligent and thorough in completing your Articles of Organization, you can pave the way for a successful and legally compliant business venture.

In Conclusion

Articles of Organization or Certificate of Formation is the most important document for your Oklahoma LLC. Before you submit/file the document make sure to provide proper and correct information about your company. If you have any questions, share that below in the comment section.