If you already have an LLC in another state and want an LLC in Washington State, then starting an LLC would be somewhat different. You must register as a foreign LLC. We have here a guide on how you can qualify and register for a foreign LLC in Washington State

On this page, you’ll learn about the following:

- Forming a Washington State Foreign LLC

- Step 1: Choose Washington State Foreign LLC Name

- Step 2: Select Washington State Foreign LLC Registered Agent

- Step 3: File Registration of Washington State Foreign LLC

- Step 4: Determine How Your Washington State Foreign LLC is taxed

- Steps to Filing Washington Foreign LLC Online

- Steps to Filing Washington Foreign LLC by Mail

- After Forming a Washington State Foreign LLC

- F.A.Qs

Forming a Washington State Foreign LLC

A foreign LLC does not need to be a company from another country but a business formed under the laws of another state. To start a foreign LLC in Washington State, you need to register it with the Washington State Secretary of State.

Step 1: Choose Washington State Foreign LLC Name

Obtain a name reservation certificate and submit it with your foreign qualification requirements at the Washington State Secretary of State. Your LLC’s legal name outside of Washington State will be listed on the application, along with the name it will use in Washington State. Take note of the requirements for naming your LLC.

Check name availability at Washington State’s business entity names and reserve your LLC name.

Step 2: Select Washington State Foreign LLC Registered Agent

You’ll need a registered agent to form a foreign LLC in Washington State and take note that a Washington State registered agent must have a local address. Here are three of the best LLC services on our list that will provide you with registered agents to ease your worries:

Step 3: File Registration of Washington State Foreign LLC

Fill out and submit a Foreign LLC Application for Registration form via email to [email protected] or by mail to Secretary of State Corporation Division 801 Capitol Way S P.O. Box 40234 Olympia, Washington 98504-0234.

Include the following:

- LLC’s full legal name.

- A fictitious name or a DBA (only if your LLC’s legal name is not available); Attach a statement of adoption of the fictitious name signed by all LLC members.

- LLC’s principal office and mailing addresses.

- LLC formation state and date.

- Registered agent’s name and address in Washington State.

- Date when your LLC will start operations in Washington State.

- Credit card information on the last page of the form for the $150 application fee.

The LLC cost in Washington State, even for foreign LLCs will differ between online filing and by mail.

Step 4: Determine How Your Washington State Foreign LLC is taxed

Foreign LLCs are also subjected to the Washington State Business Privilege Tax, and they must file LLC annual reports each year.

Note that forming a foreign LLC would be good for your business as you can legally operate in a different state thus reaching a larger market and opening more opportunities for higher profit.

Steps to Filing Washington Foreign LLC Online

Time needed: 5 minutes

To set up your foreign business LLC in the State of Washington, one must apply for a Certificate of Authority with the Secretary of State of Washington. The filing fee for the same is $200. After your application is approved, you will receive a certified copy of your registration from the Secretary of State’s office. We have explained the aspects you need to cover while applying for Washington foreign LLC.

Following are the steps to register Foreign LLC online:

- Access the Official website of the Washington Secretary of State

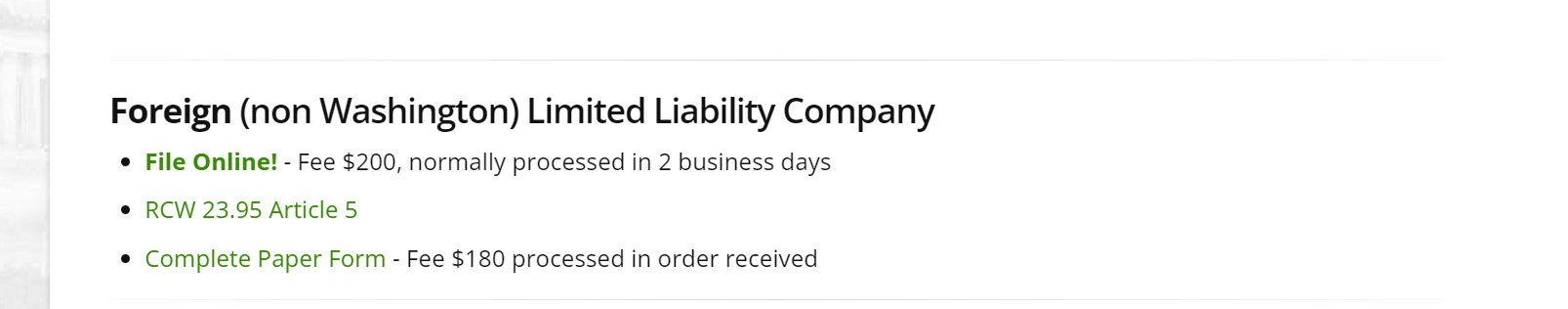

The Official website of the Secretary of State of Washington consists of an informative page dedicated to Corporations. This page provides a one-stop solution to different business filings and registrations through online mode. On this page, scroll to the heading ‘Foreign (non-Washington) Limited Liability Company’ and click on the first link ‘File Online!’.

- Login/ Create your account

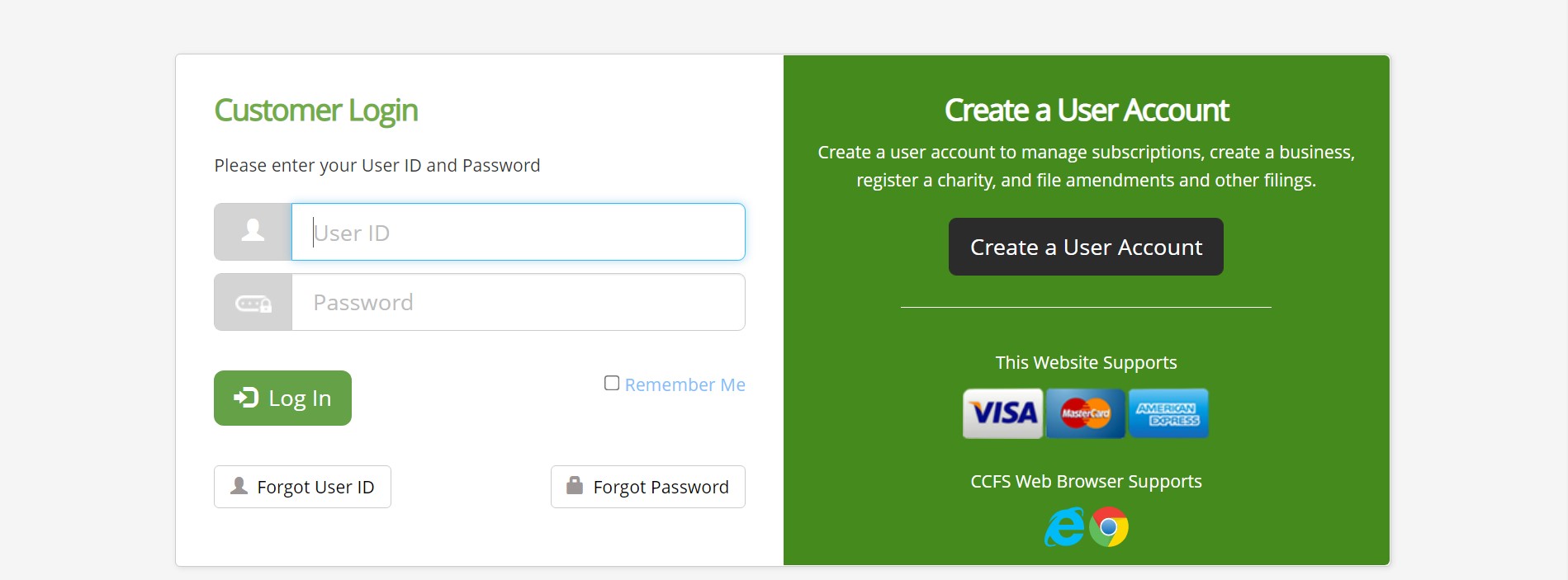

The SOS Washington Corporations and Charities Filing System page will be displayed on the screen. If you have an account on the SOS portal, then enter your login credentials and click on the ‘Login’ tab. In case you do not have an account, click on the ‘Create a User Account’ tab and read on the next step to proceed with Account Creation.

- User Account Creation

On the following page, click on the ‘Continue’ tab under the Free User Account heading. Next, a User type dialogue box appears. Select your user type as ‘individual’ or ‘entity’ accordingly. On the next page, create your User ID and password and click on the ‘Continue’ tab. Fill in the required blanks with your contact information and address and proceed to register your account.

- Start to file your application

After confirmation of your account, log in to your account on the SOS business portal. On the user homepage, select the option of “Create or Register a Business” from the toolbar. Choose the business type as “Foreign” and then select the option of “Limited Liability Company” from the list. Before you start to fill in the application form, read all the instructions carefully. Make sure to fill out every mandatory section.

- Review your details

Before you submit your application form, recheck all the information provided by you in the form.

- Make the payment

Finalize your application form by making a payment for $200 as the online fee for your foreign LLC application. You will receive a notification from the State office acknowledging your application receipt. You can expect a reply from the authorities within 2 to 5 business days.

Steps to Filing Washington Foreign LLC by Mail

If you wish to file your foreign LLC registration application by mail, you can do that easily.

- Download the Application form PDF on your device.

- Read all the instructions attached to the application form carefully.

- Start to fill in the application form as per the guidelines.

- Recheck all the details mentioned by you in the form to be correct and accurate.

- Issue a money order or check for $180 as the filing fee, payable to the ‘Secretary of State’.

- You must also attach the Certificate of Good standing/ Existence issued by the State of Original Jurisdiction.

- Collect all the documents together and mail it to the following address, Corporations & Charities Division, PO Box 40234 Olympia, WA 98504-0234. You can also drop your application in person to the following address, Corporations & Charities Division, 801 Capitol Way S Olympia, WA 98501-1226.

After Forming a Washington State Foreign LLC

Here are added things you need to accomplish after forming your Washington State Foreign LLC

- Obtain Business Licenses. Find the business licenses you’ll need using the Business License Search.

- File LLC annual reports and Business Privilege Tax.

- Pay State Taxes like sales tax; you’ll need an EIN for your LLC.

It is convenient plus easy to file for the foreign LLC if you are doing it online. The steps are very easy and that’s why it’s possible to go along with the steps and form a foreign LLC in Washington State.

F.A.Qs

If your LLC is formed under the laws of another state, it is referred to as a foreign LLC in Washington State.

Businesses incorporated outside of the state where they operate must have “foreign qualifications” issued in the other states.

A domestic LLC is a company registered in Washington State as an LLC. The entity type that has a physical presence in another state is a foreign LLC.

How Much Does It Cost to Register a Foreign LLC in Washington

To register as a foreign LLC in Washington, you can file through mail or online by paying a filing fee of $180 to the Washington Secretary of State.

One of the first costs to consider when registering a foreign LLC in Washington is the application fee. This fee is required at the time of submission and covers the processing of the application. While the fee may vary depending on certain factors, it is a necessary expense that business owners should be prepared for. Additionally, business owners should be aware that there may be additional fees associated with expedited processing of the application, should they choose to utilize this option.

In addition to the application fee, business owners should also be aware of the ongoing costs associated with maintaining a foreign LLC in Washington. These costs may include annual report fees, which are required to be filed with the state each year to keep the LLC in good standing. It is important for business owners to be aware of these costs from the outset to avoid any surprises down the road.

Another cost to consider when registering a foreign LLC in Washington is that of a registered agent. A registered agent is an individual or entity designated to receive legal documents and other important communications on behalf of the LLC. While there are many options available for registered agent services, business owners should carefully consider the costs associated with hiring a registered agent to ensure they are getting the services they need at a fair price.

Business owners should also be aware of any potential additional costs that may arise during the registration process. This may include the costs of obtaining necessary business licenses and permits, as well as any fees associated with hiring legal counsel to assist with the process. Understanding all potential costs associated with registering a foreign LLC in Washington can help business owners budget appropriately and avoid any unexpected expenses.

Overall, while the costs of registering a foreign LLC in Washington may seem daunting at first glance, they are a necessary investment for foreign entrepreneurs looking to do business in the state. By carefully considering all potential costs and budgeting accordingly, business owners can navigate the registration process with confidence and set themselves up for success in Washington’s thriving business environment.

In Conclusion

Starting a foreign LLC in Washington does not require a lot of documentation or tasks. However, it is always good to seek help from a professional when it comes to running your business. Get a professional registered agent and form your foreign LLC anywhere without a hassle.